Funds

Introduction to the Funds

In October 2019, Fineco started to offer access to mutual funds on the Investing platform.

Fineco’s clients are offered a vast range of handpicked and highly competitive investment products.

The objective is to offer clients a selection of the best products available on the market and enable the best possible diversification in investments. The "multi-brand" factor allows a further dimension in diversification of investment strategies.

Platform content

The service enables you to select funds based on geographical areas, industrial sectors and types of investment.

Having added access to investment funds, Fineco has reinforced its one-stop solution model

How does Fineco select the products?

The selection aims to offer clients high levels of excellence. It focuses on the diversification of available products at all risk levels. The objective of this strategy is to offer clients a full range of products, to satisfy the most sophisticated investment strategies and to further broaden, complete and diversify their portfolio strategies.

Accessible to all

The initial minimum investment starts from £100, an amount which makes the majority of the funds accessible to all investors.

A single account for multiple investment solutions

You can also invest in funds from different brands from your multicurrency account.

Costs

Fund Platform fee

Your fund platform fee depends on whether you hold funds or shares in your account.

There is no charge to open an account, hold cash or remain inactive.

| Value of Investments in Funds | Annual Cost* |

| 0 to £250k | 0.25% |

| £250k to £500k | 0.15% |

| £500k to £1m | 0.15% |

| £1m to £2m | 0.05% |

| £2m | Free |

* The Fund Platform fee will be calculated and paid monthly. The monthly fee will depend on the exact value of your account each month.

What is a mutual investment fund?

A mutual fund is a financial instrument comparable to a large piggy bank where the resources of many savers converge.

Investors who join a fund pool their savings and entrust them to finance professionals, usually a team of experts organised in a management company. Money managers will look for the most profitable way to invest, choosing between shares, fixed income instruments, liquidity and diversifying according to geographical areas, product sectors and issuer capitalisation.

What is a SICAV?

A SICAV, or Société d'investissement à Capital Variable, is a publicly-traded open-end investment fund structure offered in Europe. SICAV funds are similar to open-end mutual funds. Shares in the fund are bought and sold based on the fund's current net asset value.

Subscribers are real shareholders of the company and have the right to participate in meetings, exercise voting rights and compare their actions with those of the managers.

What are the main types of funds?

- EU harmonised funds

The law of the European Union subjects these to a series of investment restrictions in order to limit the risks and protect subscribers:

- They cannot invest more than 10% of the equity in stocks of a single issuer, in derivatives or in stocks not listed on regulated markets;

- They cannot invest a sum that exceeds the net value of the fund in derivatives;

- They cannot hold more than 5% of the shares with voting rights in a company. - Non-harmonised EU funds

This is a particular type of fund having greater freedom to invest in equity.

They are not subject to the constraints and limitations laid down by Community law for harmonised funds.

How does a fund operate?

The minimum unit of participation in a fund is called a share.

Investing in a fund means subscribing to a number of units equal to the amount paid divided by the value of the unit.

The number of units owned by the subscriber remains fixed for the duration of the investment unless new payments or redemptions of existing units occur.

The fund invests its assets in shares, bonds or other securities. Subscribing to a fund unit means buying a portion of a portfolio or, in other words, a mini portfolio.

What are the advantages of an investment in funds?

- Large sums are not required

Subscribing to a fund means participating – even with a modest investment – and accessing a wide and diversified portfolio of stocks and other assets. - They are easy to buy and sell

You can easily subscribe to funds through Fineco using our online platform. - They are regulated

The correct employment of capital is subject to a control and supervision system overseen by FCA - Financial Conduct Authority and managed by professionals

The professional management of savings in mutual funds means that it is the responsibility of the managers to constantly monitor the markets and exploit the best opportunities.

What are the main risks?

The risk you run by subscribing to fund shares is rather like investing in standard shares. They can go up or down, they can underperform with respect to your expectations or you can lose all or part of the capital you invested.

It is a parameter to assess and consider in relation to the return, to establish if the manager has assumed adequate risks or an unjustified degree of exposure. The higher the risk, the greater the return that should be expected in order to reward the uncertainty tolerated by the investor.

The risk is usually described as volatility - the fluctuation in the price and the return over time, the so-called Standard Deviation.

Understanding funds

What are families of funds?

There are five main categories of funds.

A Management Company which issues a fund tends to choose which category it belongs, and once that choice has been made it should maintain a consistent investment policy.

The classification identifies five primary classes of funds, divided in turn into categories that identify the risk factors (e.g. Market quotation or Issuer specialisation).

How is the performance of a fund calculated?

A fund’s performance is the result achieved by the fund over a certain period of time and is equal to the increased value of the quotas. It is obtained by calculating the percentage increase in the value of the fund quotas during the observation period.

It is important not to forget that the result of a fund, although it constitutes the reference value to assess the management, is just one of the elements needed to appraise the performance of the investment.

