Bank transfers

Single bank transfer

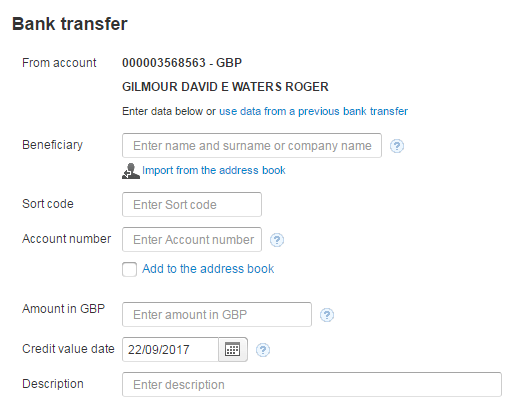

Making a bank transfer has never been easier or more secure. Log into the Client Area of your account and click on "Bank transfer" in the "Banking > Bank transfers" section. Simply fill in the fields shown below and enter your PIN to confirm. (For transfers involving amounts that exceed the threshold established by the bank, or if the OTP service is enabled, you will also be asked to enter the OTP, unless the beneficiary has already been confirmed).

You will need to fill in the following fields:

BENEFICIARY

This is the beneficiary of the bank transfer. Remember:

- do not use abbreviations or professional or honorary titles (e.g. Mr., Dr., etc.) as these could make it difficult for the beneficiary to receive the transfer;

- the beneficiary account name must always be written out in full.

SORT CODE

The sort code, which is a six-digit number, is usually formatted as three pairs of numbers, for example, 12-34-56. It identifies both the bank and the branch where the account is held.

ACCOUNT NUMBER

Code which identifies the holder of a bank account.

AMOUNT IN GBP

For each user, there is a daily limit based on the sum of outgoing Bank transfers or International bank transfers entered. Read all the details

Note. The amount of the transfer may be reduced, due to extra fees applied by the beneficiary bank or any intermediary banks. The amount of the extra fees is determined by the beneficiary/intermediary bank and is not known to Fineco in advance.

CREDIT VALUE DATE

The date when the bank transfer is credited to the beneficiary account

Minimum credit date:

Bank transfers to bank accounts outside Fineco:

1 business day for:

- Accounts with OTP service (on bank transfer) subscribed and confirmation of the transfer by 14:00.

- Accounts with OTP service (on bank transfer) unsubscribed and confirmation of the transfer by 12:00.

2 business days for:

- Accounts with OTP service (on bank transfer) subscribed and confirmation of the transfer after 14:00.

- Accounts with OTP service (on bank transfer) unsubscribed and confirmation of the transfer after 12:00.

Bank transfers to other Fineco accounts:

The same business day for:

- Accounts with OTP service (on bank transfer) subscribed and confirmation of the transfer by 14:00.

- Accounts with OTP service (on bank transfer) unsubscribed and confirmation of the transfer by 12:00.

1 business day for:

- Accounts with OTP service (on bank transfer) subscribed and confirmation of the transfer after 14:00.

- Accounts with OTP service (on bank transfer) unsubscribed and confirmation of the transfer after 12:00.

Note: Bank transfers to other Fineco accounts are credited to the beneficiary’s account on the evening of the day indicated as the credit date.

Important:

The credit date also affects the updating of the available balance of your current account.

The available balance is deducted on the transfer execution day and is equal to :

- The business day before the indicated credit date (for bank transfers to bank accounts outside Fineco)

- The same day indicated as the credit date (for bank transfers to other Fineco accounts)

Bank transfers made on a public holiday or on a non-working day are considered as received by the bank on the following business day. The credit date cannot coincide with a public holiday or a non-working day.

DESCRIPTION

Remember:

Bank transfers will be "Pending" and the amount will not be deducted from the available balance until the actual transfer date.

Should the funds not be available on the transfer date, the bank will automatically cancel the transaction. In that case, we will send an e-mail notification to the address held in our master records.

If you have requested the divestiture of a financial instrument, a currency exchange transaction, or government securities have reached the expiry date, please ensure that the amount has been recorded in the account balance of the account prior to confirming your bank transfer.

If the amount is only present in the available balance, making the bank transfer could bring your account balance to a negative balance. As mentioned in the Terms of Business, if you have a negative balance you need to pay cash into your account within 15 Working Days in order to ensure that your account is always in credit. We hereby inform you that trades on financial instruments involve an immediate update of the available balance and the divested amount is immediately available only for trading transactions.

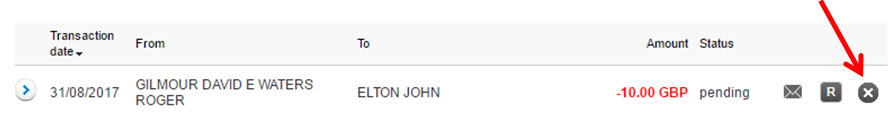

Cancelling a bank transfer

You may cancel a bank transfer directly online from the “Bank transfers > Archive” section in the Banking area.

Use the CANCEL button which is shown next to the status. This function is available until 22:55 on the instruction date.

The function will no longer be available from the day after the instruction date.

You may cancel a bank transfer through our Client Service until 14:00 on the working day prior to the credit value date.

You must enter your PIN to confirm that you wish to cancel the order. At the end of the process, always remember to check that the bank transfer status has changed to "cancelled".

RECALL

The instructing party's bank may, on its own initiative or at the request of the instructing party, recall a bank transfer that has already been executed, using the "Recall" procedure. Certain conditions must be met:

- the execution date must be no more than 10 working days after the Recall date

- the bank transfer must only be recalled for one of the following reasons: duplicate bank transfer, technical error, fraudulent origin.

If the beneficiary's bank agrees to the request, the transferred funds will be returned to the instructing party.

The beneficiary's bank may charge a fee for returning funds. This fee, which is not quantifiable in advance, will be deducted from the amount of the original payment.

Confirming a bank transfer beneficiary

Beneficiaries of bank transfers included in the "Beneficiaries address book" can be confirmed using the OTP. This can be used to confirm several beneficiaries at once, or one at a time.

