CFDs

What is a CFD?

CFD means Contract for Difference. A CFD is a type of contract in derivatives based on which the difference in value of a certain security or underlying asset, accrued between the opening and closing of a contract, is traded. As a consequence, the Bank undertakes to pay (or retain from) the customer the difference between the price of the underlying asset at the time of opening the position and the price at the time of closing.

It is an OTC derivative traded between the Bank and the customer.

Rather than physically trading or exchanging the financial instrument, the CFD is a transaction where two parties agree to exchange cash based on the change in value of the underlying asset between the point when the transaction is opened and the time when it is closed.

CFDs are derivatives traded over-the-counter (OTC market) that allow investors to benefit from the rise (long position) or fall (short position) of the price of the underlying instruments.

Other advantages include:

- greater exposure to the markets, through margin trading

- exploitation of the leverage effect using only a percentage of the value

- maintaining open positions for the time desired

- no commission fee applied to the orders. Unlike what usually occurs in regulated markets, you do not have to pay a trading fee for each single open or closed position. With Fineco you only have minimum bid-offer spreads (difference between the purchase and sell quotes)

Activations, requests and access channels

To be able to operate on Contracts For Difference you must have signed the contractual supplement for Trading Derivatives (Futures, Options, Forex, CFDs and Logos).

You can purchase and sell CFDs directly from the PowerDesk platform.

For all the details, view the Operating regulations in the reserved section of the website: "Home > Account management > Managing services > Tab TRADING and INVESTMENTS > Derivatives trading service

Intraday and Multiday trading

You can trade CFDs in margin trading and each transaction requires the deposit of a margin, i.e. a reduced percentage of the value of the transaction to guarantee fulfilment upon maturity.

You can customise the margin according to the type of trading chosen:

- for Intraday positions, the margin ranges between 1% and 6.5%

- for Intraday positions on CFDs on shares, the margin ranges between 2% and 100%

- for Intraday positions on Volatility futures CFD, the margin ranges between 10% and 20%

- for Multiday positions on CFDs on shares, the margin ranges between 10% and 100%, depending on the underlying instrument

- for Multiday positions on CFDs on indexes, bond futures and commodities, the margin ranges between 7% and 100%

- for Multiday positions on Volatility futures CFD, the margin ranges between 30% and 100%

The CFD thus enables you to benefit from the so-called “leverage effect”, i.e. the multiplication of the (positive or negative) yield of a sale or purchase compared to the capital invested, understood as the ratio between the result obtained (difference between the value of the purchase and sale) and the margin.

Example:

In the case of a transaction on a CFD, if the result is GBP 100 (the difference between a purchase value of GBP 5000 and a sale value of GBP 5100) and the margin is 1% (GBP 50), the yield obtained from the transaction equals 200% (100 / 50 = 200%).

The yield obtained by carrying out a similar transaction directly on the underlying asset, therefore using the entire value of the purchase transaction, would be 2% (100 / 5000 = 2%).

The leverage effect that characterises the CFD enables you to multiply the percentage yield of the transaction: in the example, assuming a margin of 1%, the yield of the CFD transaction is 100 times the yield obtained with a normal trade transaction on the underlying asset.

With CFDs you can take a Long or Short position with respect to the underlying asset and the duration of your positions can be:

- Intraday - Closing of the position on the same day as it was set up. At the end of the day (the closing time depends on the instrument), if the position, for any reason, is still open, Fineco will automatically close it (unless the Bank suspends the listing of the CFD given the lack of prices for the underlying).

With Carry on, an Intraday CFD can be transformed into a Multiday position at any time. - Multiday - enables you to keep the position open on the CFD beyond the day when it was set up and until it is closed, which can take place:

- automatically, at the end of the maximum duration of the instrument; or - at any time prior to the above term, with the customer closing the CFD (unless the Bank suspends the listing of the CFD given the lack of prices for the underlying instrument).

A Multiday CFD can be closed on the same day as it was set up; in this case, closing is performed in the same way as with an Intraday CFD;

Note: CFDs can be traded on the Fineco website and through the PowerDesk push platform. Trading through the FinecoBank orders Customer Care service is possible, but only to the extent of closing positions.

Note on CFDs on bond futures: in general, CFDs on bond futures follow the maturities of the underlying futures. However, to know the updated deadlines it is necessary to refer to the list published on the site in the Markets and Trading> CFD and CFD FX> Expiry dates CFD Futures, which also contains the dates and times of the automatic closing of the positions at expiration. Considering that these securities require the physical delivery (which takes place on the tenth day of the expiry month), the expiry date of the CFD falls two business days before delivery.

Fineco enables you to trade until the day before the expiry date. Each open contract is automatically closed by Fineco starting from 17:50 hours for BTPs, Short Term BTPs and OATs or from 20:50 hours for Bund, Bobl, Schatz and Buxl, of the day before the expiry date by sending a market order.

For example, the delivery date for the January-March quarter is 10 March, consequently, the expiry date of the CFD falls two business days before delivery, on 6 March, and Fineco will enable you to trade up to 5 March.

On the day before the expiry date, you can open only an overnight position which, if still open at the end of the day, will be automatically closed by Fineco.

A new expiry date of the CFD is listed on the first day the Stock Exchange is open after the last trading day of the previous period.