Calculating the effective result of a fund involves taking into consideration other factors as well, such as its riskiness, trends in the financial markets and the presence of entry, management and redemption costs.

What are the benchmarks and how are they used?

The best way of expressing an opinion on a fund’s performance is to compare it with the results of other funds in the same category and trends in related financial markets.

The benchmark is a reference index, introduced because of a legal obligation, which allows an appraisal of the performance of the various categories of funds. It is a useful instrument for assessing the manager’s ability to achieve better performance than the category average.

In this case, too, there is an appropriate index that helps us to understand how much the results of a fund deviate from the benchmark: Tracking Error Volatility.

When is the right moment to subscribe a fund?

The simplest answer is probably the most correct one: immediately!

The alternative is to engage in market timing, in other words, to postpone the investment until the right moment comes along.

A study showed that the performance of a market timer that achieves an accuracy rate of 50% of forecasts is still below the reference benchmarks. The conclusion of this study is as follows: if you are not able to make correct predictions at least two times out of three, your performance will fall short of the market’s.

As a rule, taking a market timing decision means sacrificing good performance.

How to choose a fund

Perhaps you have decided to acquire a fund but you have a nagging doubt: how to choose from the hundreds of funds available?

In this section you will find all the information you need to choose and subscribe to a fund that suits you.

What are the fund distribution channels?

Nowadays, thanks to the Internet, acquiring an investment fund has become straightforward. So the first thing you need to consider after deciding to invest in a mutual fund is whether to work with a broker or to act on your own behalf.

There are three ways of subscribing to a fund:

Go to a bank;

Approach a Personal Financial Advisor, who will help you to choose a tailor-made investment;

Acquire your fund on the Internet, after analysing prior performance, comparing trends in the main funds and choosing the management approach and style most suitable for your requirements.

How is it possible to subscribe to a fund online?

To subscribe to a fund online, you need to follow some simple rules. On the website, you will find the prospectus, the subscription form and a document which discusses the risks of financial investments. As soon as the subscription has been completed, you will be able to carry out all the transactions – simply and immediately – from your computer.

How to interpret the price of a fund?

The price of a quota in an investment fund is represented by the ratio between the total value of the securities in the portfolio and the number of quotas. For example, a fund with 500,000 quotas, which holds 9 million pounds in shares and 1 million in liquidity, has a value per unit of 20 pounds, without counting expenses.

At first sight, the value of the quota would appear to be the same as the price of a share. In fact, both represent the value of a portion of the investment and both are published in the daily newspapers and on financial websites. Even so, the similarity between the price of a quota in the fund and the price of a share finishes there.

Differences between quotas in funds and shares:

Quotas in funds – the value of a quota in a mutual fund is calculated just once a day, when trading comes to a close.

Shares – the price of shares changes throughout the day, as a result of trading.

Quotas in funds – mutual funds have an unlimited number of quotas in circulation, based on the number of investors who have bought and sold that day.

Shares – each listed company has a pre-set number of shares in circulation.

Quotas in funds – with investment funds, the value of the quota is linked solely to the current value of the holdings which comprise the portfolio and there is no objective reference price.

Shares – in order to decide if a share is appropriate or not, it is worth comparing its price to a reference value, based on parameters such as profits or cash flow.

What charges are usually applied by funds?

When you subscribe to a fund, part of the outgoings will not go to the equity to invest but will cover the expenses and remunerate the manager.

Those costs can be divided into two main categories:

- Lump sum commissions – normally applied during the buying and selling of a fund. It is a draw-down cost that decreases during the life of the investment.

- Recurrent commissions – these remunerate the work carried out by the manager. They are periodic costs charged directly against the result.

|

Lump-sum commissions |

|

|

Subscription commissions |

These remunerate the sales network and are equivalent to a percentage of the investment. They apply according to a batch system that allows for lower percentages for higher payments. Funds which do not allow for this are defined as no load. |

|

Sale commissions |

These are the lump-sum commissions most frequently applied and paid when the quotas are sold. They often apply with a tunnel system: the commission decreases until it extinguishes, depending on the life of the fund. |

|

Switch commissions |

These apply to the transfers of quotas from one fund to another within the same company, so-called switches. They may be fixed or a percentage of the capital transferred. |

|

Recurring commissions |

|

|

Ongoing charges |

These reward the company for the management and administration of the fund and are deducted directly from the equity and another cost-excluded transaction. |

|

Bonus commissions |

These are due to the management company if it achieves returns that exceed a parameter set in advance. So, it is a reward that the subscriber pays to the manager, calculated on the yield on the fund compared to the reference benchmark. |

The charges just described are not Fineco charges but are applied from the fund directly in the daily calculation of the value of the fund. Presently Fineco funds apply only Ongoing charges.

Pricing

The share price in an investment fund is the ratio between the total value of the securities in the portfolio and the number of quotas.

For example, a fund with 500,000 quotas, which holds 9 million shares and 1 million in liquidity, has a value per unit of 20 pounds, without counting the expenses.

