Reporting

With Fineco you can invest in the main world markets with just a few clicks. Thanks to the support of sophisticated tools, you will always be updated and be able to analyse in detail each security in portfolio and assess the tax aspects of each investment made.

In this section, you will find the following information in order to:

- access Fineco's commission fee plans for trading on all financial instruments

- check the Profits and Losses generated by your trading

- display all information about your entire portfolio, including the securities owned that were purchased online, offline and transferred to Fineco

- be updated about the communication of Significant losses

- understand all aspects of the Interest-bearing Portfolio system that remunerates you for lending the securities in portfolio

- check Swap Rates for foreign currency transactions and Settlement of futures to calculate the profits and losses on derivatives.

Commission fees

Fineco applies a brokerage fee for each executed order. No commission fees are applied to revoked, deleted or failed orders.

In case of orders executed in several tranches, the commission fee is charged once on the total.

If the commission fee is expressed as a percentage, the basis of calculation is the value of the order (price of the security multiplied by the quantity).

Starting from the 1st March 2020 for the following markets the trading fees are fixed regardless of the order’s value:

-Shares and ETF UK2, bonds (MOT/EuroMOT - EuroTLX and HI-MTF, Euronext)4

-US shares (Nyse, Amex, Nasdaq)

-European shares (Equiduct Germany, Xetra, Equiduct France3, the Netherlands, Portugal, Euronext1, Italy)

Below please find a summary table of the commission fee plan:

| Shares and ETF UK, Fixed commission fee | Bonds (MOT/EuroMOT - EuroTLX and HI-MTF, Euronext), Fixed commission fee |

European shares (Equiduct Germany, Xetra, Equiduct France, the Netherlands, Portugal, Euronext) Fixed commission fee |

USA (Nyse, Amex, Nasdaq) Fixed commission fee | Canada (TSX) Fixed commission fee | ||

| £2.95 | £6.95 | €3.95 | $3.95 | 10 CAD | ||

Notes:

1 For the securities of EquiductFrance, Netherlands and Portugal and Euronext, an additional fixed charge of €9 for each executed order is applied.

2 For shares on LSE are provided:

- the fixed stamp duty equal to 0,5% of the traded value for the executed Purchase Order

- the PTM (Panel on Takeovers & Mergers) Levy equal to £ 1 for transactions higher than £10,000

- the fixed stamp duty equal to 1% for listed Irish securities

3 For French securities, an additional fee of 0.3% on the net position of each day is applied with the exception of transactions that open and closed on the same day.

4 The commission fees applied on bond markets are expressed in GBP but charged on the multicurrency sub-account of the settlement currency.

Commissions fees on other European stock markets and certificates

The commission fees on other European markets traded online (Finland, Spain and Switzerland) are equal to 0.19% of the total transaction value with minimum commission fees that change for each country.

There is no maximum commission fees for executed orders on these markets, except for the Finnish market which applies a maximum fee commission per order executed of € 19, in addition to fixed charges (€ 9).

Here is a summary table:

| Fee | Min | Max | Fixed fees | |

| Finland shares/ETFs | 0.19% | €2.95 | €19 | €9 |

| Spain shares/ETFs | 0.19% | €14.95 | - | - |

| Switzerland shares/ETFs | 0.19% | 24 CHF | - | - |

Commission fees on derivative markets

*Reduced commission rates are applicable where commissions paid exceed €/$500 in one month for IDEM/EUREX (€) and CBOE ($) Markets. The reduced commission rate is maintained for the following month.

** Reduced commission rates are applicable where commissions paid exceed €/$10.000 in one month for IDEM/EUREX (€) and CBOE ($) Markets. The reduced commission rate is maintained for the following month.

***Free after having executed at least 1 trade in one month

**** For US stock options:

- a fixed commission of $ 20 for exercise will be applied.

- Should the underlying of the option detach dividend, a 1$ fee will be applied for each lot of the position (both long and short) in the portfolio at the end of the trading day prior to the dividend ex-date.