Note for CFD commodity futures: in general, CFDs on commodity futures follow the maturities of the underlying futures. However, to know the updated deadlines it is necessary to refer to the list published on the site in the Markets and Trading> CFD and CFD FX> Expiry dates CFD Futures, which also contains the dates and times of the automatic closing of the positions at expiration. Considering that the underlying of those securities are set for physical delivery and their last trading day falls on different periods according to the underlying future, the last trading day of the CFD falls two business days ahead of the underlying future last trading day. On the last trading day of the CFD, all open contracts will be closed by Fineco starting from 21:05:00 with an “at market” order for Oil, Natural gas, Gold, Platinum and Palladium. For example, say the February maturity CFD on Oil (last trading day of Oil future falls on the third dealing day before the 25th calendar day of the month before the maturity month), reaches maturity on the 22 January; consequently the CFD last trading day falls on 18 January, two business days before maturity. On that day Fineco will allow Oil CFDs trading until 21:05:00 and in the case there will be still open contracts at the end of the trading hours, those will be automatically closed by Fineco at market. A new maturity date CFD will be available on the first dealing day following the closing of all contracts of the previous maturity month CFD. In the same example of the Oil CFD, the new March maturity date will be available for trading as of 19 January.

Note for CFD on volatility futures: CFDs on Volatility futures terminate trading depending on the last trading day of the respective contract future admitted to dealing by Fineco.

Particularly CFDs with Volatility futures underlying end trading one day ahead of the last trading day of the respective contract future underlying within the service closing time for that CFD. In case at the service closing time, open contracts still exist, those will be closed with an “at market” order set by the bank on behalf of the client.

A new maturity date CFD will be available on the first dealing day following the closing of all contracts of the previous maturity.

Opening Price of the position

In the case of a long position, it is the Offer price of the CFD quoted at that time by Fineco; in the case of short position, it is the Bid price quoted at that time by Fineco.

Closing Price

When closing is carried out by the customer, it is the price of the CFD quoted at that time by Fineco: Bid if the position is long, Offer if the position is short.

In the case of automatic closing at the end of the trading day, it is the price (Bid or Offer in case of long or short position, respectively) recorded in a random instant at Closing.

If the CFD quotes, at the end of the Service, are not available due to the unavailability of the relevant data to determine the value of the underlying asset, the last Bid-Offer prices of the CFD quoted by the Bank during the day are used.

Lots, Multiplier and Spread Lot

As for futures, the lot is the unit of measurement of CFDs.

Multiplier

It is the value which, multiplied by the value of the underlying asset, defines the value corresponding to a lot of CFDs. For CFDs on indexes, shares, bond futures and commodities, the multiplier is the currency value of each index point.

| Underlying index | Reference country | Multiplier | Max spread (index points) |

| FtseMIb | Italy | 2 | 24 |

| Psi20 | Portugal | 1 | 26 |

| ibex35 | Spain | 1 | 4 |

| Dax | Germany | 1 | 0,6 |

| TecDax | 1 | 6 | |

| Cac40 | France | 1 | 1 |

| Eurostoxx50 | Europe | 1 | 1,4 |

| EU Stoxx Volatility | Europe | 1000 | 0.06 |

| OmxH25 | Finland | 2 | 8 |

| Aex | Netherlands | 10 | 1 |

| Smi | Switzerland | 1 | 6 |

| Ftse100 | Great Britain | 1 | 0,6 |

| Ipc | Mexico | 1 | 120 |

| Icl20 | Belgium | 1 | 12 |

| OmxS30 | Sweden | 100 | 3 |

| Obx | Norway | 100 | 2.5 |

| Ise30 | Turkey | 0.1 | 200 |

| DJ30 | USA | 0.5 | 1 |

| Nasdaq100 | 1 | 0,6 | |

| SP500 | 1 | 0,4 | |

| Russell2000 | 2,5 | 1,4 | |

| Jse40 | South Africa | 1 | 120 |

| Bovespa | Brazil | 0.2 | 100 |

| Underlying bond futures | Reference market | Multiplier | Max spread (index points) |

| Super BTP | Eurex | 1000 | 0,02 |

| Super BUND | 1000 | 0,02 | |

| BTP | 100 | 0,06 | |

| Short Term BTP | 100 | 0,04 | |

| OAT | 80 | 0,06 | |

| BUND | 75 | 0,06 | |

| BOBL | 100 | 0,06 | |

| SCHATZ | 100 | 0,04 | |

| BUXL | 100 | 0,08 | |

| Super BUXL | 1000 | 0.04 |

| Underlying shares | Reference market | Multiplier | Max spread* (bps) |

| UK shares market | Lse | 0.01 | No Mark-up |

| Nyse shares market | Nyse | 1 | No Mark-up |

| Nasdaq shares market | Nasdaq | 1 | No Mark-up |

*Note: Market spread applies, Fineco does not apply any mark-up.

| Futures on commodities underlying asset | Reference Market | Multiplier | Spread max (mark up) |

| Silver | CME | 2,5 | 0,16% |

| Super Silver | 50 | 0,16% | |

| Copper | 12,5 | 0,16% | |

| Super Copper | 250 | 0,16% | |

| Oil | 50 | 0,16% | |

| Super Oil | 1000 | 0,16% | |

| Natural Gas | 500 | 0,16% | |

| Super Natural Gas | 10000 | 0,16% | |

| Gold | 5 | 0,16% | |

| Super Gold | 100 | 0,16% | |

| Platinum | 2,5 | 0,16% | |

| Super Platinum | 50 | 0,16% | |

| Palladium | 2,5 | 0,16% | |

| Super Palladium | 100 | 0,16% |

Differential or P&L of the position

It is the difference between the value at the opening price of the position and that at the closing price of the position and corresponds to the profit or loss of the transaction.