As a first example, the value of the quota would be equivalent to the price of a share. In fact, both represent a portion of the investment and both are published in the daily newspapers and on the financial websites. But the similarity between the price of a quota in the fund and the price of a share finishes there.

Differences between quotas in funds and shares

- shares in funds – the value of a quota in a mutual fund is calculated once a day, at the close of trading.

Shares – the price of shares changes throughout the day, as a result of trading. - Quotas in funds – mutual funds have an unlimited number of quotas in circulation, based on the number of investors who bought and sold that day.

Shares – each listed company has a pre-set number of shares in circulation. - Quotas in funds – with investment funds, the value of the quota is linked solely to the current value of the holdings which comprise the portfolio and there is no objective reference price.

Shares – in order to decide if a share is appropriate or not, it is worth comparing its price to a reference value, based on parameters such as profits or cash flow.

Which documents should be read before subscribing to a fund and what is their purpose?

You often find that you are overwhelmed by adverts and advice that refer to the exceptional performance of this or that fund. How will you know if the fund is the right one for you?

Undoubtedly you will need more information than what appears in advertisements that fill up to a whole page or advice from an enthusiastic friend before you take an important investment decision.

You need an answer to questions such as:

- What is the fund’s investment strategy?

- What are the risks of that strategy?

- How much does the fund cost? Who manages it?

The answers to these questions are often found in an extremely important document: the prospectus.

What to look for in the prospectus?

- The objective of the investment: this is the mission of the fund. It could be the growth in value in the long-term or the quest for a constant flow of income each month.

- Strategy: this is the method by which the manager tries to achieve the objective.

- Risks: each investment is associated with a certain degree of risk, which should be indicated in the prospectus.

- Costs: the prospectus will specify the buying, selling and switch commissions and the percentage of the return withheld to reward the company that administers the fund.

- Management: this section contains information about the professionals who manage the fund.

- Further information: this specifies the taxes to be paid on the returns and any other information which the managers feel that the subscribers should have.

How to invest in funds online

Investing in Funds is easy but careful attention should be paid to the time.

On the Fineco website, in the section reserved for Funds, you can access all the information needed to choose the fund to invest in:

- Classification: to see the 5 Best / Worst funds, classified by performance;

- News: to read the latest news about the world of funds from Morningstar

- Comments: to see comments on the funds from Morningstar;

- The chance to compare funds;

- The chance to control the Risk Levels of the funds.

Choose a fund: all the funds are divided according to various characteristics (Management company, Type of investment, Sector, Geographical area, Annual trend, Minimum investment).

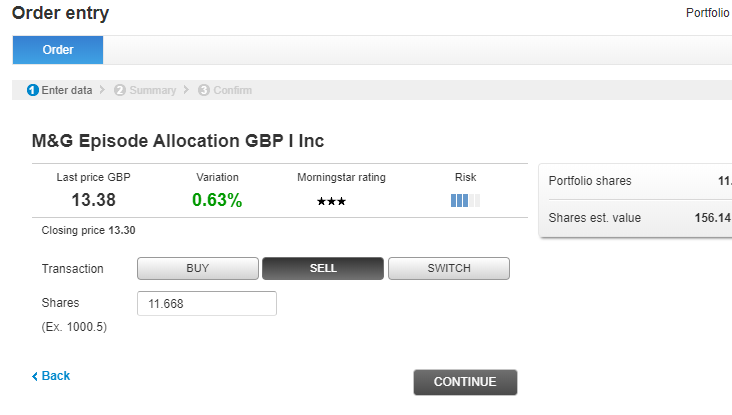

How to place an order for a fund

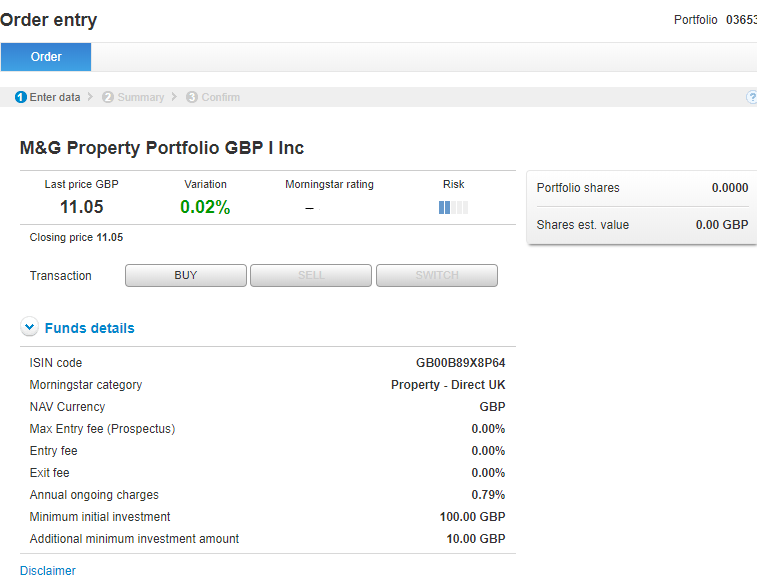

Click on the button  [“ORDER”] if wish to buy a fund and you will land on the “Order entry” webpage:

[“ORDER”] if wish to buy a fund and you will land on the “Order entry” webpage:

This page gives all the fund details, NAV ISIN listing and any commissions. The item Quotas in portfolio also gives any fund quotas which already exist in portfolio and the exchange value. The item Investments liquidity indicates the liquidity available in the current account for investment.

