MoneyMap

MoneyMap is an innovative service, entirely free and fully embedded into your Fineco current account, which enables you to monitor all spending automatically through automated way and to manage your household budget.

It consists of 5 modules: Account summary, Expense and inflows analysis, Budget tool and Categorise cash expenses, which you can customize by clicking on the cog in the top right, and selecting the Personalise MoneyMap item.

You can sort the widgets on your account page, by moving the preset sequence based on your needs. Just click on the grey bar of the module title you want to move and drag it upwards or downwards. Remember to click on the disc icon in the top right to save the changes that you made to the page.

Furthermore, you can also customise your reports by changing the categories associated automatically with your expenses, from one category to another or by creating new ones: click on the cog icon in the top right and select "Expense categories".

In MoneyMap you will find:

- expenses and inflows grouped into categories

- expenses/inflows details by single category

- cash payments and withdrawal management

- statistics

- BrandMap, to display the main stores where you shop

- set and display the Expense budget

MoneyMap groups your movements in a completely automatic way and is always updated to the business day before the consultation date. Data are aggregated on a monthly basis with a historical depth of 14 months.

Spending is grouped based on these simple rules:

- payments made in cash and entered manually are considered to have been incurred on the date of the withdrawal with which they are associated

- current account movements are categorised based on the value date

- purchases made by debit card are based on the actual payment date. Transactions can only be viewed on average from the third business day following the expense.

Each widget has a contextual guide to help you understand the functions of MoneyMap.

Category management

Category management Using the "Category management" link displayed when you click on the "settings" icon on the MoneyMap page, you can see all the expense and inflow categories automatically and create up to 10 personal categories and 6 subcategories into which you can place your movements.

Grouped transactions

At present, MoneyMap considers all current account and card spending, but excludes:

- all trading and investment movements

- Multicurrency account movements

Change expense category

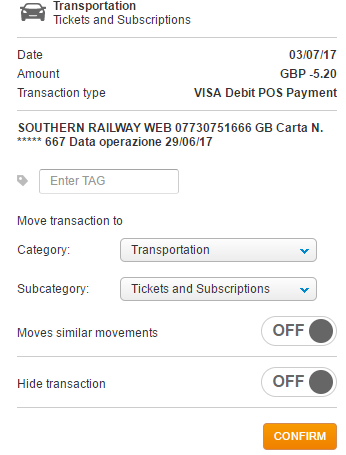

In the "account movements" section, you can check the categories associated with every single movement and, if you wish, give them a label other than the one proposed by Fineco, and also decide whether to apply that label to similar movements in future.

Hide transaction

If among your account movements there are expenses (e.g. transfers between accounts) you do not want to consider in your analysis, with the "hide transaction" option you can ask MoneyMap to exclude the movement from your analysis. You can reactivate the hidden movement at any time, directly from the "account statement" section or in “Cards”, if it is an expense made by debit card.

Hidden expenses are identified by the following icon:

![]()

To hide an expense, or an inflow or to change the category associated automatically by MoneyMap, click on the "Change" link corresponding to the icon which identifies the category of the movement, select the new category from among those available or hide the expense by activating the OFF button.

The "hidden transactions" link can be seen at the bottom of the MoneyMap page. By clicking on it, an overlay will be displayed with a list of hidden transactions. This list can be filtered by All, Inflows, and Outflows.

NOTE: when the single transaction is moved, this is immediately updated in MoneyMap, whereas any changes to the association of a category with all similar payments is visible from the next day. The Budget will also reflect any changes the next day.

Account summary

Based on the period selected, this widget shows the inflows and expenses of your account with the related savings and average spending of the period. All data are updated to the business day before the time of display.

If you have set a budget you can also monitor:

- the trend of your expenses compared with the monthly budget shown in a bar graph

- the budget remaining to be spent or the residual budget of the current month.