All outgoing bank transfers to beneficiaries that have been confirmed in the address book with the OTP, will be entered solely with the PIN, even when the bank transfer OTP service is enabled.

Otherwise, outgoing bank transfers for amounts above a given threshold defined each time by the bank, must always be confirmed by entering the PIN and the OTP.

Each beneficiary in the address book has a specific status:

|

To be confirmed |

Beneficiary not confirmed with the OTP |

| Pending confirmation |

OTP sent to your verified mobile NOTE! If the beneficiary has not been confirmed by 22:55 on the day you received the OTP, that beneficiary's status will be returned to "To be confirmed". |

| Confirmed |

Beneficiary confirmed with the OTP. |

| Cannot be confirmed |

Beneficiary cannot be confirmed as not deemed secure by the bank. |

Confirming a single beneficiary

Click on the "to be confirmed" status of the single beneficiary recorded in the list to receive the OTP on your verified mobile and then use this to confirm the beneficiary.

Confirming multiple beneficiaries

Click on the “Confirm several beneficiaries" button to confirm several beneficiaries in the address book. This means you can enter just one OTP to confirm several beneficiaries at the same time.

Note! For greater security, the bank might not allow you to confirm certain beneficiaries/IBAN codes, or might revoke them at a later date. Such beneficiaries will be recorded in the list as "Cannot be confirmed".

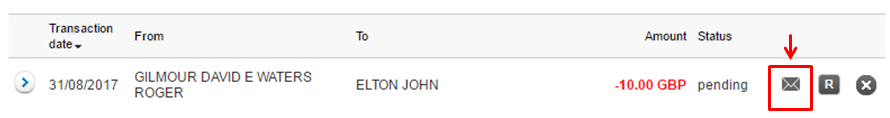

Sending an e-mail notification to the beneficiary

The function for sending an e-mail notification to the beneficiary, which can be used from the bank transfer order outcome page, is also available in the "Bank transfers > Transfers archive" section for orders whose status is "EXECUTED".

Click on the icon shown to preview the e-mail that will be sent.

You can indicate up to three e-mail addresses and choose to send a copy of the notification to your own certified e-mail address.

Daily limit for outgoing bank transfers

There is a daily limit for each user based on the sum of the outgoing bank transfers ( both bank transfers and international bank transfers) entered:

- between 14:00 on the previous day and 14:00 on T if the OTP service is enabled

- between 12:00 on the previous day and 12:00 on T if the OTP service is not enabled

The calculation only includes bank transfers with the same execution date.

The cumulative daily limit is equal to:

- £250,000.00 if the OTP service is enabled

- £160,000.00 if the OTP service is not enabled.

However, you may change the daily limit stated above by contacting our Client Service on:

- 0800 640 6667 (from landline and mobile)

- +44 (0) 207 065 7557 (from abroad)

In addition to confirmed bank transfers, transfers that have been instructed but not yet confirmed with the OTP are also included in the calculation; transfers that have been cancelled and those with an OTP that has expired are not included.

International bank transfers

The maximum amount of each SWIFT bank transfer is £50,000.00. The maximum amount of each SEPA bank transfer is €50,000.00.

Amounts over the daily limit

To order transactions that exceed the daily limit, contact our Client Service on:

- 0800 640 6667 (from landline and mobile)

- +44 (0) 207 065 7557 (from abroad)

Address book - Beneficiaries

The payees of bank transfers from your account are often a small number of people or companies to which most of our payments are made.

If you would like to manage these transactions more quickly and automatically, enter the payees in the beneficiaries address book with all the information required to execute the bank transfer.

To open the beneficiaries address book simply go to the "Banking> Bank transfers> Address book" section.

Each time you make a new bank transfer you can decide to add a beneficiary to the list by checking the specific box on the bank transfer order page.

You can add a new beneficiary to the list at any time by clicking on "NEW BENEFICIARY". You will need to enter the OTP to confirm this.

Checking your balance

If you have requested the sale of a financial instrument, a currency exchange transaction, or government securities have reached the expiry date, please ensure that the amount has been recorded in the account balance of the account prior to confirming your bank transfer.

If the amount is only present in the available balance, making the bank transfer could bring your account balance to a negative balance. As mentioned in the Terms of Business, if you have a negative balance you need to pay cash into your account within 15 Working Days in order to ensure that your account is always in credit. We hereby inform you that trades on financial instruments involve an immediate update of the available balance and the divested amount is immediately available only for trading transactions.

To make an outgoing transfer, the amount must be recorded in the account statement (normally 3 business days following the divestment).

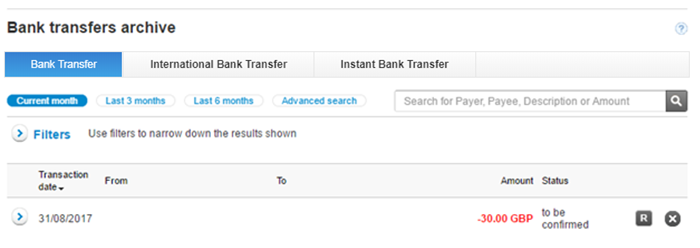

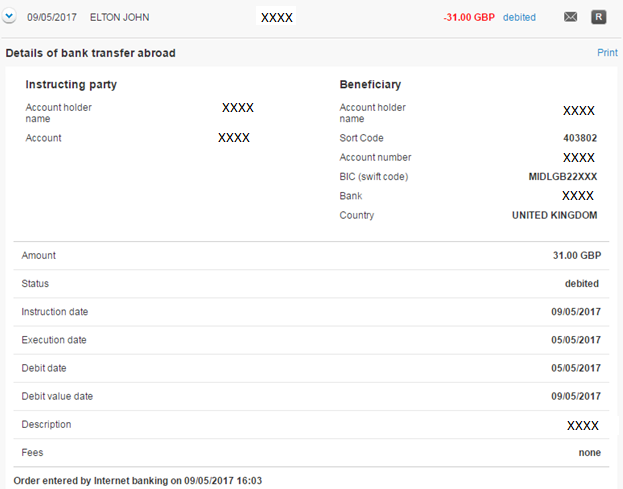

Transfers archive

Click on the Archive link in the Banking > Bank transfers section to display and print details and accounting data of:

> all outgoing bank transfers (bank transfers and International bank transfers) except international payments that can only be made through our Client Service and except Instant bank transfer outgoing (The service is currently available for incoming transfers only).