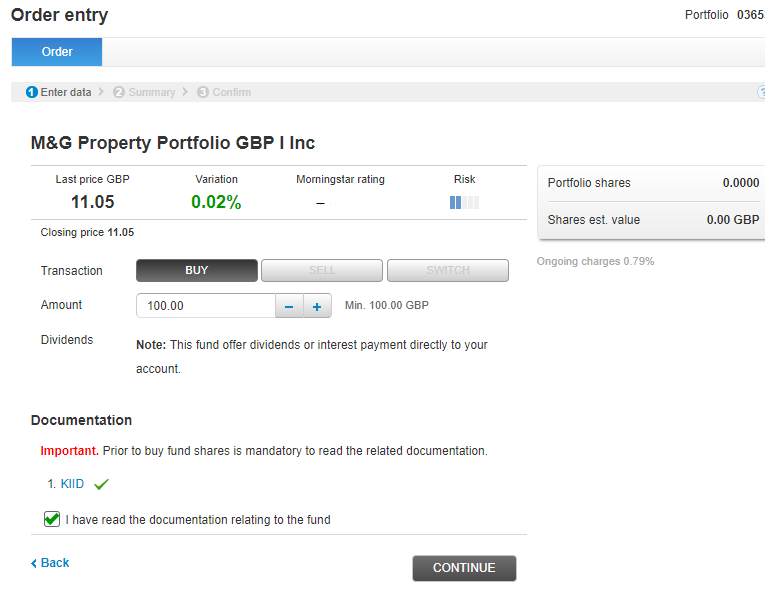

To acquire the fund, click on the button BUY.

Here you will find the template to insert the data for the order (and the amount to invest, if buying) and all the documentation about the fund, which you should read before subscribing. To proceed with the subscription, it is important to read all the documentation and click on CONTINUE.

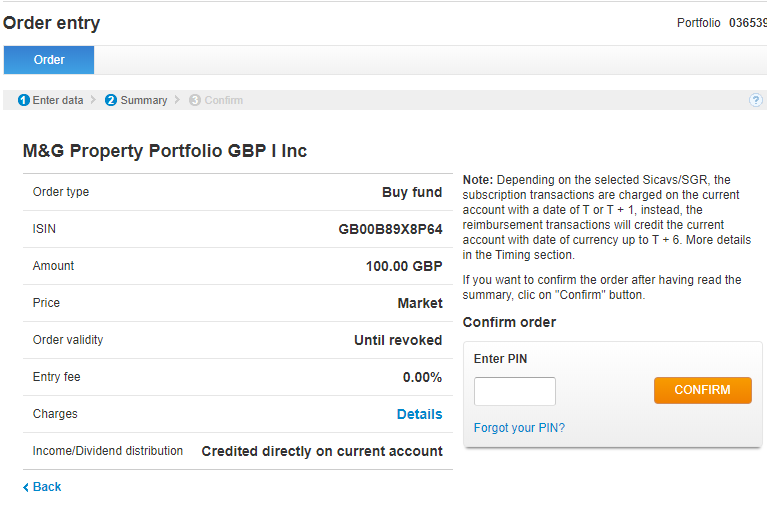

In this window, assuming the data inserted are correct, you can type your device PIN code.

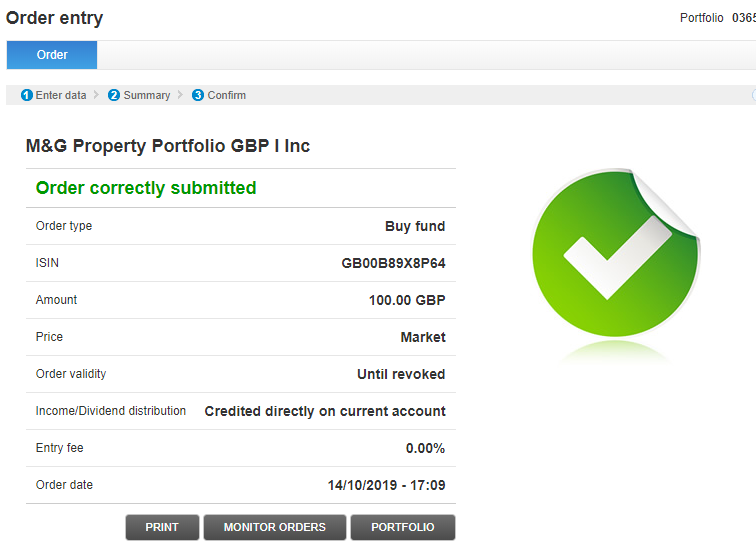

Afterwards, by clicking on the button CONFIRM, you will see that the order was received successfully by Fineco and sent to the market.