You can choose various display modes:

- cumulative or monthly graph

- trendline graph

- bar graph

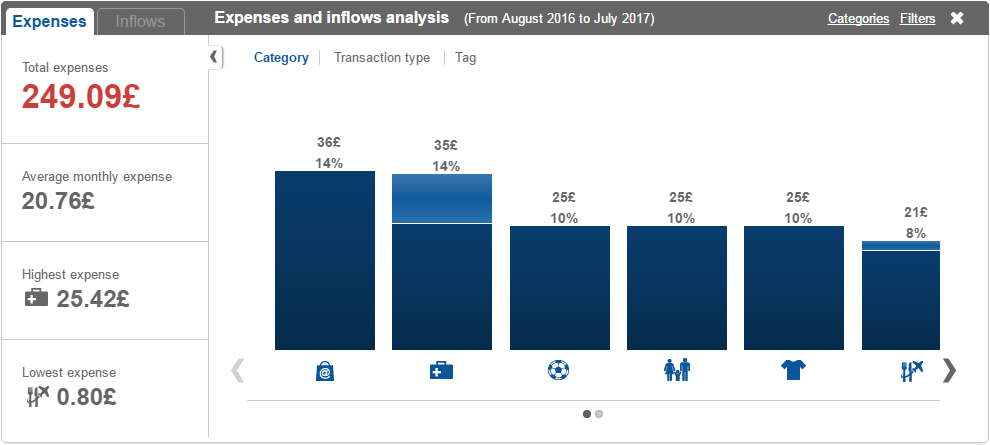

Expense and inflows analysis

Group your transactions

You can check the graph by Expense category (e.g. transport) or by transaction type.

You can use the filters to compare your expense categories.

All expenses are grouped automatically into categories and sub-categories by Fineco. You can change the way every single movement is grouped at any time and decide whether to save the rule you set and apply it to similar future movements.

You can even create your own categories/sub-categories: up to 3 new customised categories and 3 additional sub-categories for each main expense.

Customising is very easy. Just click on the expense breakdown and open the management screen where you can move or hide an expense.

You can also perform these two operations from the account movement list, where, by clicking on the icon associated with each expense, a screen is displayed that lets you associate an expense again or hide it.

Why hide expenses? Some transactions could pollute the data used by MoneyMap for the analysis of your portfolio and for the construction of the budget. For this reason, with the "hide transaction" option you can exclude any movements (e.g. transfers between accounts, extraordinary outflows or inflows).

You will be able to retrieve the hidden expenses in your account movements at any time.

NOTE: when you move a single transaction this is immediately updated in MoneyMap, while the change in the association of a category with all the similar expenses is visible from the next day. The Budget will also reflect any changes the next day.

In addition, if you have set a budget for expense categories, you can compare the expense of the month with the related budget set.

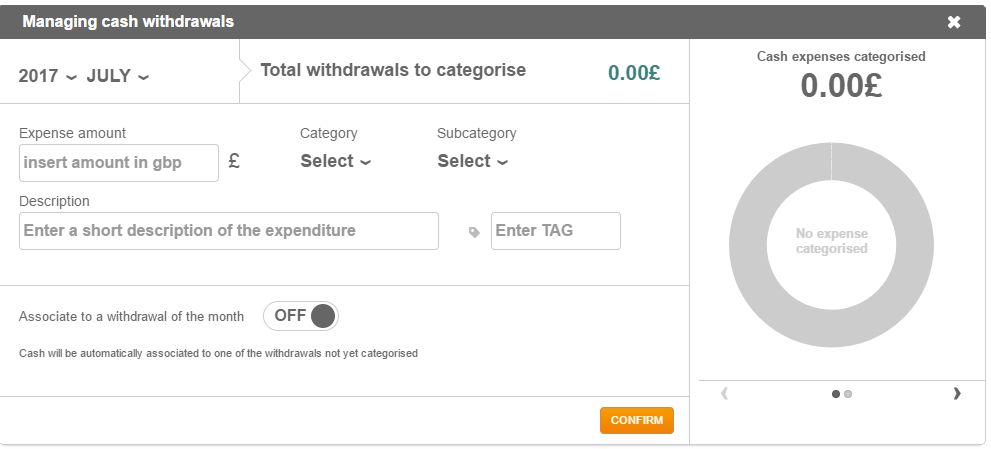

Cash withdrawal

When “expense by category” is displayed, the “cash” category is also shown, with all the cash withdrawals using a Fineco card.

You can group your cash expenses by using the “group cash” module.

Breakdown of expenses by category

You can see the breakdown of each single expense category.

For example, for the Transport category you can check how much you spent on fuel, maintenance, road tax, and see details of each single expense movement. You can change the grouping of each individual transaction at any time. Fineco will remember the rule you set forever! Click on "Expense Management".