> Single incoming bank transfers (bank transfers, International bank transfers and Instant bank transfers).

You can search by type of transfer (bank transfer, international bank transfer and Instant bank transfer) and by time frame (current month, last 3 months, last 6 months, advanced search).

The following data are shown in the summary table:

• Instruction date

• instructing party;

• beneficiary;

• amount;

• status (Credited, Debited, Pending, Executed, Reversed, Cancelled, Rejected, To be confirmed).

Use the “R” (Repeat) function to set up a new transfer order that already contains the data used for a previous order.

Expand the summary line to display full details of the transaction including, for transfers that have been executed or credited, the TRN (transaction number) and the option for printing the accounting data.

International bank transfers

International bank transfers up to £50,000 (SWIFT) (or an equivalent amount if set up in a currency other than GBP) or €50,000.00 (SEPA) can be ordered online or through our Client Service available from 8:00 to 21:00 from Monday to Friday on:

- 0800 640 6667 (from landline and mobile)

- +44 (0) 207 065 7557 (from abroad)

International bank transfers for higher amounts can only be ordered through our Client Service.

The following types of bank transfers can be ordered from the Banking > Bank transfers > International bank transfer section in the private area of the site:

• From a GBP and EUR account: Both in GBP/EUR and in other available currencies.

• From other Multicurrency sub-accounts: Only in the currency of the instructing party account selected.

Please note, due to Chinese legislation, it's not allowed to select CNY currency for bank transfer to China.

Depending on the country or currency entered, the bank transfer is automatically directed to the SEPA or SWIFT channel.

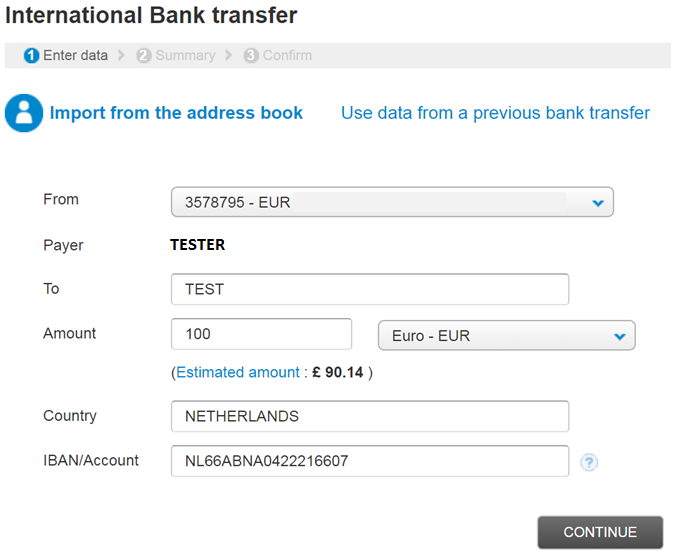

Ordering an international bank transfer

To order an international bank transfer online, enter the Banking > Bank transfers > International bank transfer section and fill in the following fields:

Account and currency

Bank transfers can be ordered from a GBP account (in the available currencies) or from a Multicurrency service (only in the reference currency of the service).

Amount

SEPA bank transfers in Euros: min € 0 - max € 50,000.

SWIFT bank transfers (in GBP or currency other than the Euro): min £25 (or the equivalent amount for bank transfers in currencies other than the Euro), max £50.000 (or the equivalent amount for bank transfers in currencies other than the GBP).

Note! Bank transfers for more than £50,000 or less than £25 (SWIFT circuit) can only be ordered through our Client Service.

For bank transfers from a GBP account, in currencies other than the GBP, the estimated amount indicated when placing the order is to be considered for guidance only. The amount actually debited to the account will be calculated using the exchange rate available at the time of execution of the transaction.

The figure entered in the amount field can have up to two decimal places, except for bank transfers set up in the Hungarian Forint (HUF) and Japanese Yen (JPY), which must be stated as whole numbers (with no decimal places).

Your account is subject to a daily limit based on the sum of the outgoing (Bank transfers and International bank transfers) bank transfers entered. Read all the details

Bank transfer currency

Bank transfers from GBP and EURO accounts can be set up in the following currencies:

|

EUR - EURO |

HKD - Hong Kong Dollar |

| USD - US Dollar |

NZD - New Zealand Dollar |

| GBP - UK Pound |

SGD - Singapore Dollar |

| CHF - Swiss Franc |

ZAR - South African Rand |

| JPY - Japanese Yen | CZK - Czech Koruna |

| SEK - Swedish Crown | PLN - Polish Zloty |

| DKK - Danish Crown | HUF - Hungarian Forint |

| NOK - Norwegian Crown | TRY - Turkish Lira |

| AUD - Australian Dollar | MXN - Mexican Peso |

| CAD - Canadian Dollar | RUB - Russian Ruble |

| CNY - Chinese Renminbi |

Bank transfers from other currencies accounts can only be set up in the currency of the account to be charged.

Beneficiary

This is the bank transfer payee. Remember:

- do not use abbreviations or professional or honorary titles (e.g. Mr., Dr., etc.) as these could make it difficult for the beneficiary to receive the transfer;

- the beneficiary's name and surname or company name must always be written out in full.

Country

This is the country of the foreign bank to which the funds will be transferred. The fields you will need to fill in with details of the beneficiary's current account will be shown depending on the payee country and currency entered. For example:

• IBAN: this has between 18 and 32 digits depending on the beneficiary country

• Account Number and Branch Number, with 7 and 5 digits, respectively, required for bank transfers to Canada

• CLABE, an 18-digit code, required for bank transfers to Mexico

• ABA: a 9-digit code used for transfers to the USA

• BSB: this 6-digit code is required for bank transfers to Australia

• Purpose Code: this 3-digit code is required for bank transfers to ABU DHABI or DUBAI. The Purpose Code must be indicated in the description field. Purpose Code list.

and/or other information required in order to submit the order.