The theoretical P&L of every single position is calculated by taking into account the sign of the position. If the open position is Long, the profit will be calculated on the bid price, in case of a Short position, on the offer price.

Note for CFDs on shares in a currency other than the GBP:

The differential is calculated in the reference currency and debited/credited in GBP. Since they are expressed in currencies other than the GBP, the conversion will take place at the exchange rate applied by Fineco at the end of the day when the differential (P&L) is realised.

Trading on the Fineco website

You can buy and sell CFDs directly from the Markets and trading page of the website. By clicking on the link within the menu in the "CFDs and CFD FX" section you can access the list of CFDs on indexes and bond futures available.

In the summary table, for each CFD the following is shown:

Descr.: full description of each CFD (e.g. FTSEMIB)

Currency: trading currency BID P: bid price.

By applying this price, you sell the CFD OFFER P: offer price.

By applying this price, you buy the CFD Var %: percentage variation of the current bid price compared to the closing price of the previous day

Time: time of the last change

Click on the link of the security to open the instrument breakdown page; click on  to open the book to place your orders.

to open the book to place your orders.

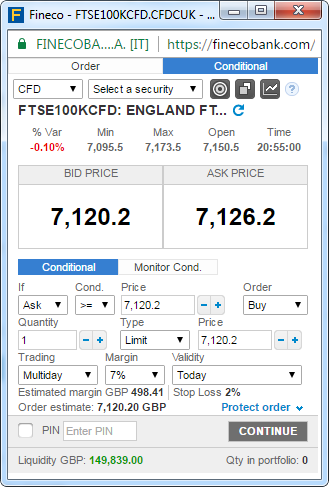

Trading method

The book is the tool that enables you to trade. From the drop-down menu above you can select the individual instrument on which to trade.

To place an order, just fill in the fields:

- Quantity - number of contracts;

- Type - order type "limit" or "market";

- Price - this field is disabled for "market" orders; conversely, enter the price for "limit" orders;

- Trading - select Intraday or Multiday

- Margin - it depends on the trading and the instrument being traded.

For a CFD on the FTSE100 index (FTSE100KCFD), you can select from a minimum of 2% to a maximum of 6% for Intraday trading, and from a minimum of 7% to a maximum of 100% for Multiday trading; - Validity - orders can be placed in two different ways:

- Today: It allows you to place an order valid until the end of the trading day of the underlying instrument. The order placed is cancelled upon closing if not executed. This parameter is pre-set on the order page and is the only one that can be used for orders on Intraday positions.

- Until cancellation: the order will be valid until cancelled by the user.

Click on the Monitor tab to see the status of your orders.

From the monitor you can also cancel the order by clicking on “x”.

Protect order or Conditional Order

You can enter Stop Loss, Take profit and Trailing stop on individual orders. Only Stop loss and Take profit can be entered on the position.

You can also enter Conditional Orders. For reference you can choose between BID (selling price) and OFFER (purchase price). The Conditional Order is not shown in the book until the chosen price condition is reached.

The orders placed can be displayed in the CFD order Monitor section and the open positions can be displayed in the Summary portfolio and the CFD Detailed Portfolio.

Orders Monitor

In the CFD monitor you can see all the orders which were placed on the same CFDs. Summary row:

>The first row summarises the overall balance of the position and indicates:

- Security: symbol of the CFD

- Status: status of the position (Open - Closed)

- Validity: sign of the position (Multiday or Intraday)

- Qty executed: number of lots executed on the position

- Average price: average book value of the position

- Market: trading market

- Date time: date and time of first opening of the position.

- Expiry: expiry date of the position

> The expanded row includes all the details of the orders that make up the position:

- Order status: placed, cancelled, executed;

- Sign: Buy or Sell

- Qty entered: number of lots entered, referring to the order

- Price entered: price entered on the market

- Value date

- Expiry of the order

- Qty executed

- Average price: weighted average price of the order executed

- Date time: day and time of executing the order

- Protection: the buttons to enter Stop loss or Take profit orders on the individual order. If they were already entered while creating the order, the buttons will be lit; click on them to display/change/cancel the stops already entered and not yet executed.

Portfolio

The portfolio area dedicated to CFDs contains all the open positions on this market with the related details. In addition, the expanded row includes:

- the Protect position button to enter Stop Loss and Take Profit on the same position.

- the book button to place other orders

- the Close position button

- the link to display all strategies entered on individual orders which make up the position

Profit & Loss realised

The Reporting > Profits&Loss section of the “Futures, CFDs and Options” menu includes all the profits and losses realised in the day with the transactions on CFDs.

The first row summarises the gain and loss relating to all the closings made in the day on an individual CFD. By expanding the row the individual closings are shown with the related P&L.

For each position closed the following is displayed:

- Symbol: symbol of the CFD on which the position was closed

- Transaction date: date of closing the position

- Average opening price: book value of the position

- Average closing price: closing price of the position

- Market: conventionally indicated as CFDUK

- VALUE DATE: indication of the value date on which the closing is updated

- P&L: profit or loss of the individual position

IMPORTANT: The reported P&L is always displayed in GBP. Where the CFD is not traded in GBP, the P&L shown uses as exchange rate the one recorded at the time of closing the position and at end of day it will be adjusted with the official exchange rate of the day. Details.