From here you can access the funds Monitor, in order to check the status of your order.

The following transactions will always be possible from the "Funds" Order Monitor:

> Cancel the order just placed

> Print the execution of your order at the time when it is really carried out. Check the times in the Learning Center for more details.

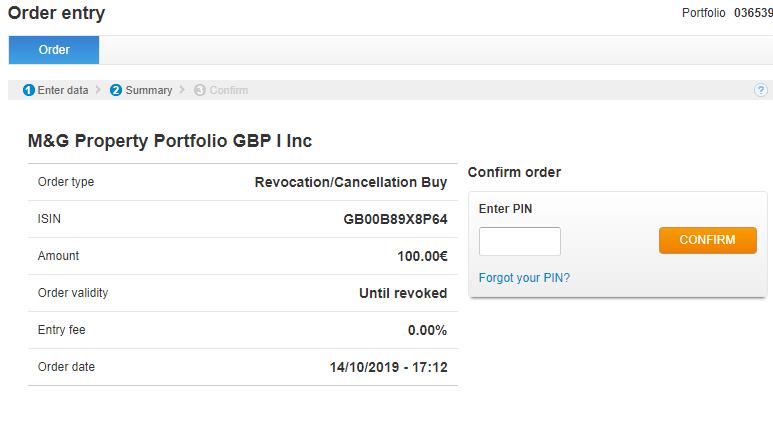

CANCEL AN ORDER

From the monitor it is possible to cancel a placed order by clicking on (X). A summary template will be opened which shows the order data. It is necessary to insert the PIN to confirm the cancellation.

N.B.: To supplement the provisions of the Disclosure in accordance with the Legislative Decree no. 190 of 19 August 2005 ", it is stated that, according to guidelines recently given in the doctrine, which have been consolidated in practice, over the interpretation of that decree, in the event of the placement of OICR (mutual investment funds and SICAV [Société d'Investissement à Capital Variable]) via remote communication techniques, the right of withdrawal and suspension of the validity of contracts for 7 days, starting from the subscription by the investor and envisaged by sub-section 6 of article 30 of the Legislative Decree no. 58 of 1998, will not apply. Consequently, with effect from 9 January 2006, the contract will be valid from the subscription date.

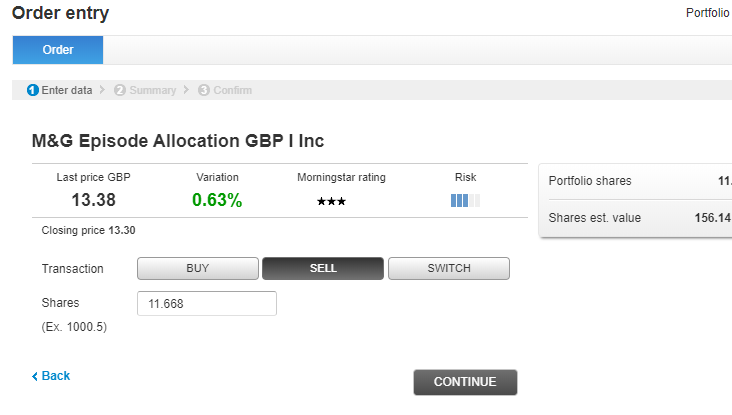

SALE AND SWITCH

From the funds Portfolio, by clicking on the button ORDER in relation to a fund, an order template will open with active keys for the Sale or Switch of the fund.

How to sell a fund?

Here you will find some useful information to help you understand better transactions to sell quotas in a fund (disinvestment).

Please note the Nav applied to the transaction differs from that shown in the fund card at the moment when the order is placed. It will be fixed just once daily, at the end of trading, based on the last price available.

What are dividend distribution funds and what are the advantages?

Dividend distribution funds allow the advantages of managed savings products to be linked to a periodic income flow, just like happens with the dividend with shares and the warrant with bonds.

The distribution of proceeds tends to be periodic. Every 1, 3, 6 or 12 months, based on what is defined in each individual prospectus, the Management Company may distribute part or all of the profits to investors, in the form of dividends.

The amount of proceeds to distribute, fixed in some cases as a percentage of the management adjustment, obviously depends on the fortunes of the fund (warrants and interest charged, capital gains achieved).

Dividend distribution funds can be identified, as they bear the suffix INC or ACC.

State a preference for the enjoyment of dividends

When subscribing a distribution fund, you will be able to choose the way in which you enjoy the dividends. In fact, you can choose whether to credit them directly to the current account or to reinvest them automatically in quotas in the fund.

N.B.

The preference and the alteration for the distribution of dividends are allowed only for SICAV which allow for that type of product.

