Bonds

The bond is a credit security issued by a company or by a State for collection of debit capital. The aim is to collect capital to be invested directly by savers and on more advantageous conditions with respect to bank loans.

Unlike shareholders, those buying bonds do not take on the business risk and do not participate in the management of the issuer, as there is no right to vote at meetings.

FinecoBank offers a wide range of issues with different risk, maturity and yield characteristics with a constant real-time price list.

In order to trade you just have to:

- Select the market on which to operate, choosing between MOT and EuroMOT, the Italian Stock Exchange order book markets dedicated to debt instruments, EuroTLX, a market managed directly by TLX S.p.A. and Hi-mtf, a market organized by Hi-mtf S.p.A.

- Check the data sheet of the single bond, which contains the issue price, its redemption price, the yield of the bond and all the other features

- Place the order on the selected security by just entering the amount (nominal amount) that you intend to purchase or sell, or, possibly, also the price limit (for orders to be executed on EuroTLX, MOT and EuroMOT and on Hi-mtf, Order driven segment).

- Check that the order details are correct, verifying the total amount of the transaction, including accrued interest (Accrual).

- Confirm the operation

The portfolio will always be updated in real time with the processed operations.

However, “convertible” bonds can be transformed into shares of the issuer, subject to specific conditions.

While shareholders have the right to dividends, bondholders become a creditor of the issuer and have the right to receive interest and to capital reimbursement at maturity or on the basis of a predetermined repayment plan.

Interest can be fixed or variable, payable with a quarterly, six-monthly or annual coupon.

Bonds can be issued at par, below par and above par; often, to encourage subscription, the issue is below par: in this case, the fact that the subscription price (what you actually pay) is lower than the nominal value (which is the reimbursement price at maturity) increases performance.

To guarantee subscribers against the issuer’s risk of insolvency the issue of bonds can be accompanied by guarantees.

Bonds cannot be issued for an amount greater than the issuer’s capital, paid-up and existing according to the most recently approved financial statements; this general principle can only be waived if the issue is accompanied by guarantees.

On completion of initial placement (primary exchange), these securities can be traded on the primary exchange and on the secondary exchange, where they are generally quoted on the basis of the clean price.

The Bond Centre page

The Bond Center page of the website is functional and full of content to provide you with a comprehensive overview of the bond markets.

In just one page you can find:

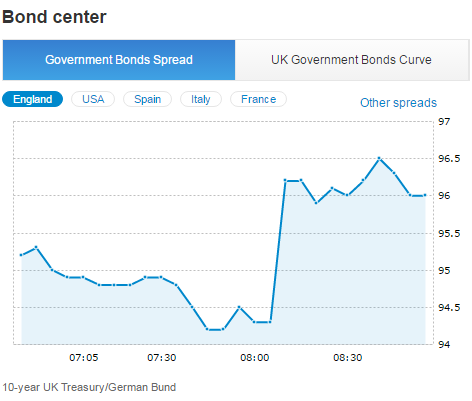

- Graphs of the Spreads of the European government bonds

A graph is displayed, on a weekly basis with a 6-month depth, showing the spreads of the 10-year government bonds of Britain, the US, Spain, Italy and France and the 10-year German Bund.

The "Other spreads" link enables you to see the data of the spreads of the other main European countries and Japan.

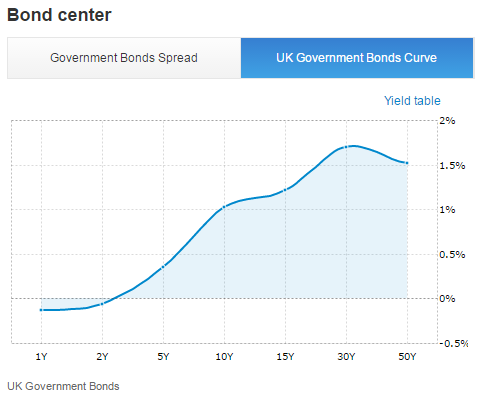

- Yield curve of the UK government bonds graphically shows the alignment of the yields of the UK government bonds depending on their duration and offers a clear view of the distribution of the market yields.