The “last week, last month and advanced search” section displays the P&Ls of the CFD transactions closed in the previous days (also partially), again in EUR.

Where the CFD is in a currency other than GBP, the historical P&L shown will consider the exchange rate recorded at the end of the day of the settlement procedure or in the case of positions closed on other days as the sum of all the P&Ls in the expanded row.

In the expanded row, the same logic is adopted by reporting the prices of the index and converting the P&L at the exchange rate recorded at the end of the day of the settlement procedure.

NOTES:

> Intraday Positions You cannot open an Intraday position and a Multiday position at the same time on the same CFD.

> Multiday Positions All the positions with multiday trading remain open at the time of closing the day and bear interest. The interest will be debited or credited depending on whether the position is long or short, subject to applying a spread in favour of the bank.

Trading on PowerDesk

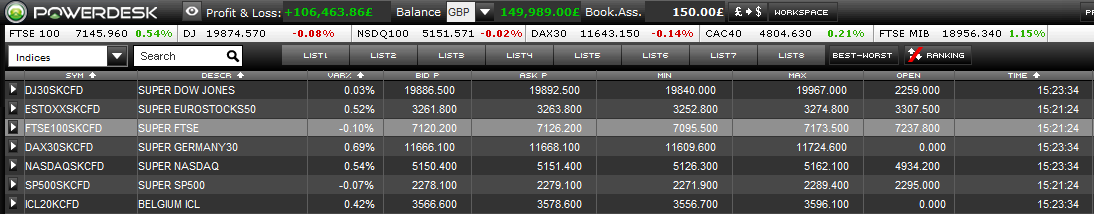

From the PowerDesk platform click on the link in the dropdown menu in the top left part of the page to access the list of available CFDs.

The Watchlist shows the following for each CFD:

SYM: symbol that identifies each CFD.

DESCR: extended description of each CFD (for example FTSE MIB).

BID P.: bid price. By applying this price, you sell the CFD.

OFFER P.: offer price. By applying this price, you purchase the CFD.

MIN: the lowest bid price quoted by the Bank during the day.

MAX: the highest bid price quoted by the Bank during the day.

CHG: percentage change in the current bid price over the closing price of the previous day.

TIME: time of the last change.

Trading method

You can place orders directly from the CFD basket or by entering the instruments of interest into one of your customised watchlists; in this case you must indicate the CFD symbol in the "sym" box and add it to the list like any other financial instrument or drag it, left-clicking the desired list.

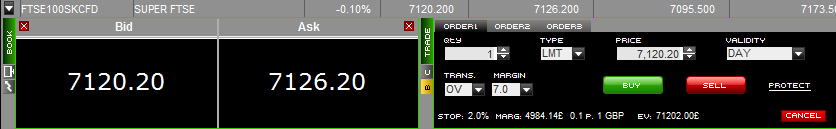

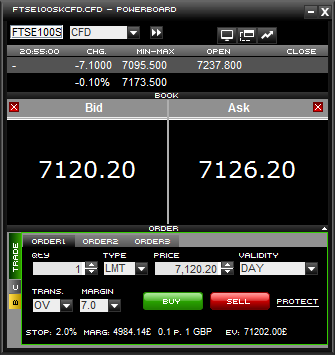

There are two different methods available: Expanding the row in the watchlist or in PowerBoard:

- By expanding the row of the individual CFD in the watchlist both the bid and offer prices are displayed

- By right-clicking on the CFD, you can access PowerBoard: at the top you can see the bid and offer prices and just below is the order entry form.

You can change the CFD displayed from the two drop-down menus at the top or simply with the drag & drop option.

The Bid/Offer monitor and chart are also available on PowerBoard.

Placing orders

Three types of orders are available: LIMIT and Conditional orders, with which you can send Fineco an order to purchase or sell a CFD if the market reaches a certain level and MARKET orders, which can be used to apply the quote available at the current price.

Order entry

The same order entry form is available in the expanded row and in PowerBoard.

To purchase you must apply the offer price; to sell you must apply the bid price.

For every order you must indicate:

Number of lots: for each instrument the lot corresponds to an underlying equivalent value

Type: the type of order entered. It can be "Market", "Limit " or "Conditional".

Price: LMT (limit price); MKT (market)

Validity: DAY, your order is valid until the end of the trading day; GTC, valid until cancellation (valid only for multiday positions).

Trad: Intraday (operations that must be closed at the end of the day); Multiday (valid for several days).

Margin: for Intraday trading, the margin levels range between 1% and 6% For Multiday trading, the margin must be selected from a pre-determined list ranging between 7% and 100%

Orders monitor

By clicking on the "CFD" link in the PowerDesk monitor you can display all the orders placed on CFDs.

>Summary row: The first row summarises the overall balance of the position and indicates:

- SYM: the exchange rate symbol of the position.

- ST: status of the position; OP (open position); CL (closed position).

- L/S: position sign; Ov (multiday or overnight on cross); In (intraday cross position).

- ENT. Q: number of lots entered on the position

- ENT.P: price entered

- EXE.Q: number of lots executed on the position

- EXE.P: average book value of the position

- STOP: stop price level at which the position will be automatically closed

- DATE: date of first opening of the position.

- Margin: margin of first opening of the position

repeat order button

repeat order button button to cancel placed orders

button to cancel placed orders button to enter strategy on position or individual orders

button to enter strategy on position or individual orders button to Change the position margin

button to Change the position margin

> The columns related to individual orders show:

- SYM: the time the order is executed.