Below is a summary of the IDEM and EUREX instruments:

| Stock-index futures Fees | |||

| FTSE MIB - Dax | €0.95 per lot | ||

| Mini FTSE MIB - Micro FTSE MIB - DJ EuroStoxx 50 - DJ Stoxx - VSTOXX | €0.95 per lot | ||

| TecDax | €0.95 per lot | ||

| Mini DAX | €0.75 per lot | ||

| Micro Dax - Micro EuroStoxx | €0.75 per lot | ||

| Bond futures | |||

| Bund - Bobl - Schatz - Buxl - EuroBTP (long and short term) - Bonos | €2.00 per lot | ||

| Futures on sector indexes | |||

| DJ EuroStoxx Automobiles - Banks - Oil and Gas - Insurance - Technology - Telecom | €2.00 per lot | ||

| FTSE MIB Options | €3.95 | €2.95* | €1.95** |

| Eurex monthly charge1 | £15 | Free* | Free** |

Note:

- The relevant date for calculating the commission fee band and for debiting the Eurex monthly charge is the transaction date.

Summary table for CME:

| Stock-index futures Fees | |||

| e-mini S&P 500 - e-mini Nasdaq 100 - e-mini Dow Jones | $1.95 per lot | ||

| Micro futures | $0.70 per lot | ||

| Nikkei Index ($) | $2.70 per lot | ||

| Futures on currencies | |||

| Mini EuroDollaro Fx - Euro Fx - British Pound - Swiss Franc - Australian Dollar - Canadian Dollar - Japanese Yen | $2.50 per lot | ||

| Futures on commodities | |||

| Mini Crude Oil - Light Sweet Crude Oil - Heating Oil - RBOB Gasoline - Natural Gas - Mini Natural Gas - Gold - Mini Gold - Silver - Copper - Palladium - Platinum - Corn - Mini Corn - Wheat - Mini Wheat - Oat - Soybean - Mini Soybean - Soybean Meal - Soybean Oil - Rough Rice | $2.00 per lot | ||

| Futures on US Treasuries | |||

| 5 Year T Note, 10 Year T note, US Treas B, Ultra US T B | $2.00 per lot | ||

| US Options | $3.95 | $2.95* | $1.95** |

| US stock options - exercise**** | $20 | $20 | $20 |

| US stock options - underlying dividend detach**** | $1 | $1 | $1 |

| CBOE monthly charge | $15.00*** | Free | Free |

| CME monthly charge | Free | ||

You can also trade via Customer Care on several foreign markets for which there is no available online operation. In this case, there is no additional cost to the following trading fees:

| Market | Trading fee |

| ATX - Austria | 0.19% Min € 24.95 |

| KFX - Denmark | 0.19% Min 100 DKK |

| ASE - Greece | 0.50% Min € 24.95 plus fixed taxes* |

| IOX - Ireland | 0.19% Min € 14.95 plus fixed taxes* |

| OBX - Norway | 0.19% Min 120 NOK |

| OMX - Sweden | 0.19% Min 135 SEK |

Some markets (marked with an asterisk) require the payment of a stamp duty. Fineco applies these expenses transparently with no extra charge:

> Ireland: 1% of the value only for buy orders

> Greece: 0.0675% of negotiated value for purchase orders and 0.0,2675% for selling orders

Trading offline securities

Through the Customer Service you can trade securities listed in stock markets which cannot be traded online.

In these cases, the following commission fees are applied:

| Maximum commission fee for OTC Bonds and Certificates (Euro and foreign) | Up to 0.10% - min € 5 |

| Maximum commission fee for Certificates on offline regulated markets | Up to 0.70% - min €15 |

| Maximum commission fee for Italian securities | Up to 0.70% - min €15 |

| Maximum commission fee for the securities of other offline foreign regulated markets ** | Up to 0.70% - min €15 |

| Maximum commission fee for OTC US securities | min $3.95 - max $6.95 fixed |

(**)Securities that cannot be traded online refer to those other than the securities listed on ASE: Greece, ATX: Austria, KFX: Denmark; IOX: Ireland; OBX: Norway; OMX: Sweden, which are subject to the different conditions described earlier.