The curve is traced by placing the residual maturity of the securities on the horizontal axis and the corresponding yield on the vertical axis.

The "Yield Table" link enables you to display the details of the reference securities with the related maturity, coupon and yield.

- News about bonds updated in real-time

- Table of Top bonds where the UK and foreign Government Bonds and the Corporate bonds with the highest yield % of the day are shown, with the possibility of running a more detailed advanced search.

- The Most popular showing the products most chosen by Fineco customers.

- Table of the day’s Best and Worst where, in a single screen which is continuously updated, you can see the bonds that performed or underperformed during the trading day.

Portfolio and Quotes

Portfolio > The Portfolio's “Market value £” field shows the "clean price" and the "accrued interest" of the bond separately. To obtain the Bond’s actual market value, i.e. how much you would cash in today by selling the security, we must add the first value (the “clean price”) to the second ("accrued interest").

Note: In the event of transfers from other banks or transfers from other Fineco's securities deposits, the comparison between the market price and the average book value may give rise to incorrect gains/losses as the two prices are not consistent. The market price is gross of withholdings, if any, while the average book value in the event of transfers from other deposits or other banks is net of withholdings.

Listing: The price of the bonds > In the bond listing page you will find two prices: the Seller’s price (or clean price) and the Buyer’s price (or ask clean price). However, when you purchase or sell a bond, it is necessary to add to the price (clean price) the portion of interest accrued from the last coupon detachment (the so-called accrued interest), thus obtaining the actual purchase or sale price (Tel quel price):

The actual purchase price (Tel quel) = Clean price + Accrued interest

For example, if you buy a bond on 4 January with a half-year coupon detachment (1 February and 1 August), in addition to the market price (“clean price”), you will also pay the accrued interest, i.e. the part of the coupon which has already accrued between 1 August (last ex-dividend) and 6 January (purchase value date).

The amount of the accrual changes every day as a result of the accumulation of the accrual and this is always added to the security price at the time of the trade, thus generating a higher outlay when purchasing, but also a greater yield when selling.

If the purchase takes place on the same day of the coupon detachment, the accrual will be zero and the purchase value will only comprise the "clean price".

Example: You purchase a nominal value of Euro 2,000 of the ABC security with an annual yield of 5.25% and a half-year coupon detachment.

Purchase Date: 04/01/2017

Value date: 06/01/2017 (date of purchase plus 2 trading days)

Issue date: 01/02/2013

Redemption Date: 01/08/2017

Ex-dividend date: 01/02 and 01/08 every year

Coupon amount: 2.625% half-year

Clean price: €116.01

Fee: €9.95

Days of accrued interest: 158 (days from 01/08/06 to 09/01/2017)

Interest accrued to 06/01/2017: 2.25408

The accrued interest represents the gross value of the coupon on the value date which of course will be calculated by taking into account the gross amount of the coupon divided by the days in the pertinent six months multiplied by the days since the beginning of the six months to the operation’s value date *(1)

Issue price: €98.345

Redemption price: €100

Total issue discount: €1.655 (100-98.345)

Days of accrued discount: 1438 (from 01/02/2013 to 06/01/2017)

Life days of the security: 5660 (from 01/02/2013 to 01/08/2028)

Accrued issue discount = €0.42048 (100-98,345*1438/5660)

Withholding tax on discount = €0.05256 (12.50% 0.42048)

The withholding tax on the issue discount is deducted from the interest accrued at the time of purchase. In case of redemption, the entire tax will be charged. The difference between the two amounts will determine the amount of net discount payable for the days of ownership of the security.