- ST: order status; IM (order placed); Ca (order cancelled); EX (order executed);

- L/S: sign of the order; B (buy order); S (sell order)

- ENT.Q: number of lots entered, referring to the order

- ENT.P: price entered on the market

- EXE.Q: number of lots executed on individual orders

- EXE.P: execution price of individual orders

- DATE: execution date of the order

repeat order button

repeat order button button to cancel placed orders

button to cancel placed orders button to enter strategy on position or individual orders

button to enter strategy on position or individual orders

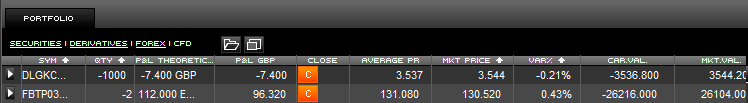

Portfolio

All the open positions on this market are grouped in the portfolio area dedicated to CFDs. The individual columns indicate:

- SYM: the symbol of the CFD related to the open position.

- QTY: number of lots in portfolio and sign (+ or - depending on whether the position is long or short)

- P&L THEORETICAL: the theoretical profit or loss arising from your transactions. It is always expressed in the currency of the underlying CFD.

- P&L GBP: this is the real-time conversion of the provisional P&L in GBP. The definitive P&L in GBP will be determined based on the closing exchange rate.

- CLOSE: this button automatically closes your position with a market order.

- AVERAGE PR.: the average book value of the position.

- MKT PRICE: the value of the CFD updated in real time (bid price for long positions and offer price for short positions).

- VAR%: percentage change of the PL

- CAL. VAL: book value in the currency of the underlying

- MKT. VAL: value at the market price.

- TYPE: shows whether the position is open in Intraday margin or overnight and the related %

- CUR: shows the reference currency of the CFD

Realised Profit & Loss

With PowerDesk, you can view all profits and losses made during the day through transactions on CFDs.

In the P&L panel, you can access details of CFD transactions. The first row summarises the gain and loss relating to all the closings made in the day on an individual CFD. By expanding the row the single closings are shown with the related P&L.

For each position closed the following is displayed:

- SECURITY: exchange rate with which the position was closed

- POSITION: the position’s sign (Long/Short)

- TIME: closing time of the position

- P&L TOT: profit and loss for each position

- P&L PERC : profit and loss as a percentage

- QTY: the total value of the position

- MP LOAD: position’s book value (opening value)

- MP CLOSE: the position's closing price (closing price)

- CAR. VAL.: position’s value at opening

- CL. VAL.: position’s value at closing

- CURRENCY: closing currency

- MARKET: market where the order is executed

Intraday positions

For Intraday trading, select "MI" in the "Trading" drop-down menu in the order entry page. You cannot open an Intraday position and a Multiday position at the same time on the same CFD.

Multiday positions

All positions open at the time of closing the day are multiday positions and bear interest. The interest will be debited or credited depending on whether the position is long or short, subject to applying a spread in favour of the bank.

Operational examples

Below are some operational examples about trading with CFDs on indexes and bond futures.

> CFD Long intraday underlying indexes

Underlying: index “X”

Number of lots: 1

Multiplier: 2

Margin chosen: 2.5%

Automatic Stop Loss: 1%

Position sign: Long (the Customer is a Buyer)

Bid-Offer prices of the CFD:

16,195-16,205 (at the opening of the Contract),

16,040-16,050 (at the closing of the Contract)

Value: GBP 32,410 (16,205*2)

Margin value: GBP 810 (16,205*2*2.5%)

Opening Price: 16205

Stop Loss Price: 16,205-1%= 16,043.

Closing Price: 16,040

Differenziale: (16,040 – 16,205) *2*1 = -330 GBP (loss)

> CFD Long multiday underlying indexes

Underlying: “Y” index

Number of lots: 1

Multiplier: 5

Margin chosen: 7%

Automatic Stop Loss: 2%

Position sign: Long (the Customer is a Buyer)

Opening date of the position: t Closing date of the position t+1

Value of the Underlying index at opening in t: 16,200 CFD

Value at the end of day t: 16,300

Value of the Underlying index at closing t+1: 16,045 CFD’s Bid-Offer prices:

16,195-16,205 (at the opening of Contract t),

16,040-16,050 (at the closing of Contract t+1)

Value: GBP 81,025 (16,205*5)

Margin: GBP 5,672 (16,205*5*7%)

Opening Price: 16,205

Stop Loss: 16,205-2%= 15,880 bid price.

On date t, the long position was not closed at the end of the day. Consequently, when the markets close, the margin will be retained (charged to the current account): GBP 5,672. charge applied to Multiday positions: 3.25 (average swap rates +2.95) average swap rates on day t: 0.3% Charges debited at closing: GBP 6.85 [((16,300*5*1) – 5,672)*3.25/36,000] Closing Price on day t+1: 16,040

Differenziale: (16,040 – 16,205) *5*1 = GBP -825 (loss) Total loss: (825+6.85) = GBP 831.85

> CFD Long intraday underlying bond futures in GBP

Underlying: bond future “X”

Number of lots: 1

Multiplier: 100

Margin chosen: 1%

Automatic Stop Loss: 0.5%

Position sign: Long (the Customer is a Buyer)

CFD’s Bid-Offer prices:

115.49 – 115.55 (at the opening of the Contract),

115.62 – 115.68 (at the closing of the Contract)

Value: GBP 11,555 (115.55*100)

Margin value: GBP 115.55 (115.55*100*1%)

Opening Price: 115.55

Stop Loss Price: 115.55-0.5%= 114.97.