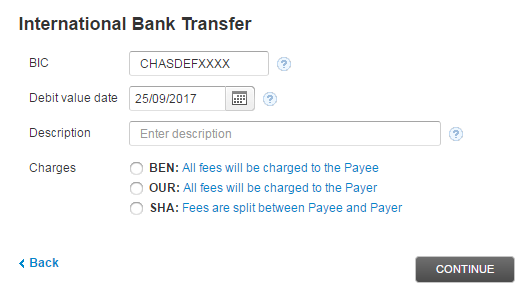

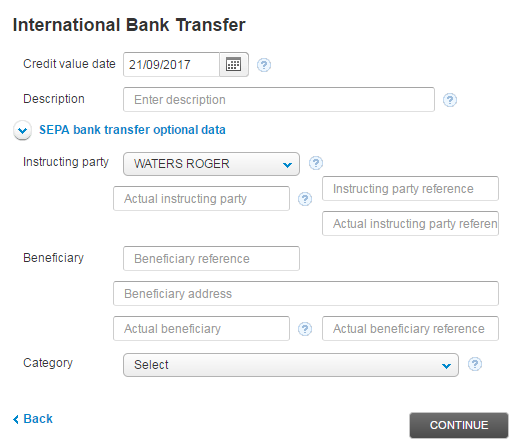

When you click on “Continue”, the bank transfer order will be sent to the SWIFT or SEPA channel, depending on the payee country, and one of two different pages will open:

BIC

The alphanumeric BIC code, composed of between 8 and 11 digits, must only be indicated for bank transfers using the SWIFT channel. For SEPA bank transfers, this code is determined automatically by Fineco.

Credit value date/debit value date

• for orders through the SEPA circuit, you must indicate the credit value date for the beneficiary;

• for orders through the SWIFT circuit, you must indicate the debit value date on your account, as per the time frames stated in the relevant section. These time frames vary from country to country and according to the currency selected.

Bank transfers entered on a holiday or non-working day are considered as received by the bank on the following business day.

Important

The credit/debit value date also affects the times for updating the available balance on your current account.

Therefore, the available balance is deducted on the execution date indicated in the order.

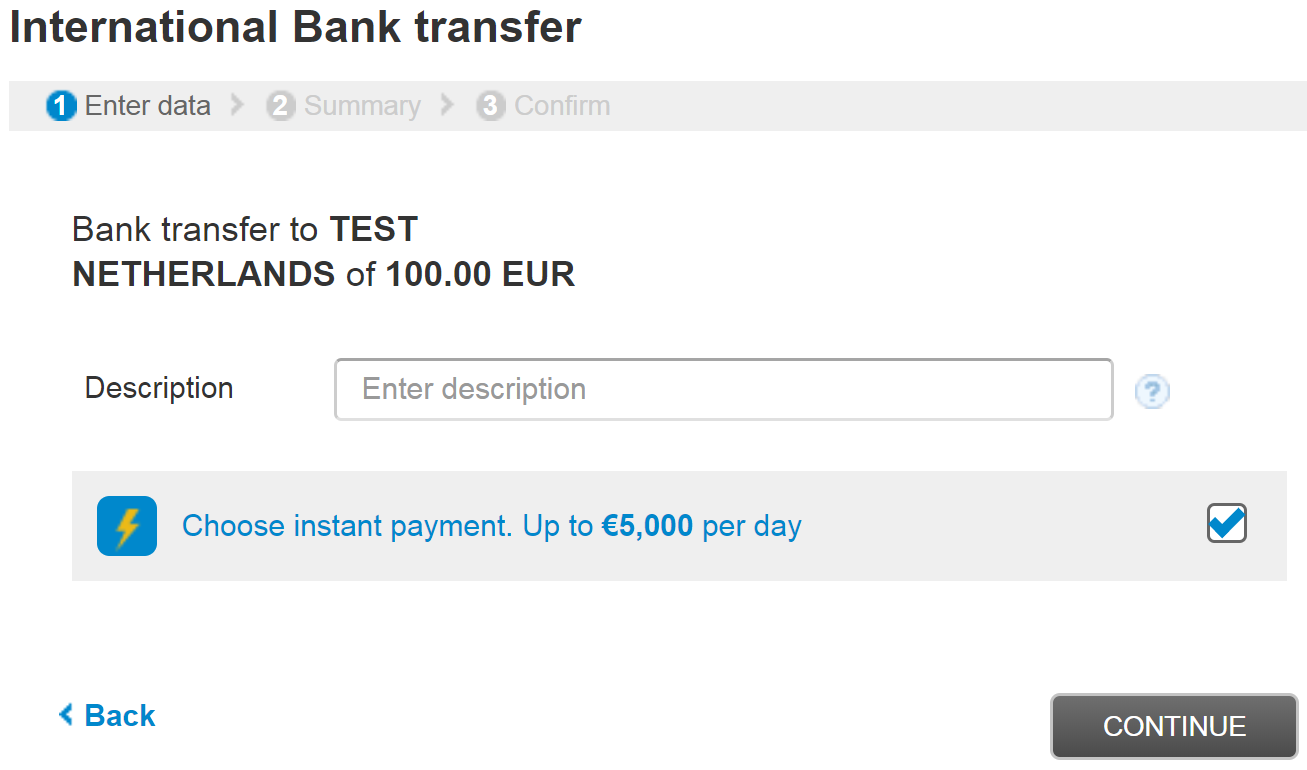

Description

This states the reason for the payment.

Fees

Bank transfers using the SEPA circuit are always free of charge.

Bank transfers using the SWIFT circuit cost £19.95. The fee is charged the day the transfer is executed. For bank transfers from a Multicurrency service, the fee is charged in the same currency (the equivalent value of the fee is calculated using the rate of exchange available at the time of execution).

Bank transfers from SEK sub-account to PSD Countries are free of charge.