Actual value of the transaction: €2329.20 *(2)

Net price: €116.51 (2330.15/2000*100)

Actual value of the transaction: €2375.28*(3)

Tel quel price: (displayed at the time of purchase)

(1) 2.625 (half-year coupon) *161/184 (days of the six-month period from 01/08/2005 to 01/02/2006)

(2) 2000*116,01/100 = 2320.20 (value no fees) 2320.20 + 9.95 fees = 2330.15 (value with fees)

(3) (116.51 + 2.25408) * 2000/100 = €2375.28

On the next ex-dividend date (01/02/2017), you will receive payment of the accrued interest from 01/08/2016 to 01/02/2017, which will offset the amount paid at the time of trade for the accrued but not enjoyed coupon and the accrued discounts which will be charged in full in the case of redemption or for the days accrued on the sales value date.

Bond market lists fields > the column shows the target market of the single bond.

All bonds traded on the EuroTLX market are displayed with the initials “ETLX”.

All bonds traded on the MOT and EuroMOT markets are identified by the symbol "MOT-EUR".

Bonds traded on the Hi-Mtf Order driven and Quote driven markets are identified as "Hi-Mtf".

Yield: The effective yield of the security, i.e. the rate of return offered by the security should the same be kept in the portfolio until maturity. It is based on the purchase price paid and on the flows (principal and interest) at present value, which will be collected over time. Future flows not yet determined concerning floating-rate securities, coupon rates and any indexed redemption rates, are estimated daily by assuming the last values of the indexing parameters as constant over time.

The yield is expressed on an annual basis and does not take into consideration any stamps and fees expenses paid on the transaction.

The calculation of the bond yield is based on internal models and must be regarded as merely indicative. FinecoBank is not responsible for any investment decision based on the returns shown by the system. The only values which are binding for FinecoBank are therefore the Bid and Offer quotes.

Coupon (annual in progress): The rate at which the bond is paid. It can be paid on an annual, half-year or quarterly basis and can have a fixed or variable rate. For variable rate bonds, the rate is directly related to the rate of indexation.

Rating: The issuer’s rating is provided by a leading specialised agency.

NOTE: If the issuer has not been rated, we recommend paying particular attention when selecting the investment.

Maturity: The maturity date of the security, on which the issuer will repay principal.

Click on the  button to add the bond to your list of favourite securities.

button to add the bond to your list of favourite securities.

To purchase or sell a bond, click on the corresponding button  and the order placement screen will be displayed.

and the order placement screen will be displayed.

Average book value

For bondholders, the section Portfolio - Portfolio summary of the website will show the book value (clean price):

The average book value is the purchase price (or the average of the unit purchase prices in the case of several executed orders), net of commission fees and any accrued interest.

Rating and yield

Bond rating

When rating a bond, reference is usually made to the rating, i.e. the rating of the issuer by a rating agency.

Specifically, the rating measures the ability of an issuer to meet a financial obligation it has undertaken, repaying the principal borrowed and paying interest due and is given a symbol (e.g., a triple-A), which is processed starting from indicators relative, in particular, to the issuer’s credit risk. However, the rating does not indicate the suitability or otherwise of holding the securities of a given issuer in a portfolio, and does not refer to price volatility or the liquidity of the security.

The most important rating agencies are Standard & Poor's and Moody's. They rate the quality of bond issues using different criteria. Standard & Poor's rates the credit quality of company bonds giving particular weight to the loan agreement, its guarantees, financial resources, profitability and management quality of the issuer.

The rating given for each bond is provided by Standard & Poor's. Rating scale:

|

|

Code |

Meaning |

|

Investment |

AAA |

Highest credit rating |

|

AA |

High credit rating |

|

|

A |

Medium-high credit rating |

|

|

BBB |

Medium credit rating |

|

|

High Yield |

BB |

Medium-low credit rating |

|

B |

Speculative |

|

|

CCC-CC |

Fully speculative |

|

|

C |

Only for income bonds |

|

|

DDD-DD |

With payment default; the rating |

As shown in the table, bonds with a high rating are classified as Investment Grade. They are rated as having little risk and consequently, they do not offer a particularly high yield. On the contrary, high yield bonds have a medium-low rating and, against a fairly high risk, offer higher yields.