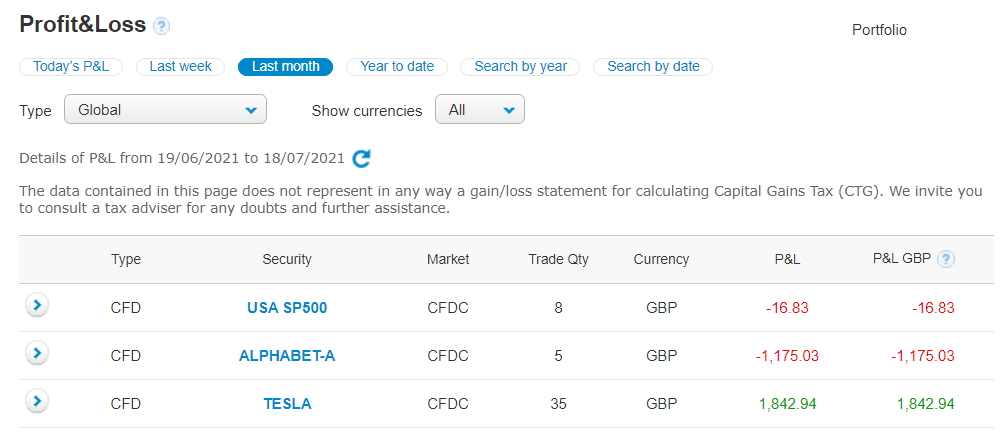

Profit & Loss

In the Profit&Loss section you can display all the profits and losses of your trading operations.

Today’s P&L

Here you can see:

- the Global Profit&Loss where you can see the total performance of the day.

- the profits and losses broken down by Asset Class (Shares, Bonds, CFDs, CFDs Fx, Futures and Options).

"Today’s" P&L is calculated as the difference between the market value of the position at closing time and its book value. In order to display the daily P&L, no trading fees are therefore included.

Details of P&L

Each row shows the summary of the instrument’s performance, with an indication of the total amount which has been negotiated and its performance.

Each row displays the following information:

- Symbol: of the traded instrument

- Security: of the traded instrument

- Market: the reference market on which the individual instrument is traded

- Trade Quantity: the total amount traded

- Currency: the trading currency of the instrument

- P&L: the total profit or loss of the instrument traded shown in the trading currency

- P&L GBP: the total profit or loss of the instrument calculated by converting the P&L into native currency at the current exchange rate

Furthermore, click on  to expand the row and obtain the following additional information about the individual transactions that comprise the general row:

to expand the row and obtain the following additional information about the individual transactions that comprise the general row:

- Symbol: of the traded instrument

- Transaction Date: the date on which the transaction was executed

- Average opening price: the price at which the position was opened

- Average closing price: the market price at which the position was closed

- Market: the reference market on which the individual instrument is traded

- Quantity: of each transaction

- Description: type of transaction

- Currency: the trading currency of the instrument

- P&L: the total profit or loss of the transaction shown in the trading currency

Note

- the transactions carried out on ETFs will be displayed on the day the transaction is settled;

- Transactions carried out on the Forex market between 00:00 and 06:00 hours are displayed only in the Portfolio Forex > Recent orders section

Average book value

The average book value is the average unit purchase price (net of commission fees, net of stamp duties, expenses and sundry charges) of the securities in portfolio on which the realised profit or losses are subsequently calculated.

Why is the book value sometimes different from the purchase price? To understand how the book value is calculated, you have to consider the particular calculation methods used.

At the beginning of the day, the carrying average book value is calculated based on all the past buy/sell transactions in chronological order.

The average book value of the day, in case there are more than one transaction on the same security, is calculated considering all buy orders first regardless of the chronological order.

Historical P&L

By selecting the available time horizons, it is possible to view the historical P&L (starting from 6th April 2021).

The carrying average book value is calculated in chronological order, net of commissions and all other components that contribute to the calculation of the total P&L. Therefore, even in the case of purchases and sales on the same day on the same instrument, the average carrying price shown will be the result of a calculation made in chronological order.