The positions of the funds in portfolio will not be altered.

What is the average book value of a mutual fund?

The average book value of a mutual fund or SICAV, in the case of purchase transactions, is the average purchase price per unit calculated by dividing the sum debited to the current account by the number of quotas which arise from those transactions. That value should not be confused with the NAV of the fund on the day when the transaction is carried out, as it also includes the costs and commissions paid.

A typical calculation

To give an example, let us say that, on 10 January, fund A was acquired for a figure of € 1,000, the NAV (market price) of the fund on the execution date is € 10 and this fund has an entry commission of 1%:

- the sum debited against the current account is € 1,009 (entry commission for brokerage of € 9)

- the number of quotas subscribed is 99 (1000 - 10=990/10=99)

- the average book value viewed is 10.192 (1009/99).

Let us say, then, that on 20 March a later subscription was made to fund A for a sum of € 500, the NAV (market price) on the execution date is € 11:

- the sum debited against the current account is € 509 (brokerage commission of € 9)

- the number of quotas subscribed is 45 (500 - 5=495/11=45)

- 144 quotas will be viewed at an average book value of 10.542 (1518/144).

In the case of switch transactions, the average book value of a mutual fund or SICAV is calculated by considering that transaction, for a viewing opportunity, as the combination of two distinct movements: one of sale and a later one of purchase. So, the average book value of the fund resulting from the switch is fixed by dividing the exchange value of the disinvested fund (including any costs and commissions on entry – envisaged only for certain Sgr funds -) by the number of the incoming quotas in the fund following the switch.

A typical calculation

Just by way of example, let us say that, on 10 January, there was a total switch from fund A to fund B, we may also say that:

- the position in fund A in the dossier is 100 quotas and the NAV (market price) of the fund on the execution date is € 10

- the NAV (market price) of fund B on the execution date of the transaction is € 6 and for the sake of simplicity, there are no switch costs and entry commissions to pay on the new fund

- the number of quotas subscribed is 166.666 (100X 10=1000/6=166,666).

The average book value viewed is € 6 (it coincides with the Nav, because we have hypothesized that no costs have accrued on the transaction and fund B has no entry commissions to pay).

The average book value of a mutual fund or SICAV, in the case of transfers from other institutions, is the price notified to Fineco by the transferring institution. Only in situations where that is not notified to us, the average book value applied is the Nav on the day when the fund was placed in the dossier opened at Fineco.

What is the Morningstar rating?

Morningstar was the first company to spread a simple idea among savers: the funds’ performances should be appraised in light of the costs and risks assumed by the managers. The instruments used to assess the funds have developed over time but the principle remains the same.

The Morningstar rating expressed between stars allows a classification of the funds’ performances, bearing in mind the costs and degree of risk taken on.

The key features of the Morningstar Rating System are:

- The Morningstar Categories

- The costs

- The correct performance, depending on the risk

Morningstar Categories

Morningstar Categories group the funds by consistent investment policies and are based on an analysis of the specific composition in securities of the portfolios in question. Morningstar makes the utmost commitment to collect and analyze the fund portfolios. That is because the stated investment policies and the name of the funds are not sufficient to allocate a particular category to a fund.

The relevant parameters employed consist of the characteristics of the securities which make up the portfolio. For shareholding funds, consideration is also given to capitalization and the growth prospects and, for bonds, the duration and reliability of the issuer.

The main categories employed by Morningstar Europe are:

- Euro Area Large Cap shareholdings

- Euro Area Mid Cap shareholdings

- Euro Area Small Cap shareholdings

- Europe Large Cap shareholdings

- Europe Mid Cap shareholdings

- Europe Small Cap shareholdings

- North America shareholdings

- North America Small Cap shareholdings

- Japan shareholdings

- Asia, e.g. Japan, shareholdings

- Asia shareholdings

- International shareholdings

- International Small Cap shareholdings

- Technology Media & Telecom shareholdings

- Natural Resources shareholdings

- Real estate shareholdings

- Financial shareholdings

- Balanced – Moderate

- Balanced

- Balanced - Aggressive

- Convertible bonds

- Euro Monetary Area

- Euro Area short-term Bonds

- Euro Area Government Bonds

- Euro High Yield bonds

- International Bonds

- Euro Area Bonds

- GBP Area Bonds

- Dollar Area Bonds

Costs

All commissions are deducted from the funds’ gross performance. Moreover, the Morningstar rating takes into systematic account the subscription commissions. For each shareholding or balanced fund an entry commission is envisaged at 5%, unless the maximum commission to apply is lower. For bond or monetary funds, an entry commission is envisaged at 3%, unless the maximum commission to apply is lower. As a rule, there is a trade-off between the entry commissions and the management commissions and Morningstar does its best to assess the funds in the most correct and efficient way possible over a horizontal reference timeframe.