Important: the rating given for Italian government bonds is the rating of the issuer.

Yields

They are provided by Skipper Informatica using the formulae approved and used by the market. Data are constantly updated every 10 minutes.

Search procedures

Bond search procedures

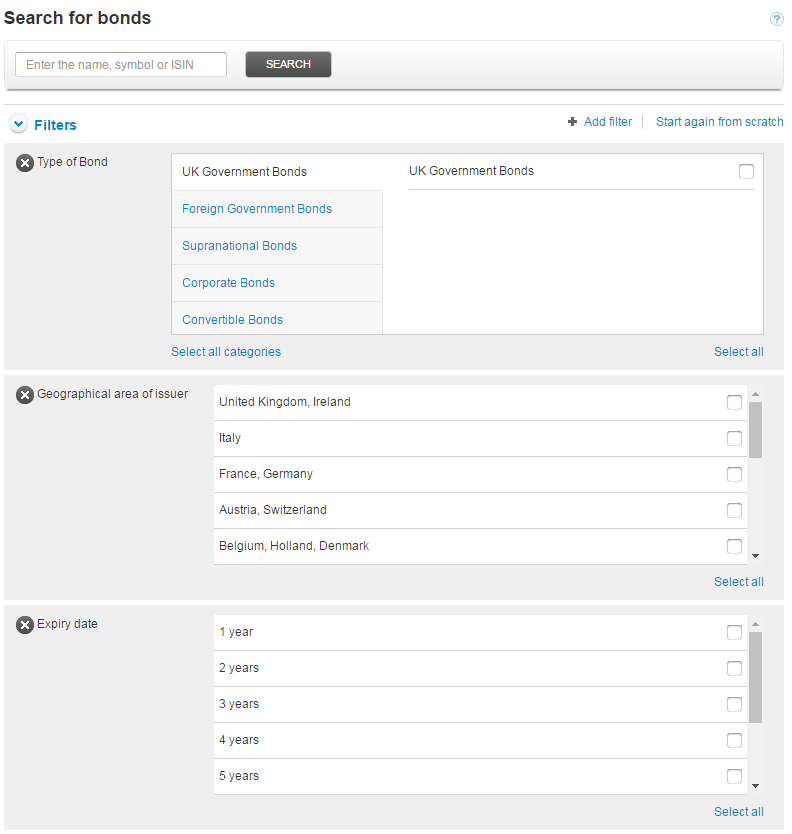

The search engine embedded in the Markets and trading section - Bonds - Search for bonds is a useful tool to identify the best bonds within the wide range offered by Fineco, in an easy, fast and intuitive manner. It is possible to set the search and to select the bonds through various criteria which include searching by keywords or selecting one or more advanced filters, which may even be combined with one another:

Main advantages:

- New search interface, fast and intuitive

- Faster outcome search engine

- Possibility of searching for bonds by simply typing their description or their ISIN:

- Several search filters with the possibility of crossing and combining them to obtain targeted searches

- Controls on the selected filters. The system suggests filters which are always compatible in order to avoid an unsuccessful search.

- More details in the results. The information concerning securities is grouped into two categories: "General" and "Yields"

- The possibility of accessing the Stock sheet, of adding the security to your favourites, of accessing the trading screen directly, or of displaying the 5-level book in push.

- Detailed information concerning Yields and Ratings

SEARCH MODE

Setting a search is extremely simple and intuitive.

You can look for any bond by typing the ISIN or the security description directly in the text-search box.

or you can select one or more search parameters using advanced filters (accessing Search For Bonds from Trading Markets> Bonds). There are more than 100 filters available, grouped into macro-categories:

Type of Bond

Geographical Area of Issuer

Maturity

Trading Markets

Currency Trading

Annual yield

Minimum lot

Coupon

Ex coupon

Frequency

Rate

S&P Rating

Commission fees

To set the filters just click on "Add Filter" and select the ones you want by clicking on "Add".