The P&L shown is the total of the following components:

- Trade > P&L from trading

- Reimbursement > P&L in case of Fund redemption

- Commissions

- Interests > bond accrual

- Overnight fee

- Dividend

- Coupon

Each row displays the following information:

- Type: type of asset class

- Security: of the traded instrument

- Market: the reference market on which the individual instrument is traded

- Trade Quantity: the total amount traded

- Currency: the trading currency of the instrument

- P&L: the total profit or loss of the instrument traded shown in the trading currency

- P&L GBP: the total profit or loss of the instrument calculated by converting the P&L into native currency at the current exchange rate

Furthermore, click on  to expand the row and obtain the following additional information about the individual transactions that comprise the general row:

to expand the row and obtain the following additional information about the individual transactions that comprise the general row:

- Symbol: of the traded instrument

- Transaction Date: the date on which the transaction was executed

- Average opening price: the price at which the position was opened

- Average closing price: the market price at which the position was closed

- Market: the reference market on which the individual instrument is traded

- Quantity: of each transaction

- Description: type of P&L (trade, reimbursement, commissions, interests, overnight fee, dividend, coupon)

- Currency: the trading currency of the instrument

- P&L: the total profit or loss of the transaction shown in the trading currency

It is possible to export to excel or pdf by clicking on the relevant link at the bottom of the page.

The excel file consists of two sheets: one for the general line and one for the detail line.

Notes:

- Reported commission fees do not take into account any government related fees. Financial transaction taxes can vary by country, for more information, see Help> Trading> Government Taxes

- The data contained in this section does not represent in any way a gain/loss statement for calculating Capital Gains Tax (CTG). We invite you to consult a tax adviser for any doubts and further assistance

- For Classic CFDs, FX CFDs and Logos CFDs the historical P&L is calculated in GBP using the CFD exchange rate at the end of the trading day

- The daily P&L value may differ from that displayed starting from the next day. This is for the following reasons:

- The daily P&L does not take into account the commissions

- The average book value is calculated as indicated above in the Today’s P&L paragraph

- The GBP P&L calculation on CFDs takes place during the overnight process. On the closing day itself, the P&L is reported in the native currency of the underlying

-

Due to rounding performed by the system in conversions between currencies, the data shown may differ by a few cents from the expected values

-

In the event that a sell order is split into several tranches, the individual tranches will be displayed in the expanded line and the commission will be linked to only one of them

-

In the event that a buy order is split into several tranches, in the expanded row the buy commission will report the quantity of the tranche to which the commission is linked

-

The commissions relating to futures and options do not show sign / quantity as they are calculated at the end of the day on the sum of the operations carried out during the day on the instrument

-

The Trade Quantity item is valued only if there has already been a P&L from a partial/full close position trade

Tax aspects

Dividends

No withholding tax applies to dividends paid by resident companies.

Withholding tax applies to dividends paid by non-resident companies according to the percent rate set in the company’s country of residence.

Note: The Canada Revenue Agency (CRA) has reviewed the tax regulations that govern taxation at source of all dividends originating in Canada and received by non-resident subjects. Following this review, starting from 1 January 2013, the taxation at source applied to dividends paid to non-resident subjects in Canada will be 25%.

Instrument Depreciation

According to Article 62 paragraph 2 of Commission Delegated Regulation (EU) 2017/565 , investment firms that hold a retail client account that includes positions in leveraged financial instruments or contingent liability transactions, shall inform the client where the initial value of each instrument depreciates by 10% and thereafter at multiples of 10%.

Referring to the services offered by the Bank, the instruments in scope for this Regulation are:

- CFDs and CFDs FX

- All financial instruments characterized by leverage such as leveraged ETFs or Certificates

Fineco monitors on a daily basis every open position on these instruments and carries out two types of controls.

Position Control

If the client has a position still opened at the end of the day on an instrument in scope for the Regulation, Fineco compares the average opening price of the position (not considering fees) with the official end-of-day closing price of the instrument.

If the depreciation results equal or greater than 10% (or a multiple of 10%), the client will receive a notification email the day after and he will be able to find further details in his Client Area > Portfolio > Reporting > Instrument Depreciation.

In the following days, no more emails will be sent unless the position has a new depreciation equal or greater than the threshold reported previously.

Transaction Control

If the client has a position on an instrument in scope for the Regulation which has been closed (totally or partially) during the day, Fineco compares the average opening price of the position (not considering fees) with the position closing price or with the average closing price in case of multiple executions (not considering fees).

If the depreciation results equal or greater than 10% (or a multiple of 10%), the client will receive a notification email the day after and he will be able to find further details in his Client Area > Portfolio > Reporting > Instrument Depreciation.

Significant losses related to your Total Financial Asset

The Total Financial Asset (TFA) is the sum of the available balance of your current account and the total value of your portfolio.