Closing Price: 115.62 Differential: (115.62 – 115.55) *100*1 = GBP 7 (gain)

CFD Long multiday underlying bond futures in GBP

Underlying: bond future “Y”

Number of lots: 1

Multiplier: 80

Margin chosen: 8%

Automatic Stop Loss: 6%

Position sign: Long (the Customer is a Buyer)

Opening date of the position: t Closing date of the position: t+1

Value of the Underlying future at opening in t: 134.73 CFD

Value at the end of day t: 134.93

Value of the Underlying future at closing t+1: 134.,65 CFD’s Bid-Offer prices:

134.74 – 134.80 (at the opening of the Contract t),

134.72 – 134.78 (at the closing of the Contract t+1)

Value: GBP 10,784 (134.80*80)

Margin: GBP 862.72 (134.80*80*8%)

Opening Price: 134.80

Stop Loss: 134.80-6%= 133.51 bid price.

On date t, the long position was not closed at the end of the day. Consequently, when the markets close, the margin will be retained (charged on the current account): GBP 862.72. charge applied to Multiday positions: 3.25 (average swap rates +2.95) average swap rates on day t: 0.3% Charges debited at closing: GBP 0.97 (134.93*80*1*3.25/36,000) Closing Price on day t+1: 134.72

Differential: (134.72 – 134.80)*80*1 = GBP - 6.40 (loss) Total loss: (6.40 + 0.97) = GBP 7.37

CFD Long intraday underlying shares in USD

Google price: 1026 – 1027

Shares purchased: 10

Multiplier = 1 GBP/USD

Exchange rate = 2

Requested MGA: 10

Stop Loss: 7,5%

MGA = 10 x (1,027) x 10% = USD 1,027 (at the exchange rate 1,027/2 = GBP 513.5)

At the closing of the position, the margin in GBP matches that retained (GBP 513.5) T

The PL is calculated in the domestic currency and translated into € using the settlement procedure. The customer closes the position at 1,025. The loss is (1,027-1,025) x 10 = USD 20 Let's assume that the exchange rate at settlement is GBP/USD = 2.1 We will have a loss of 20/2.1 = € 9.52.

CFD long multiday underlying shares in USD

Apple price (at the opening of the contract): 93.55 – 93.69

Shares purchased: 300

Multiplier = 1 GBP/USD

Exchange rate = 2

Requested MGA: 15

Stop Loss: 10%

MGA = 300 x (93.69) x 15% = USD 4216.05 (at the exchange rate 4216.05/2 = GBP 2108.02)

Opening date of the position: t

Closing date of the position: t+1

On date t, the long position was not closed at the end of the day. Consequently, when the markets close, the margin will be retained (charged on the current account): GBP 2,108.02.

Charge applied to Multiday positions: 3.35 (for long positions on CFDs with underlying traded in a currency other than GBP: 2.95% + average bid/ask of the swap rate of the related currency) USD swap rate: + 0.4Euribor on day t: + 2.95% CFD value at the end of day t: 94.36 Charges debited at closing: US 2.63 (94.36*1*300*3.35/36,000) Apple prices (at the closing of the contract t+1): 94,20 – 94.36 Closing Price on day t+1: 94.20

Differential: (94.20 – 93.69) *300*1 = USD 153 (gain)

Net gain: (153 – 2.63) = 150.37 USD

Let's assume that the exchange rate at settlement is GBP/USD = 2-1 we will have a gain of 150.37/2.1 = GBP 315.78

Maximum position for CFDs

For each placed order, it will be checked that on the single account, for the single position, the lots (those already held on the position + the lots of the new order) do not exceed the maximum limit established by the Bank.

To know the maximum position allowed on the CFD, check the "Returns and details" section ("Max lots") of the instrument.

Stop Loss and Take Profit on CFDs

Automatic orders are also available for CFDs, with no extra cost, and enable you to protect your positions also when you are not at the PC, or cannot connect to the website or the PowerDesk platform.

Transactions on CFDs are characterised by the uniqueness of the positions. This means that trading on a derivative on different days does not lead to opening several positions; the position remains unique.

For example, if on 4 February I open a position on FTSE100KCFD for 2 multiday margin lots, with a 7% margin; on 5 February I can only extend this position but I cannot open an intraday position or a new multiday position with a different margin.

Only after closing the first position, can I open another.

This distinction is important to understand how to protect your CFD trading with automatic orders. There is in fact Fineco's automatic stop loss on the position which closes the entire position when a certain price is reached. This Stop Loss cannot be changed by the customer but a Stop Loss with a "tighter" price level and a Take Profit may be entered. Automatic orders on the individual orders in the position may also be entered (Stop Loss, Take Profit, Trailing Stop).