For each macro category, you can select the filter, or the combination of filters, which most interests you:

To clear everything (Filters and results list) and start over with a new search, simply click the link

SEARCH RESULTS

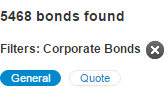

The search results are combined in two different groups "General" and "Listing " and are distributed through several pages. The number of pages and the browsing links are indicated at the bottom of the list.

The "General" group shows the results by highlighting "Security", "last price", "Currency", "coupon", "net yield", "maturity" and "Market".

The "Listing" group shows all the useful information for trading in securities such as "Security", "ISIN code", the "offer price", "bid price", the "trading market". All the information in the list may also be ordered according to your preferences by clicking on the column headers.

Important information concerning the search, such as the number of bonds found and the filters selected for the search, is provided together with the list of results.

You can add new filters at any time, in order to further refine the results list, or to delete already active filters to obtain different results. To further filter the results, you can also add a keyword by typing it into the search box.

By clicking on the description, you can display a detailed description of the bond. You can also add the securities to your favourites by clicking on the  button or access the order screen directly by clicking on the

button or access the order screen directly by clicking on the  button.

button.

Important

In order to use all of the new search engine features correctly, you may want to access your browser settings or Internet options and select the option "accept/enable cookies".

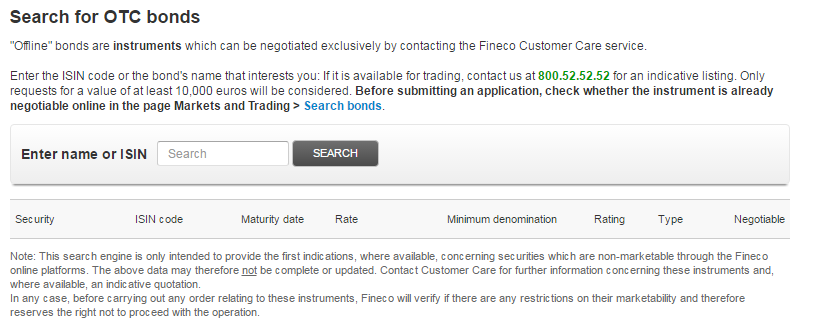

OTC bond search procedures

Some bonds are not listed on an official market, but can be bought and sold between counterparties that are on the OTC (Over the counter) market.

The search engine in the Markets and trading section > Bonds > OTC Search is a useful tool to locate, in an easy, fast and intuitive manner, the bonds that Fineco allows you to trade on the unregulated OTC market.

You can find out whether the security can be traded with Fineco over the phone by directly typing the ISIN or the security description into the text-search box.

The name, ISIN code, maturity, rate, the minimum lot that can be traded, the rating and the type of instrument will be displayed for the searched securities.

Once you find the security, you can call the free phone number 0800 525 252. Our specialists will immediately provide you with the best quote on the market at that time.

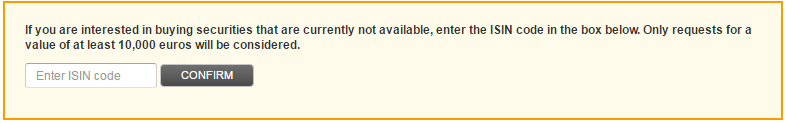

If the search does not produce any results you can ask Fineco to consider the possible admission to trading.

Simply enter the ISIN code into the box in the page and click on Confirm to send Fineco the request automatically.

Once all the assessments have been made, a reply email will be sent with the outcome.

Market costs and rules

Costs and rules of the EuroTLX market

The EuroTLX market is the multilateral trading system (Multilateral Trading Facility - MTF) organised and managed by Euro TLX SIM S.p.A., a system which brings together, within and in accordance with non-discretionary rules, multiple purchase and sale interests of third parties.