Change expense category

In the "account statement" section, you can check the expense categories associated with each single movement and, if you wish, give them a label other than the one proposed by Fineco, and decide whether to apply it to similar future movements.

Cash withdrawal categories

In MoneyMap you can register how the cash withdrawn from the ATM was used for your expenses.

Select the reference month, state the amount and description of the expense and finally select the category and subcategory.

You can also state whether to associate the expense with a specific withdrawal made in the month or let MoneyMap do it automatically.

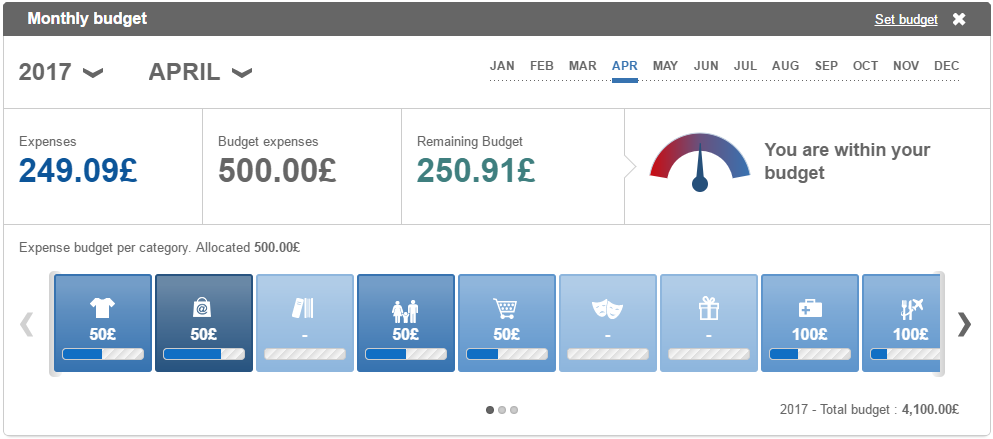

Budget

Set your monthly expense Budget for every month to keep your expense limits under control.

You can also set limits for each single expense category.

For each month of the year, you can control how much you spent, the budget set and how much you have left to spend. Also by single expense category!

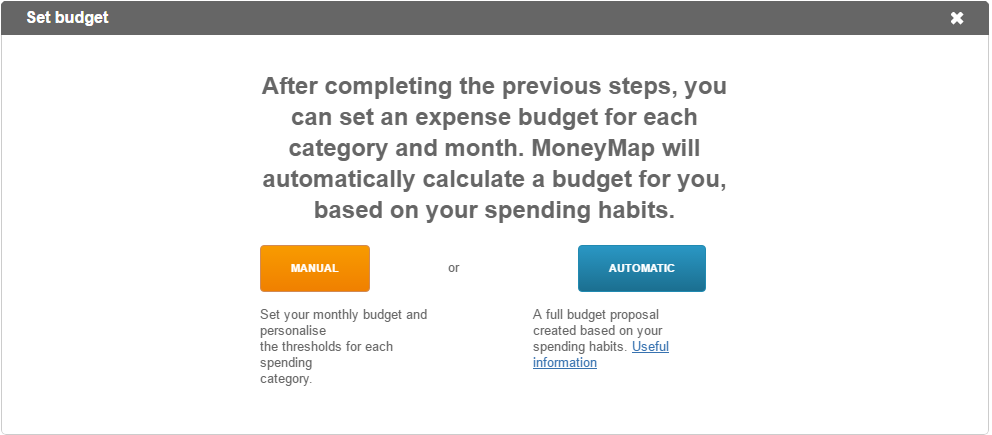

How to set the Budget

You can do so manually or you can choose to let Fineco do it all for you by proposing a budget based on your spending behaviour over previous months. All automatically!

AUTOMATIC BUDGET

With this function MoneyMap automatically proposes monthly budget thresholds based on your spending behaviour over the previous year, already distributed across each expense category.

The Budget module proposes 3 calculation options from which you can choose the one that best suits your spending and saving goals.

Conservative: in line with the expenses of the previous year

Weighted: saving 10% compared to the expenses of the previous year

Challenging: saving 20% compared to the expenses of the previous year

Note: to have an accurate budget estimate, before launching the calculation of the automatic Budget, we advise checking and possibly updating the categories associated with your account movements, also from the previous year. If you change one or more expense categories, please remember that MoneyMap requires 24 hours to reprocess the new data and recalculate your expense habits.