Charges

For SWIFT bank transfers only, this amount may be deducted to cover charges applied by the beneficiary bank or by any other banks acting as intermediaries in transferring the funds.

Therefore, when setting up the transaction, you will need to select one of the following options:

- OUR: All bank expenses associated with the transaction are borne by the instructing party.

- SHA: Expenses are borne by instructing party and beneficiary. Specifically, the expenses of the instructing bank are borne by the instructing party and any expenses of intermediary banks and of the beneficiary bank are borne by the beneficiary.

- BEN: All bank expenses associated with the transaction are borne by the beneficiary.

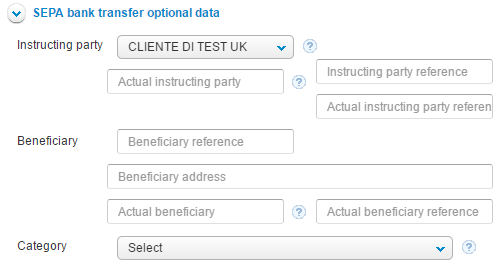

For transfers through the SEPA circuit, you can also enter the following optional data:

• Instructing party

You can select the bank transfer instructing party from among the current account holders.

• Instructing party reference

This is the ID code of the instructing party, provided thereby and sent to the beneficiary.

• Actual instructing party

The actual instructing party is the entity on whose behalf the instructing party makes the payment.

• Actual instructing party reference

This is the ID code of the actual instructing party, provided by the instructing party and sent to the beneficiary.

• Beneficiary reference

This is the beneficiary's ID code.

• Beneficiary address

This is the beneficiary's address.

• Actual beneficiary

This is the entity on whose behalf the beneficiary receives the payment.

• Actual beneficiary reference

This is the ID code of the actual beneficiary.

• Category

This 4-digit code allows the beneficiary bank to use specific processing methods.

By saving the beneficiary's data you can create a beneficiaries address book so that you only have to enter the data the first time. You will therefore be able to make subsequent payments by automatically recalling all the data needed to make the transfer.

You can access the “Transfers archive” at any time to display and print all the data contained in previously submitted payment orders.

Remember:

The status of the bank transfer will be "pending" and the amount will not be deducted from the available balance until the day it is actually transferred.

Should the funds not be available on the transfer date, the bank will automatically cancel the transaction. In that case, a notification e-mail will be sent to your registered e-mail address.

Important!

In accordance with anti-money laundering regulations, bank transfers of €5,000 and more, when the actual instructing party is a third party other than the current account holders, require the identification data and a copy of the ID document of the instructing party. Therefore such bank transfers cannot be ordered online, but only by submitting the printed form.

To place the order you will therefore need to:

1. Print and fill in

a. A form with the data of the actual instructing party

b. A form with details of the bank transfer

2. Attach a copy of a valid ID document

3. Send all these documents, duly filled in and signed, to Finecobank:

- by fax to: +44 (0) 207 0657553

- or by e-mail to: support@finecobank.com

The bank transfer will be carried out by the next business day after all documents have been received by the bank; when the transfer has been carried out you will receive an e-mail with confirmation.

SEPA countries

SEPA stands for Single Euro Payments Area. It currently comprises 34 countries, which can be broken down as follows:

• The 19 EU countries that have already adopted the Euro;

• The other 9 EU countries;

• Norway, Iceland and Liechtenstein, which belong to the European Economic Area;

• Switzerland, Principality of Monaco and San Marino.

LENGTH OF THE IBAN CODE BY COUNTRY

The IBAN (International Bank Account Number) is used to identify the current account and the bank. The length of this code varies depending on the bank transfer beneficiary country. The summary table below shows the number of digits in the IBAN for the various beneficiary countries and whether or not the country is part of the SEPA circuit.