You can trade on these markets both from the FINECO website, and from the PowerDesk platform. The purchase and sale of bonds completed on the EuroTLX entail a fixed commission fee of £9.95.

The maximum per order can be reduced to £3.95 according to the fees generated during the quarter or based on the asset management in the portfolio. Further details

Trading on EuroTLX takes place for all bonds from 8:00 to 17:00 hours. Bank bonds are an exception as they are traded from 8:00 to 16:30 hours.

However, similarly to any regulated market, you can also send orders to FinecoBank outside trading hours, at any time and day of the week.

Some of the bonds available on EuroTLX are also negotiable on the MOT market.

In this case, you can choose the market on which you wish to trade these bonds from the drop-down menu, in the order placement template.

If the customer does not choose differently, the order entered will be traded on the reference market chosen by FinecoBank in its Execution Policy (available in the public area of the Fineco website, OPEN AN ACCOUNT, All the terms, MiFID Regulations). At present, this market is the MOT of the Italian Stock Exchange.

All contracts executed on the EuroTLX market are settled on the third trading day after they are entered into, except for contracts relating to Treasury Bills, for which the deadline is two days.

For the purposes of the calculation of the value dates, the EuroTLX sets different calculations according to whether there are public holidays concerning the instrument currency, market public holidays or in case of public holidays of the centralised management system of the particular market segment. Details

When the order is placed, both the clean price at which you are purchasing the security and the overall price including the net interest accrued until that moment (net tel-quel price) are shown.

Securities held in the portfolio are valued at their clean price.

Costs and rules of the MOT and the EuroMOT markets

MOT and EuroMOT market transactions follow the rules and regulations laid down by Borsa Italiana.

Transactions on securities listed on the MOT/EuroMOT markets are subject to a fixed fee of £9.95.

The maximum per order can be reduced to £3.95 according to the fees generated during the quarter or based on the asset management in the portfolio. Further details

You can trade on these markets both from the Fineco website, and from the PowerDesk platform.

On MOT and EuroMOT, the continuous trading phase is from 08:00 to 16:30.

Auction phases are:

- Opening auction phase from 07:00 to 08:00

- Closing auction phase from 16:30 to 16:35

Moreover there is a trading phase at the closing auction price between 16:35 and 16:42.

However, similarly to any regulated market, you can also send orders to Fineco outside trading hours, at any time and day of the week.

With regard to trading, you can place purchase or sale orders up to a maximum of Euro/USD 500 thousand concerning the first tier. By trading through the orders office, you can place phone orders for amounts exceeding Euro 500,000 and obtain a license to operate for higher amounts in accordance with the increasing amount tiers set by the Italian Stock Exchange Filters (Customer orders placed with amounts of more than Euro 500,000 and up to Euro 1,000,000)

All MOT and EuroMOT bond contracts are settled on the second trading day following their signing.

When the order is entered, both the clean price at which you are buying the security and the overall price including the net interest accrued until that moment (net tel-quel price) are shown.

The Italian Stock Exchange establishes the minimum tradable quantity, the maximum price variation limits and other necessary conditions in order to ensure an orderly trading conduct in the markets.

Costs and rules of the Hi-MTF market

On the Fineco website, you can trade the bonds on the Hi-MTF market, the Multilateral Trading Facility (MTF) organised and managed by Hi-MTF SIM S.p.A., a system which allows the gathering, within it and based on non-discretionary rules, of multiple third-party purchasing and selling interests in financial instruments.

The fixed fee is £9.95.

The Hi-MTF market consists of two “Quote driven” and “Order driven” segments which differ in terms of:

- Trading

- Quote driven: In this market, a market maker undertakes to show quotes on a continuous basis or upon request, bid and offer quotes at which he/she is willing to purchase and sell the securities traded.

- Order driven: Trades are concluded through the interaction of the orders placed by all the brokers participating in the market, thus creating the trading book.