Automatic order entry timetable

You can enter, change and cancel automatic orders (Stop, Take and Stop) at different times according to the instrument:

| Underlying index | Reference country | Automatic order entry timetable |

| Super BTP | Eurex | From 07:00 to 17:55 |

| Super Bund | From 7:00 to 20:55 | |

| FtseMIb | Italy | From 8:00 to 20:25 |

| Psi20 | Portugal | From 8:00 to 16:35 |

| ibex35 | Spain | From 07:00 to 18:55 |

| Dax | Germany | From 07:00 to 20:55 |

| TecDax | Germany | From 08:00 to 16:30 |

| Cac40 | France | From 7:00 to 20:55 |

| Eurostoxx50 | Europe | From 7:00 to 20:55 |

| OmxH25 | Finland | From 7:00 to 20:55 |

| Aex | The Netherlands | From 7:00 to 20:55 |

| Smi | Switzerland | From 7:00 to 20:55 |

| Ftse100 | Great Britain | From 7:00 to 20:55 |

| Ipc | Mexico | From 14:30 to 20:55 |

| Icl20 | Belgium | From 8:00 to 16:30 |

| OmxS30 | Sweden | From 8:00 to 16:25 |

| Obx | Norway | From 8:00 to 16:20 |

| Ise30 | Turkey | From 7:30 to 15:30 |

| DJ30 | USA | From 9:00 to 21:10 |

| Nasdaq100 | From 7:00 to 21:10 | |

| SP500 | From 7:00 to 21:10 | |

| Russell2000 | From 7:00 to 21:10 | |

| Jse40 | South Africa |

From 7:00 to 15:00 |

| Bovespa | Brazil | From 14:00 to 20:00 |

| Underlying share | Reference market | Automatic order entry timetable |

| UK Shares | Lse | From 8:00 to 16:35 |

| USA Shares | Nyse e Nasdaq | From 14:30 to 20:50 |

| Underlying share | Reference market | Automatic order entry timetable |

| Silver | CME |

From 7:00 to 21:05 |

| Super Silver | From 7:00 to 21:05 | |

| Copper | From 7:00 to 21:05 | |

| Super Copper | From 7:00 to 21:05 | |

| Super Oil | From 7:00 to 21:05 | |

| Natural gas | From 7:00 to 21:05 | |

| Super Natural gas | From 7:00 to 21:05 | |

| Gold | From 7:00 to 21:05 | |

| Super Gold | From 7:00 to 21:05 | |

| Platinum | From 7:00 to 21:05 | |

| Super Platinum | From 7:00 to 21:05 | |

| Palladium | From 7:00 to 21:05 | |

| Super Palladium | From 7:00 to 21:05 |

Stop Loss and Take Profit on individual orders

I place an order to buy a lot of the XXXKCFD instrument (multiday trading) at a price of 17,515. I enter a stop loss at the price of 17,450 and a take profit at 17,675. The order is executed and my position consists of one lot. During the day I purchase another lot priced at 17,535 and I enter a trailing stop of 25 ticks (1 tick = 5 index points) and purchase two further lots at the price of 17,555, and on this order I put a stop loss equal to 17,520 and a take profit at 17,595. The order is executed and my position (consisting of three orders) is now of four lots.

Each order has conditions that reside on Fineco’s servers. As each condition occurs, a "market" order will be sent.

Let’s assume that the next morning the instrument is quoted at 17,595 (take profit of the third order), Fineco will send a market order for two lots, i.e. the quantity inserted with the third order. The total position will be reduced, therefore, to two lots. At this point the instrument abruptly reverses its trend, passing from 17,595 to 17,470 (trailing stop entered on the second order, calculated as the highest level reached - 25 ticks *5 = 22,595-125 = 17,470): Fineco will send a market order for one lot. The position will be reduced to one lot. The instrument continues its descent to the price of 17,515 (stop loss of the first order), Fineco will send a market order for one lot which closes the position.

Stop Loss and Take Profit conditions on the position

Using the example above, let’s assume you have a position consisting of three orders on the XXXKCFD as previously described. The overall position consists of 4 lots and the security is quoted at 17.595.

I decide to enter a stop loss and a take profit on the position equal to 17.550 and 17.645, respectively. As soon as XXXKCFD reaches 17.645, a market order is sent equal to 4 lots, which closes the entire position and cancels all the conditions previously set on the single orders.

Notes:

- Automatic orders set on multiday positions are valid for 2 years from their placement.

- Only from the website (not from PowerDesk) you can also set a Trailing Stop on the position which, on multiday positions, lasts one day.

Important notes:

- The joint use of a Stop Loss and/or Take Profit on the order and on the position might not lead to the immediate closing of the position, reversing the position.

In addition, once the condition set on the position occurs, you will no longer be able to enter the SL/TP on the same position again. - Placed orders not yet executed always keep the position open.

Let's assume I have a long position on the XXXKCFD instrument formed of 2 lots at 17.850 with a Stop Loss on the order at 17.800 and a Take Profit on the position at 17.900. I decide to extend the position, entering a new buy order of 1 lot with the limit price equal to 17.825 and a Trailing Stop at 5 ticks; the order is placed but not executed yet.

I place a sell order of two lots with the market price; the order is executed but the position will still be open due to the purchase order of one lot still placed but not executed.

As a consequence, the Take Profit at 17.900 set on the position will be cancelled but the Stop Loss and Trailing Stop orders set on the single orders will stay active.

To close the position, I will have to cancel the order that is still in place. - Please remember that intraday trading is not allowed on the closing day of the positions due to the expiry of the instrument.

As a consequence, only multiday positions can be opened, which must be closed by the closing time of the intraday service (different for each instrument and stated on the Trading Timetables page); otherwise the closing will be automatically entered by Fineco. - Upon the closing of intraday trading, for example at 16:30 hours for FTSE100KCFD, the conditions entered on the individual orders will not be checked by Fineco’s servers. This implies that should there be, in the period between the closing of the intraday trading (16:30 hours in the example) and the time when the position is closed by Fineco, any Stop loss, Take Profit or Trailing stop settings, these orders will be rejected and the position will be closed by Fineco.