COUNTRIES THAT USE THE IBAN

|

Country |

No. of digits in the IBAN |

Part of the SEPA |

|

ALBANIA |

28 |

NO |

|

ANDORRA |

24 |

NO |

|

SAUDI ARABIA |

24 |

NO |

|

AUSTRIA |

20 |

YES |

|

AZERBAIJAN |

28 |

NO |

|

BAHRAIN |

22 |

NO |

|

BELGIUM |

16 |

YES |

|

BOSNIA |

20 |

NO |

|

BRAZIL |

29 |

NO |

|

BULGARIA |

22 |

YES |

|

CYPRUS |

28 |

YES |

|

VATICAN CITY |

27 |

NO |

|

COSTA RICA |

21 |

NO |

|

CROATIA |

21 |

YES |

|

DENMARK |

18 |

YES |

|

UNITED ARAB EMIRATES |

23 |

NO |

|

ESTONIA |

20 |

YES |

|

FINLAND |

18 |

YES |

|

FRANCE |

27 |

YES |

|

GEORGIA |

22 |

NO |

|

GERMANY |

22 |

YES |

|

GIBRALTAR |

23 |

YES |

|

GREECE |

27 |

YES |

|

GREENLAND |

18 |

NO |

|

GUADELOUPE |

27 |

YES |

|

GUATEMALA |

28 |

NO |

|

FRENCH GUYANA |

27 |

YES |

|

IRELAND |

22 |

YES |

|

ICELAND |

26 |

YES |

|

BOUVET ISLAND |

15 |

YES |

|

GUERNSEY |

22 |

NO |

|

JERSEY |

22 |

NO |

|

MADEIRA |

25 |

YES |

|

ISLE OF MAN |

22 |

NO |

|

REUNION ISLAND |

27 |

YES |

|

SAINT-BARTHELEMY |

27 |

YES |

|

SAINT-MARTIN (FRENCH PART) |

27 |

YES |

|

ALAND ISLANDS |

18 |

YES |

|

AZORES |

25 |

YES |

|

SAINT PIERRE AND MIQUELON |

27 |

YES |

|

WALLIS AND FUTUNA ISLANDS |

27 |

NO |

|

FAROE ISLANDS |

18 |

NO |

|

VIRGIN ISLANDS |

24 |

NO |

|

ISRAEL |

23 |

NO |

|

ITALY |

27 |

YES |

|

JORDAN |

30 |

NO |

|

KAZAKHSTAN |

20 |

NO |

|

KOSOVO |

20 |

NO |

|

KUWAIT |

30 |

NO |

|

LATVIA |

21 |

YES |

|

LEBANON |

28 |

NO |

|

LIECHTENSTEIN |

21 |

YES |

|

LITHUANIA |

20 |

YES |

|

LUXEMBOURG |

20 |

YES |

|

MACEDONIA |

19 |

NO |

|

MALTA |

31 |

YES |

|

MARTINIQUE |

27 |

YES |

|

MAURITANIA |

27 |

NO |

|

MAURITIUS |

30 |

NO |

|

MAYOTTE |

27 |

YES |

|

MOLDAVIA |

24 |

NO |

|

MONACO |

27 |

YES |

|

MONTENEGRO |

22 |

NO |

|

NORWAY |

15 |

YES |

|

NEW CALEDONIA |

27 |

NO |

|

NETHERLANDS |

18 |

YES |

|

PAKISTAN |

24 |

NO |

|

PALESTINE |

29 |

NO |

|

FRENCH POLYNESIA |

27 |

NO |

|

POLAND |

28 |

YES |

|

PORTUGAL |

25 |

YES |

|

QATAR |

29 |

NO |

|

UNITED KINGDOM |

22 |

YES |

|

CZECH REPUBLIC |

24 |

YES |

|

DOMINICAN REPUBLIC |

28 |

NO |

|

ROMANIA |

24 |

YES |

|

SAN MARINO |

27 |

YES |

|

32 |

NO |

|

SAO TOME |

25 |

NO |

|

SERBIA |

22 |

NO |

|

SEYCHELLES |

31 |

NO |

|

SLOVAKIA |

24 |

YES |

|

SLOVENIA |

19 |

YES |

|

SPAIN |

24 |

YES |

|

SPITSBERGEN |

15 |

NO |

|

SWEDEN |

24 |

YES |

|

SWITZERLAND |

21 |

YES |

|

FRENCH SOUTHERN AND ANTARCTIC LANDS |

27 |

NO |

|

EAST TIMOR |

23 |

NO |

|

TUNISIA |

24 |

NO |

|

TURKEY |

26 |

NO |

|

UKRAINE |

29 |

NO |

|

HUNGARY |

28 |

YES |

BANK TRANSFER EXECUTION TIMES

Bank transfers from EUR account in Euro currency

Maximum debit value date: 20 business days (Forex calendar)

Minimum debit value date:

• Bank transfers to Countries NOT part of the PSD (Payment Services Directive): 2 business days (Forex calendar)

• Bank transfers to countries that participate in PSD: 1 business day (Forex calendar)

Other international Bank transfers different than above

Maximum debit value date: 20 business days (Forex calendar)

Minimum debit value date: 3 business days (Forex calendar)

SEPA SCHEME

Maximum credit date: 20 business days

Minimum credit date:

1 business day for:

- Accounts with OTP service (on bank transfer) subscribed and confirmation of the transfer by 14:00.

- Accounts with OTP service (on bank transfer) unsubscribed and confirmation of the transfer by 12:00.

2 business days for:

- Accounts with OTP service (on bank transfer) subscribed and confirmation of the transfer after 14:00.

- Accounts with OTP service (on bank transfer) unsubscribed and confirmation of the transfer after 12:00.

CANCELLING BANK TRANSFERS

SEPA bank transfers can be cancelled directly online from the Banking > Bank transfers > Archive section. There is a CANCEL button by the following statuses:

• Pending acceptance/In progress.

• Accepted: the function is available until 17.00 on the business day prior to the payment date indicated by the client in the order, except for bank transfers to Fineco accounts, when it is available until 17:00 on the payment date.

• To be confirmed (with OTP ENABLED): the function is enabled until the established cut-off for confirming the bank transfer (14:30 or 22:55).

The function is not available:

• after 17:00 on the business day prior to the payment date indicated by the client (after 17:00 on the business day that is also the payment date for internal transfers);

• when the status is EXECUTED;

SWIFT bank transfers can only be cancelled directly online in the Banking > Bank transfers > Archives section on the instruction date.

Cancellation must be confirmed by entering the PIN. After cancelling the bank transfer, always check that its status has changed to "cancelled".

After the instruction date, SWIFT bank transfers can only be cancelled through our Client Service within the following time frames:

• Bank transfers in Euros: until 14:30 on the working day prior to the debit value date indicated in the order.

• Bank transfers in currencies other than the Euro: until 14:30 on the third working day prior to the debit value date indicated in the order.

AMOUNTS OVER THE DAILY LIMIT

To transfer amounts that are over the daily limit, call our Client Service from Monday to Friday between 8:00 and 21:00, on:

- 0800 640 6667 (from landline and mobile)

- +44 (0) 207 065 7557 (from abroad)

SENDING AN E-MAIL NOTIFICATION TO THE BENEFICIARY

The function for sending an e-mail notification to the beneficiary, which can be used from the bank transfer order outcome page, is also available in the "Bank transfers > Archive" section.

Click on the icon shown above to preview the e-mail that will be sent.

You can indicate up to three e-mail addresses and also choose to send a copy of the communication to your own certified e-mail address.

International bank transfers through our Client Service

To send an international bank transfer through our Client Service, call:

- 0800 640 6667 (from landline and mobile)

- +44 (0) 207 065 7557 (from abroad)

and give the operator all the necessary information.

Note that payments can only be made through the SEPA channel if the beneficiary's BIC is included in the circuit. Otherwise, the bank transfer will automatically be forwarded through the SWIFT channel (Abroad EU).

Important

For bank transfers through SEPA, the beneficiary bank might charge the beneficiary; on the other hand, for bank transfers through SWIFT (Abroad EU), both the beneficiary bank and the foreign banks involved in the transfer process might charge the beneficiary.