In case of positions with significant losses which exceed 50% or 75% of your Total Financial Asset with reference to transactions in financial derivative instruments (Futures, Options, FX CFDs, classic CFDs, Logos CFDs and Logos Time CFDs), Fineco will report to you via email.

The initial TFA was observed at 08:00 hours on the day 25/10/2017.

The reference TFA (to which losses are compared) is calculated as the initial TFA plus net account transactions of the same day (for example, bank transfers, incoming transfers, payments, cheques credited/charged, etc).

In detail, the reference TFA for the day “T” is calculated by adding the net account transactions of the day “T” to the reference TFA of “T-1”.

Calculations are only carried out on accounts with an initial TFA and/or reference TFA of over £5,000.

The P&L considered is the P&L accumulated from the first executed trade since October 25th. The P&L is calculated for each position as the difference between the closing price and the average opening price; Multi-day position fees are also included as negative P&L items.

For purchase/sale transactions on Futures or Options in currencies other than GBP, the exchange rate applied is the Bank of England's daily spot exchange rate for the trade date against GBP. For CFDs in non-GBP currencies, transactions will be settled on your current account in GBP following a conversion. Conversion will take place by applying our exchange rate of the day on which the P&L is realised.

If the option expires out-of-the-money, the loss is equal to the option premium.

The procedure carries out checks daily on every single account (the P&L accrued on different accounts, even if the account holder is the same, are therefore considered separately) and in the event that accumulated losses exceed 50% or 75% of the reference TFA an email is automatically sent to you.

The procedure leaves out from checks all positions already reported for reaching the second threshold (75%). If the procedure issued a first-band report (50%) and subsequently the client TFA decreases under the minimum £5000 threshold, the position is therefore monitored and/or reported. It shall only be excluded if the second threshold (75%) is reached.

The email is sent on the business day following the day on which the threshold is reached.

Note: If the net account transactions of the day are negative, the ratio between the net account transactions of day T and the reference TFA of the day T-1 is calculated. Accumulated losses are normalised by the same percentage.

Here are some examples:

Example 1:

Reference TFA of the day (T-1): £10,000

Outgoing transactions at the end of day (T): £ -1,000

Incoming transactions at the end of day (T): £ +500

Net transactions of the day: -1000 +500 = £ -500

Percentage of net transactions compared to the reference TFA: 5%

Accumulated losses on day (T-1): £ -6,000

Losses of day (T): £ -100

Accumulated losses on day (T): £-6,100

Losses normalisation: 6,100 * (1-5%) = £ 5,795

New total amount of accumulated losses is £5,795 and the new reference TFA is £9,500

Losses exceed 50% of the TFA, therefore the client is informed via an automatic email.

Example 2:

Reference TFA at the of day (T-1): £ 10,000

Outgoing at day (T): £ -500

Incoming at day (T): £ +1,000

Net transactions of day (T): +1000 -500 = £ +500

Percentage of net transactions compared to the reference TFA: not calculated because net account transactions of the day are positive

Accumulated losses on day (T-1): £ -6,000

Losses of day (T): £ -100

Losses normalisation: does not take place

New total amount of accumulated losses is £6,100 and the new reference TFA is £10,500

In this case losses do not exceed 50% of the TFA, no communication is sent.

Interest-bearing portfolio

The Interest-bearing portfolio is a free service that remunerates you for lending the securities in your portfolio. Activation is completely online: in the specific Portfolio > Reporting section, click on "Activate" and in just a few steps you will be able to activate the service on one or more security portfolios.

Securities may start to give a return from the day after activation.

The service can be deactivated at any time by clicking on the "Deactivate" button. The service will be deactivated the day after your request.

Securities that can be activated for remuneration are all shares, government securities, ETFs and covered warrants.

Portfolio remuneration is based on the simple principle that there are operators on the market who need to use securities for various transactions (such as issuing structured products or derivatives, for example, for trading or hedging operations) and that there are savers or investors with securities that they keep in a portfolio. Fineco, therefore, acts as a pure intermediary and, after checking which of its customers that have activated the Remunerated Portfolio service own certain securities, gathers them together and lends them to these operators, who pay a commission fee for the loan. The commission fee is then paid into the customer’s current account once a month, as "remuneration" for their "portfolio".