- Trading hours

- Quote driven: The timetable for placing orders and trading is from 08:00 to 16:30 hours

- Order driven: Pre-auction phase: from 07:40 to 08:00 hours. During this period of time, retail customers cannot place orders.

Continuous trading is possible from 08:00 to 16:00 hours.

Furthermore:

- Technical blackout: From 16:00 to 16:05 hours

- Pre-auction phase from 16:05 to 16:20 hours (when it is still possible to place orders)

- Auction phase from 16:20 to 16:30 hours (when the orders still entered or partially executed with a maturity valid "until the date" or "until cancellation" are executed)

- Type of order

- Quote driven: In this segment, orders can be placed with the price type:

- Market

- Limit (equal to or greater than for purchases, equal or lower than for sales, compared to the quoted prices of the Market Makers)

and valid “until cancellation”, i.e., until the close of the trading time of the trading session where they were placed.

During the trading time, orders can only be placed if there are quotes which generate purchase and/or sell trades. - Order driven: In this segment, only the following orders can be placed:

- Limit price

however, you can choose between two maturities for the order:

- “Valid until cancellation": i.e., if not executed during the day, until the closure of the trading timetable of the session and/or until revocation by the subject who entered it.

- “Valid until the date”: until the complete execution of the order, i.e. for a period not greater than the date stated and/or until revocation by the subject who entered the order.

However, similarly to any regulated market, you can also send orders to Fineco outside trading hours, at any time and day of the week.

Note:

> All bonds on the Hi-MTF market cannot be traded on other bond markets offered by Fineco (MOT, EuroMOT, EuroTLX). As a consequence, execution of the orders will only be possible on Hi-MTF.

> All contracts executed on the Hi-MTF market are settled on the second stock market trading day after their signing. When the order is placed, both the clean price at which you are purchasing the security and the overall price including the net interest accrued until that moment (dirty price) are shown.

Securities held in the portfolio are valued at their clean price.

> All orders placed with a validity of more than one day will be refused by the market if the maturity date entered is after the repayment date of the security or included in the three business days prior to the repayment date.

For example, if security XX matures on 26 September, Hi-MTF will refuse all orders placed with validity after 26 September and those with validity between 23 and 26 September.

For more details, visit the official website of the Hi-MTF. Market.

Costs and rules of the Euronext market

On the Euronext bond market, which includes the markets of France, Holland and Portugal, trading follows the rules and regulations laid down by Nyse Euronext.

Various types of bonds are available:

- Government Bonds

- Supranational Bonds

- Corporate Bonds

Trading on these markets is only available from the Fineco website, and is arranged into 3 phases:

> From 07:00 to 08:00 hours Market opening phase

Where the opening price is determined; this is the price at which you can make the highest number of orders and is equal to the last theoretical opening price calculated. Once the opening price is calculated, the orders consistent with this price are executed.

> From 09:00 to 16:30 hours Continuous market trading

You can enter, change and cancel orders. The orders placed are executed in real-time as soon as an opposing order is crossed with the price proposed for the transaction. On the trading book, the five top bid and offer proposals are shown.

> From 16:30 to 16:35 hours Market closing auction phase

All the orders entered in the five minutes prior to the closing are crossed.

However, similarly to any regulated market, you can also send orders to FinecoBank outside trading hours, at any time and day of the week.

Orders of the “Limit” or “Market” price type may be placed.

When the order is placed, both the clean price at which you are purchasing the security and the overall price including the net interest accrued until that moment (dirty price) are shown.

Securities held in the portfolio are valued at their clean price.

Transactions on securities listed on the Euronext market are subject to a fixed commission fee of £ 9.95.

To be able to display the quoted prices, you must enable the Euronext market on the website in the Account management > Service management > Trading and investment section.

Nyse Euronext establishes the minimum tradable quantity, the maximum price variation limits and other necessary conditions in order to ensure an orderly trading conduct in the markets.