Receiving an international bank transfer

To receive bank transfers in Euro from instructing banks that are members of SEPA Schemes, the following data must be used by the ordering party:

> The IBAN (International Bank Account Number) of the FinecoBank account on which you wish to receive the payment

> The SEPA BIC code: FEBIITM1

To receive bank transfers in currencies other than Euro or in Euros but from countries not members of SEPA, the following data must be used by the ordering party:

> The IBAN (International Bank Account Number) of the FinecoBank account on which you wish to receive the payment

> The BIC SWIFT code: FEBIITM2

Note: For transfers in a foreign currency or in EUR from countries not belonging to the SEPA area, the amount of the transfer could be reduced, due to charges applied by any intermediary banks that will intervene in the process of transferring the sums.

We recommend checking with the sender of the transfer if it is possible to send the transfer with OUR expenses in order to avoid the amount arriving reduced due to expenses applied by any intermediary banks.

Alternatively, for EUR transfers, we recommend checking with the payer bank if it is possible to send it through the SEPA channel.

Euro Instant Bank transfer

The Euro Instant Bank transfer is a service that allows for the immediate transfer of euro funds between current account holders of banks in the SEPA [Single Euro Payments Area] and those that have signed up to the service.

The service is available 24 hours a day, 365 days a year.

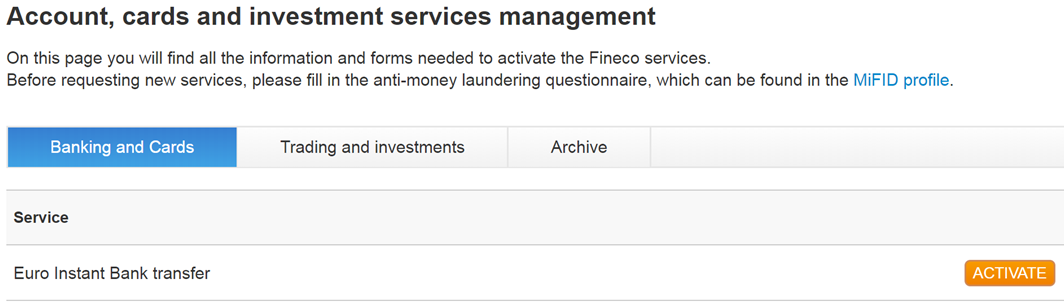

Activating the Euro Instant Bank outgoing transfer service

In order to make Euro Instant Bank transfers, you must first activate the service in one of the following ways:

- following the pathway “Home > Account Management > Managing Services and clicking “ACTIVATE” where it reads “Euro Instant Bank transfer”:

- Through arranging an International Bank transfer sent to a payee who is eligible for instant bank transfers.

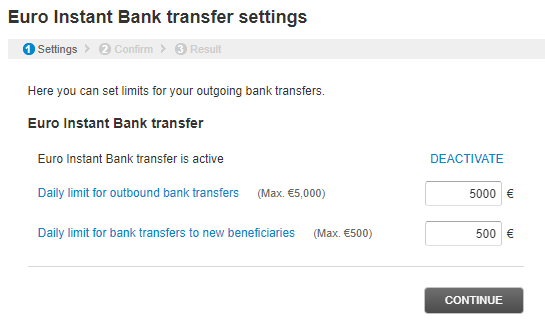

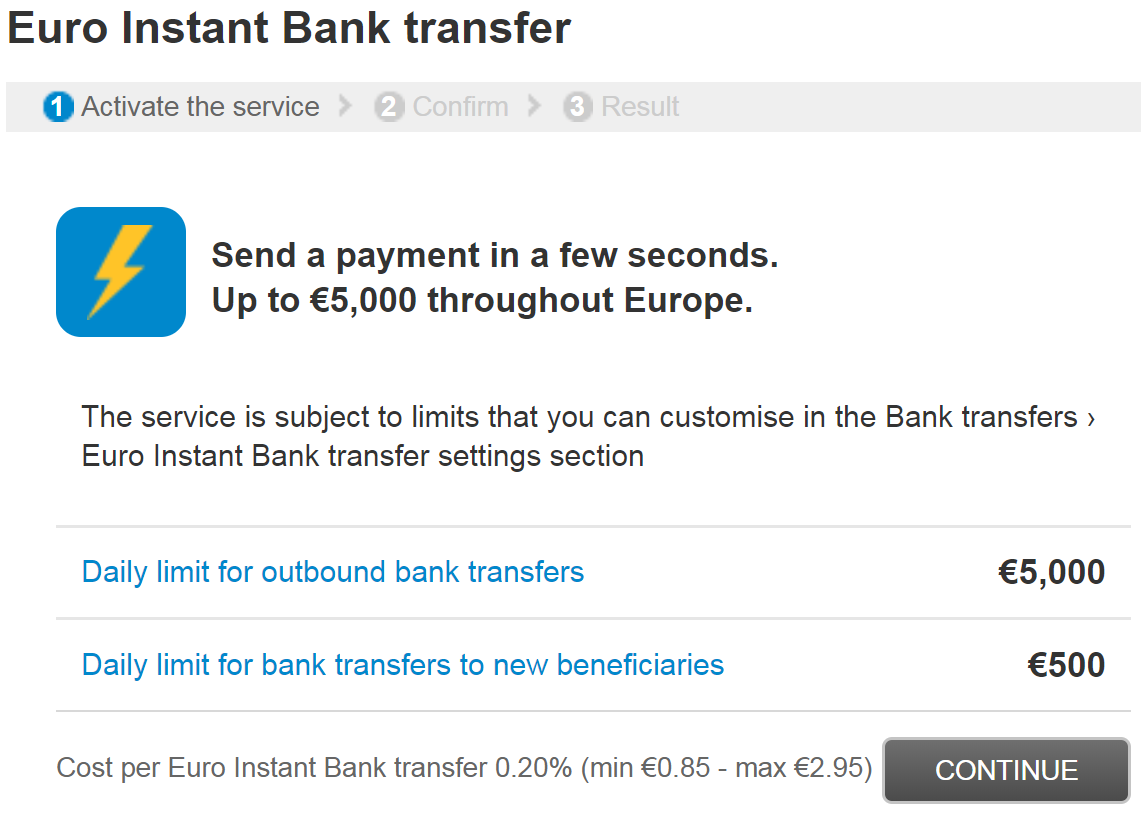

Maximum amount limits for outgoing Euro Instant Bank transfers

Each individual user is restricted to a daily limit represented by the sum total of the outgoing Euro Instant Bank transfers.