Correct performance for the risk

All funds are allocated a Rating which takes into account the monthly performance over the last three years. While aware that the volatility of a fund’s historic performance is not a perfect reflection of its risk (partly for this reason, we have opted to focus on the overall composition of their portfolios, which is the method employed to make the best possible use of the available data). Consequently, calculations for the Morningstar Rating are made on the base of profits for the investor, depending on the fund’s performance. The basic assumption is that an investor prefers to obtain regular returns over time rather than make huge gains and disastrous losses. In other words, he/she is adverse to risk. In practice, we assume that regular returns over time are felt to be better.

Stars

Once the calculations have been made, stars are allocated within each category, in the following way:

First 10% *****

Next 22.5% ****

Further 35% ***

Next 22.5% **

Last 10% *

The rating is given each month and may change, just like the funds’ performances.

Do all funds have a Rating?

Not always. There are cases where it is not possible to give one. For example:

- The data for the fund’s performance goes back less than three years.

- There is such precious little information that no category can be allocated to the fund.

- The fund has made continuous changes of category after changes in the asset allocation, so the historic returns are no longer relevant.

- Some funds with particular characteristics are too few and far between to be able to draw up a classification.

The use of the Morningstar Rating

The Morningstar Rating is one of the pieces of information that can be used to make a first selection on the funds to include in your portfolio. Together with the rating, Morningstar permits the observation of the main securities in the portfolio and other detailed information. Although the Morningstar information provides a valuable support, every investor should still continue to pay attention to his/her own asset allocation, to consider his/her tolerance of risk and verify the commissions on the funds and the requirements of income and liquidity. The rating does not provide any guidelines for these vital decisions.

Just one further point needs to be stressed: the Morningstar Rating is allocated to the fund and, should the manager change, the movements may not continue the same. It follows that a particular rating may be due almost entirely to the ability of a money manager, who later departed from the fund’s management

What is VaR (Value at Risk)?

VaR (Value at Risk) is defined as the maximum loss that a financial instrument (or a portfolio of financial instruments) may sustain over a particular time period, while allowing for a certain confidence interval.

The VaR used by Fineco

The VaR which Fineco uses, also known as VaR2, is projected weekly and has a confidence interval of 95%.

This means that, in 5% of cases, there is a chance of sustaining a higher loss than the estimated one.

This is a statistical measurement (estimate) of the risk of financial investments employed by the Bank, summarized in a number which ranges from 0 to 1000. It is applicable to all types of financial instruments and to portfolios of instruments.

VaR measures the market risk, including the fluctuation in the credit spread, but it does not take into account either the issuer’s insolvency risk or the liquidity risk of the financial instruments.

VaR is calculated on the basis of historic simulations. It relies on the historic series of 2 years of market prices or risk factors that dictate the prices of the financial instruments, in order to estimate the potential maximum weekly loss that an instrument or portfolio could sustain, in 95% of cases (e.g. a VaR of 16 represents the estimated maximum weekly loss on an investment of € 1,000 i.e. € 16 for every € 1,000 invested). VaR is recalculated from time to time and may change in relation to the evolution of the financial and credit markets.

Based on VaR, we have devised a staggered indicator, divided into four increasing levels that enable you to assess the risk level of certain financial instruments.

VAR should be seen as a feature which indicates the risk and not as a guaranteed protection for capital within the levels shown.

If we do not own all the essential information needed to make a precise measurement, the VaR of the individual instrument / product calculated by the Bank is determined prudently by using the proxy, based on the type of product.

Investment product forms

In this section, you will find information about the financial products on which you can conduct transactions with Fineco.

Absolute Return Funds

- Compare highs and lows on the markets

The financial markets, especially for shareholdings, are not characterized by a constant and positive trend. On the contrary. The strategy of the absolute return investment, with an absolute return, is geared to obtain positive results in any market phase, whether with hikes or falls. - Preservation and growth

The objective of an absolute return investment is the preservation of the capital and its constant growth over time, free of market trends. - Freed from the benchmark

Traditional funds are tied to a benchmark: a market index which, on the one hand, represents the performance objective (the manager should earn at least as much as the benchmark) and, on the other, is a portfolio constraint (in its investments, the manager is expected to replicate the make-up of the index; it may over-weigh or under-weigh a security or a sector but should not ignore it).

Absolute return funds often have as their objective a performance equal to that of a monetary market index (for example, the performance of Bot), plus a spread (an increase, calculated as a percentage). Consequently, they are unrestricted by market indexes and are able to manage the investment choices with more flexibility. - The importance of the mandate

Absolute return funds are particularly suitable for investors who do not have time to monitor their own investments but want them to accompany the trends in the financial markets. For this reason, absolute returns are suitable for those who wish to entrust their investments to highly specialized management teams and to leading Investment Houses around the world who can call on all the tools and specific management techniques to administer the investments with considerable know-how and professionalism and who will feel fully confident about always making the best choices. - Diversify at controlled risk

In a diversified portfolio, absolute return funds may be a valid alternative to an investment in monetary funds and instruments and bonds, with the objective of pursuing positive performance achieved through adequate control of the risk.