Note: All bonds on the Euronext market cannot be traded in other bond markets offered by Fineco (MOT, EuroMOT, EuroTLX and Hi-MTF). As a consequence, execution of the orders will only be possible on Euronext.

Differences between EuroTLX, MOT/EuroMOT, Hi-MTF and Euronext

Thanks to FinecoBank you can trade some bonds both on the EuroTLX market and on the MOT/EuroMOT markets of Borsa Italiana. Therefore, during the purchase or sale of these bonds, you will be able to choose on which market to trade the security. FinecoBank adopts the MOT market as a reference for Best Execution, but you can select the market in which you intend to buy or sell the bond.

On the MOT/EuroMOT and EuroTLX markets, the quantities available for purchase or sale are those indicated in the order book for each price level, without a guarantee of processing in a single operation.

Once you have placed a sell order, for example, of a security in the portfolio on the MOT market (even for a partial amount of the total owned), the entire amount must only be sold on this market, the MOT, unless you cancel the sell order placed earlier on the security.

Furthermore, on the MOT/EuroMOT and EuroTLX markets, you can set a price limit for both your purchase or sale transactions and wait that the order is processed once the target threshold has been reached.

All obligations on the Hi-Mtf market are not negotiable on other bond markets offered by Fineco (MOT, EuroMOT and EuroTLX).

On the Hi-Mtf market, the execution of orders differs according to the trading segment: for bonds on the Quote driven segment, as there are market makers, orders can be executed immediately by indicating the prices displayed by the market maker itself.

For securities placed in the Order driven segment, exchanges are concluded through the interaction of orders placed by all the intermediaries joining the market, thus creating the trading book.

The method adopted by Fineco for trading on the Euronext bond market is by price and number of securities: the amount represents the number of securities traded for that price, including any accrued amount. E.g.: 10,000 x 1,000 (price) = €10,000,000 equivalent.

EuroTLX and MOT on PowerDesk

Fineco offers you all the EuroTLX, MOT and EuroMOT bonds on PowerDesk with the latest in push quotes, a 5-level book, PowerBoard and Time & Sales prices.

You have all Fineco customers’ top traded securities in the EuroTLX and MOT lists. With the search option, you can search for and select all the other securities of the EuroTLX and MOT markets and then insert them into your personalised watchlist.

On PowerDesk all you have is the clean price without any details concerning the coupon, its maturity and detail sheet. You will find more comprehensive information concerning each security on the Fineco website.

The PowerDesk portfolio enables you to display and trade all the securities purchased on the EuroTLX and MOT markets.

The P&L screen includes regularly updated information about the profits and losses recognised.

Trading risks

Warning

Some of the corporate bonds traded through the organised trading system (SSO) of FinecoBank (those with a rating equal to or lower than BBB- or those with no rating) feature a very high level of risk; therefore investors should conclude transactions concerning these instruments only after having understood the nature and level of exposure to the inherent risk.

Issuer Risk

The investment in these bonds is exposed to the issuer risk, i.e., their value is linked to the creditworthiness of the Issuer. As a consequence, this risk is connected to the possibility that the Issuer, due to a deterioration of its capital soundness, is unable to fulfil its obligations linked to repaying the principal invested and paying interest.

Interest rate/market risk

Investors must consider that the actual measure of the interest linked to the investments in question continuously adapts to the market conditions through changes in the price of these securities.

Specifically, for fixed-rate securities, the longer the residual life is, the greater the variability of the price of the security compared to the changes of market interest rates.

As a consequence, the actual yield could be different from the one calculated at the time of its purchase.

Thus, it is important for investors, in order to assess the suitability of their investment in this category of security, to check the time by which they may need to disinvest.

Currency risk

If a financial instrument is expressed in a currency other than the pound, the investment is exposed to the risk of volatility of the exchange rate between the pound and the foreign currency.

As a consequence, the trend of the exchange rates may affect the overall result of the investment.

Liquidity Risk

Since these bonds are not traded on regulated markets, the price of these instruments may be affected by a lack of liquidity in the market.