The daily cumulative limit for each individual user is equal to €5,000.00, but you may choose to reduce the daily limit in the section for the Euro Instant Bank transfer settings.

The daily maximum of €5,000.00 is not calculated per calendar day, but rather based upon the transactions made in the previous 24 hours.

The maximum possible amount that can be initially transferred to new payees, to whom bank transfers have never previously been sent, is equal to 500.00 euros per day. Within 48 hours of arranging a bank transfer to a new payee, the limit for each individual transfer will increase up to the amount limit established within the Euro Instant Bank transfer settings.

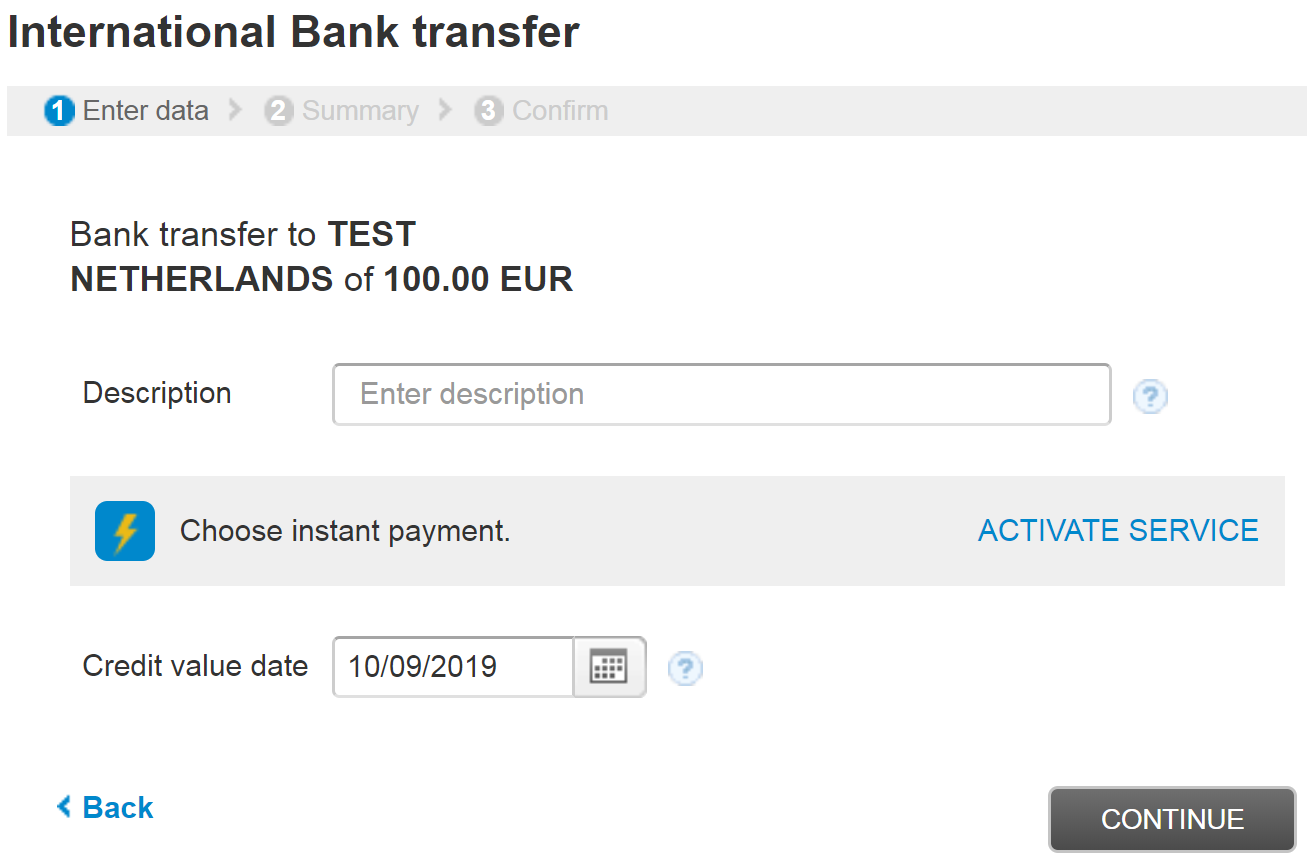

Arranging a Euro Instant Bank transfer

It is only possible to arrange Euro Instant Bank transfers from the euro multicurrency in the euro currency.

To arrange an instant bank transfer online:

- go to the section Banking > Bank transfers > International Bank transfer

- choose the euro multicurrency, insert an “IBAN” registered within the SEPA that is capable of receiving Euro Instant Bank transfers and an “Amount” in euro currency fitting the Instant Bank transfer arrangement with the payee

- click continue

- choose the appropriate checkbox to proceed with arranging an Instant payment and confirm the payment.

We remind you that every time you wish to confirm a Euro Instant Bank transfer, it will be necessary for you to insert the Mobile Code or device pin and the single-use SMS PIN code sent to the mobile phone number you provided when registering (for customer who has not activated the Mobile Code).

We remind you that once the arrangement of a Euro Instant Bank transfer has been confirmed, it cannot be cancelled.

Note: It is necessary that, in addition to the bank to which the transfer is being sent, the payee’s bank account is capable of receiving Instant Bank transfers.

In the section “Bank transfers archive” you can view and print all of the information about payment arrangements that have been made at any time.

Fees

The cost of a single outgoing Euro Instant Bank transfer is equal to 0.20% of the transfer amount (min. 0.85 euro – max. 2.95 euro). The fee is debited at the time of making the bank transfer of euro multicurrency in the euro currency.

Receiving a Euro Instant Bank transfer

Receiving a Euro Instant Bank transfer is free of charge.

Euro Instant Bank transfer settings

By following the pathway Banking > Bank transfers > Euro Instant Bank transfer settings, it is possible to reduce the maximum amount limits for outgoing instant bank transfers.