By activating the service you authorise Fineco to lend the portfolio securities in order to pass them to the institutional investors, and can be useful for various purposes, such as structured transactions or hedging operations.

The securities are always available for you.

This is how Fineco enables you not only to make your liquidity earn, but also the securities in your portfolio.

However, you cannot be sure that your securities will be lent when you activate the service, because this depends on operator demand, but if they are lent, each day you can accrue a small return which is credited to your current account once a month.

How does it work?

The "Interest-bearing Portfolio" service is active on the entire security portfolio. The securities remain completely available to you during normal trading. Each lending transaction leaves you free to sell your securities when you want, both in normal stock exchange sessions and during after-hours trading.

Your transactions do not undergo any change and you can continue to place orders valid for several days, set Stop Losses or place orders with the markets closed.

Each day, Fineco matches with each borrowed security the list of customers who have activated the service and have that security in their portfolio for a value equal to or exceeding GBP 1,000 (to avoid credits to more than two decimal places).

The list is numbered (1, 2, 3, ... N) so that each number corresponds to a customer.

Then a number (from 1 to N) is extracted: the total quantity of the security in the portfolio of the customer that corresponds to that number is lent.

A second extraction follows and so on, for each security, until the depletion of the quantity that Fineco Bank needs. If there is a further need, customers whose portfolios hold amounts lower than GBP 1,000 of the value of the required security will be selected using the same system.

Each time one of your securities is subject to a transaction, the next day you will find the corresponding entries in the Credit section, where you can also check all the transactions, with the details on each and the rate of return applied. Each transaction is also reported in the Portfolio/Reports section, among the Orders and accounts.

What's the return?

The remuneration of the securities depends on the market conditions and the specific demand for the security. Therefore the remuneration is subject to daily changes and is constantly updated online.

The table available on the page dedicated to the service contains the remuneration rates of the main securities; this means that securities that are not in the table may also be remunerated, according to the demand of the operators and the market.

The remuneration of each transaction is calculated by multiplying the number of your securities by the reference price of the day and by the active remuneration rate for that share for that day. Since it is an annual tax, the result must be divided by 360.

Since each transaction occurs daily, the remuneration each day will be small, because the rate refers to the year, but the sum of all these small amounts can become very high if you own many securities and if your securities are taken every day.

In the Remuneration section you will find the details of the transactions with the monthly credits.

Rates on currencies

The CFDs Fx enables you to purchase or sell the currency pairs of the Forex market, with settlement at the end of the day the transaction was executed and payment on the following business day.

By performing a foreign currency purchase and sale transaction you send FinecoBank the order to purchase or sell a specific amount of foreign currency (the base) against payment or collection of the related value expressed in another currency (the quote currency or reference currency) at the ruling exchange rate.

The Trading Spot FX is different from the traditional service that enables you to translate directly the euro/foreign currency amount (dollar) with the currency immediately available for any amount and no leverage effect the influences the spot exchange rates on the Forex market.

CFDs Fx trading is provided to the customer via various channels: the Bank’s website, the PowerDesk2 platform in push, mobile applications, iPhone, iPad and Android. Limited to the closing of positions you can also operate through the phone orders of FinecoBank client service.

The period of duration of your currency positions may be:

- Intraday - Closing of the position on the same day as it was set up. At the end of day (10:50 pm), if the position is still open for any reason, Fineco will close it automatically.

- Multiday – the position on CFDs Fx can stay open until its expiry date (i.e., 12 months from the opening date of the position); at this moment, Fineco will close it automatically.

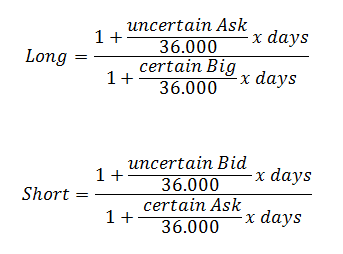

The interest which shall be applied to each FX CFD position opened for more than a Working Day (Multiday), to be composed of a fixed and a floating part described as follows:

- Fixed interest: charge of 2.95% of the position value in Euro, using the CFD Fixed Currency as reference

- Floating Interest: calculated by applying the Interest Rate spread on each working day, as detected between 10:00:00 pm and 10:30:00 pm, as the average between Bid and Ask prices of the CFD

Long positions are calculated as the difference between:

- Mathematical average of CFD price

- Mathematical average of CFD price multiplied for the abovementioned factor.