Dividend funds strategy

- Choose the most generous

The main criterion employed in these funds to choose the securities in which to invest is the existence of a constant distribution of the profits. That is to say, companies which, in their corporate policy, demonstrate their commitment to reward the shareholders with dividends. The funds collect the profits distributed by the companies and, from time to time, redistribute them among the subscribers in the form of quotas or warrants. So, investment in these funds combines the earnings associated with the revaluation of the shares and, therefore, of the fund, with the chance of a periodic income. Naturally, its amount cannot be constant and depends on the trends of the companies and the economy as a whole. - Consolidated enterprises

The policy of how to distribute the profits of each company does not depend just on the results of the balance sheet. To invest in funds with this speciality also means investing in consolidated companies, which are characterized by positive data in the balance sheet and which tend to reward shareholders. Enterprises in a phase of growth tend to prioritize investments and, therefore, distribute to members a marginal quota of the profits, whereas more consolidated companies tend in practice to more often reward shareholders with participation in the profits. - Shareholding but conservative

These characteristics mean that investment in funds with high dividends, although they pose the usual risks of the share market, has a more modest degree of volatility than others. In that way, it may help to distribute better the overall level of risk of a more structured share portfolio.

Protected Capital Funds

- Protection...

To invest a sum, which you may need not too far away in the future. And not take the risk that, at the moment of settlement, the capital may have been reduced excessively following a rather unfavourable market situation. Protected capital funds meet those sorts of requirements. They can satisfy the needs of many prudent savers adverse to risks and all those who give priority to the need to preserve capital but who wish to take up investment opportunities in the financial markets. - ... and performance

Unlike an investment which is purely monetary or a short-term bond, protected capital funds, by virtue of the investment (albeit modest) in shares and long-term bonds, may offer an interesting return and with extremely modest risk. - Know in advance the riskiness of the investment

Protected capital funds do not guarantee either the return of the capital or a minimum return. In particular market situations, a loss may occur, although it should be modest. The investor is always aware of the investment risk it may face.

Fund of Funds

- Double diversification

Sub-funds employ, to form their investment portfolio, quotas of other funds or SICAV, instead of investing directly in securities (shares, bonds, etc.). Diversification is therefore achieved at two levels: the first concerns the equity of the individual funds which, by definition, is diversified among numerous different securities; the second concerns the equity of the sub-funds, which include products which differ in their specialty, geographic area and style of management. - Efficient selection

In theory, anyone can construct unaided a diversified fund portfolio. However, in practice he/she is likely to encounter minimum thresholds of access, costs and difficulties in finding information about the managers and products. Sub-funds constitute an extremely wide-ranging basket. They may select, thanks to the monitoring of a considerable number of mutual funds and the manager’s analysis abilities, the best in each investment category, by selecting from among the products of the largest management houses in the world. Buying from "wholesalers", then, reduces the impact of costs on the portfolio. - Wide range of choice

By now, the family of sub-funds is particularly numerous: anyone can find at close proximity the type of investment which best meets the investor’s objectives, strategies and profile. - For small amounts of capital, too

Unlike asset management in funds, which is based on the same principles, sub-funds do not demand large capital and may be subscribed by just about any saver.

• Maximum transparency: the daily NAV is available for sub-funds

• Simplicity in buying and selling, just like a fund.

Target date funds

- An investment with a due date, without restrictions

There are considerable situations in which one may want to invest long-term and with a pre-fixed maturity date. For example, capital to employ to coincide with a pension or to allocate to sons and daughters when they complete their education. However, the bulk of investments with a due date is highly rigid: it is not possible to disinvest ahead of the maturity date – unless with penalties - or increase or amend the investment. On the other hand, the target date funds offer an investment with a maturity date and without restrictions. - Freedom and flexibility

There are numerous target date funds. It is possible to liquidate the investment at any time, without a penalty. To increase it with fresh payments. To prolong it if, on the anticipated maturity date, you prefer to keep the investments and maintain the result obtained. The different durations available for the funds enable anyone to meet his/her specific requirements. - The best mix between shares and bonds

The secret of the target date funds lies in the combination in time of the share investment with the bond one. When the maturity date is far away, it is possible to sustain the risks of the share market and the quest for ever higher returns. As the due date approaches, it becomes essential to reduce the risk and preserve the results achieved by shifting the investment to bonds and monetary stocks.

Specialist BRIC funds

- Choose the emerging countries

"BRIC" funds focus on a selected group of Emerging Countries, compared to funds which usually invest in developing areas. Consequently, they allow for a more informed choice, tailor-made to match the investment objectives. - A diversified portfolio

Investment in a "BRIC" fund is appropriate for savers with a high risk profile. Nevertheless, the portfolio is spread over four different markets: the manager is able to over-weigh the one it finds most interesting and under-weigh the one which, at a particular phase, has cloudier prospects. This allows a relevant reduction of the level of risk.