Multiplied for the quantitative factor of the position and converted in Euro, employing the current Euro/Uncertain currency exchange rate. The resulting amount, if negative, will be billed to the client. If positive, it will be credited to the client’s account.

Short positions are calculated as the difference between:

- Mathematical average of CFD price multiplied by the abovementioned factor

- Mathematical average of CFD price

Multiplied for the quantitative factor of the position and converted in Euro, employing the current Euro/Uncertain currency exchange rate. The resulting amount, if negative, will be billed to the client. If positive, it will be credited to the client’s account.

Daily, should the position result, at the end of the day, reduced or zeroed if compared to the initial one, interest is calculated and recorded.

Multi-day positions that stay unchanged for at least 90 days have interest calculated according to the available balance. Record of said interest, with the corresponding writing on the current account, will happen when the position is closed, even partially.

Example:

If on Day t I open a long position on CFD GBPUSD for 10,000 lots with a 2% margin (and 1% Stop loss), the amount of the margin will equal GBP 200 (10,000 *2%).

Given the Bid/Offer prices of the CFD, equal to 1.3044-1.3047, the average book value will correspond to the offer price of 1.3047 and the Stop loss will be equal to 1.2916.

If the End-of-day Bid-Offer prices equal 1.3010-1.3013 the arithmetic average of the price of the CFD will be (1.3010 + 1.3013)/2 = 1.30115.

Fixed Borrowing Interest calculation:

2.95%*10,000/360*1 = Euro 0.82

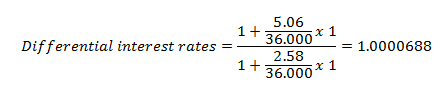

Floating interest calculation:

Bid Price–Offer Price certain currency’s rate of interest: 2.58-2.60

Bid Price –Ask Price uncertain currency’s rate of interest: 5.04-5.06

Differential interest rate: 1.0000688

Arithmetical average of the CFD price multiplied by the above given rate differential 1.30115*1.0000688= 1.301238

As the position is Long, the difference is calculated between:

- The arithmetical average of the CFD price

- The arithmetical average of the CFD price multiplied by the rate differential: (1.30115 - 1.301238) = - 0.000088

This difference is then multiplied by the position quantity (10,000 units): 10,000*( - 0.000088) = - 0.88

This amount is translated into GBP at the ruling GBP/USD exchange rate (1.3018) and will be equal to (- 0.88/1.3018) = - GBP 0.68

Consequently, the total interest charged will be (0.82 + 0.68) = GBP 1.5

Interest will be calculated daily, but debited on the current account only when the position is partially or entirely closed.

Note: every 90 days, on the positions which are still open, this interest will be allocated on the available trading balance and entered among the reserved items.

Settlement of futures

Futures on a share index are settled daily through a mark to market mechanism, based on which contracting parties who have experienced an adverse market trend must pay an amount (called the variation margin) to the clearing house.

The settlement price is the official price used to calculate the gains and losses of a derivative contract and is determined daily for each futures contract.

If the position is not closed during the day, Fineco will debit/credit your current account directly with the variation margins determined by the difference between the opening price of the position and the daily settlement price.

If the position is not closed, each day the margin relating to the difference between the settlement price for the day and the settlement price for the previous day is credited/debited to your account.

When the position is closed, if this is done before the end of the trading day, the debit/credit will be the difference between the closing price of the position (the price of the executed order) and the value of the settlement price of the previous day.

For example, if you have opened a long position on MINIL7 at 38,380 on 19/03 and did not close it during the day, if the settlement price on 19/03 is 37,772, your current account will be debited with value date 20/11 (T+1) with the variation margin of € 608, the difference between 38,380 and 37,772.

If the settlement price on 20/03 is 38,094, with date 20/11 and value date 21/03 the sum of € 322 will be credited, the difference between the settlement price on 19/11 and the settlement price on 20/11: 38,094 - 37,772 = € 322.

Settlement price on 21/11: 37,506, with date 21/03 and value date 22/03 the sum of € 588 will be debited, the difference between 37,506 and 38,094.

When your position is closed, at 37,575 for example, the sum of € 69 will be credited: 37.575 – 37.506 (21/03 settlement).