- Before Fineco sends the automatic Stop Loss, any orders entered on the position which is about to close, will be cancelled.

- Trade & Reverse cancels any Stop loss and Take profit entered on the position, but does not modify the settings placed on the individual orders which remain active.

Let's assume, like in the previous example, I have a long position on the FTSE100KCFD instrument formed of 2 lots at 17.850 with a Stop Loss on the order at 17.800 and a Take Profit on the position at 17.900. I decide to extend the position, entering a new buy order of 1 lot with the limit price equal to 17.825 and a Trailing Stop at 5 ticks; the order is placed but not executed yet.

I decide to reverse the position by placing a sell order of four lots with market price; the order is executed but the position will be short for one lot.

In addition, the Take Profit at 17.900 set on the position will be cancelled but the Stop Loss and Trailing Stop orders set on the single orders will stay active. - The conditional orders are valid for a day and, if not executed, the conditions associated with them (Stop Loss, Take Profit or Trailing Stop) will be cancelled upon the expiry of the order.

Automatic Stop Loss

With each open position Fineco automatically associates a Stop Loss, which varies according to the traded instrument, the trading and the margin selected.

The Stop Loss is a "market" order, which automatically closes your position in the event of excessive price variations. For example, if you are trading FTSE100KCFD (CFD on the FTSE100 index) and you selected a 10% margin, the Stop Loss will start at 5%.

The Stop Loss Price is not guaranteed and, as a consequence, there is no guarantee that the position will actually be closed at this price. You can enter your own Stop Loss orders for the closing of the position, by specifying the price threshold at which the order is activated. The price threshold stated must be higher (or lower for Short positions) than the one used by the Bank for the automatic Stop Loss order.

Note: The value of Fineco’s automatic Stop loss, if it is not a multiple value of the minimum tick, will be adjusted to the mathematically closest trading multiple.

You can enter orders at a price near the automatic Stop Loss, but if there is a sudden market movement, any orders made near the automatic Stop Loss may not lead to the immediate recalculation of the new level of automatic Stop Loss, producing as an effect the opening of a new position with an opposite sign.

Carry-on

Each CFD intraday position can be converted to a Multi-day directly on your instructions by the end of Trading Hours on the day the CFD position is opened. This service is available through website or Powerdesk platform.

Intraday Positions may be converted to Multi-day Positions in accordance with the specific terms applicable to the CFD.

This is not possible if:

- You have already opened a Multiday position referencing the same Underlying Asset; or

- You have placed instructions – still not yet filled – on the same Intraday Position; or

- The CFD you have chosen is only available for Intraday trading

The carry-on shall continue for subsequent Working Days until you decide to close the position or it is closed as a result of the execution of a Stop Loss Order. A continuation or carried-on position may not be continued for more than 12 months. In addition we may elect not to roll-over or close a position if there is any Margin deficit or short fall.

Carry-on (website): for each CFD intraday opened position, in the Portfolio section, you can find the  button that allows you to convert your position from Intraday to Multi-day. Via link, a confirmation page will be displayed to you. On this page you can select the margin percentage for your Multi-day position and you can see all details of the new position ( quantity, average book price).

button that allows you to convert your position from Intraday to Multi-day. Via link, a confirmation page will be displayed to you. On this page you can select the margin percentage for your Multi-day position and you can see all details of the new position ( quantity, average book price).

If you click on the “confirm” button, the intraday position is automatically converted to Multi-day.

Carry-on (Powerdesk): for each CFD intraday opened position, in the Orders Monitor section, you can find the “OV” button that allows you to convert your position from Intraday to Multi-day. If you click on this button, a popup will be displayed to you where you can select the margin percentage for your Multi-day position and you can see all details of the new position. If you click on the “confirm” button, the intraday position is automatically converted to Multi-day.

How to change margin?

You can vary the deposited margin for each intraday or Multi-day position. These changes can be made both rising and decreasing on the same day that the position is opened or in the following days. One margin change per day for each position is allowed. You can vary the margin every working day until the closure of the position except for the day the position expires.

You can vary the margin by the  button in the Portfolio section of the website or in the orders monitor in the Powerdesk platform.

button in the Portfolio section of the website or in the orders monitor in the Powerdesk platform.

Example

CFD Long Multi-day position with Index as Underlying Asset

Underlying Asset: index “Y”

Number of Lots: 1

Multiplier: 1

Chosen Margin: 7% (525.49 GBP)

Automated Stop Loss: 2% (7357.1)

Opening price: 7,507.2

Value 7,507.2 GBP

Assuming that the CFD offer price decreased at 7,400, the client decides to vary the margin of the position in order to modify the automated stop loss threshold that, if reached, will automatically close the position.

Via MC button, he selects the new margin percentage and he confirms with his PIN.

The chosen margin is 15% (GBP 1126.08). The automated stop loss is automatically recalculated at 10%:

- The available balance is reduced by GBP 600.59 (1126.08 - 525.49)

- New margin of the position: GBP 1126.08

- New automated stop loss: 6,660

Margin change time period allowed

You can vary the margin until the automatic closure of intraday trading hours.

Note:

- Margin change is allowed when Markets are opened.

- If you increase the margin, in case of the stop loss threshold is reached due to a variation of the underlying asset price the loss that could be generated would be greater than the one you could suffer if you do not change the margin.

- If you have placed instructions – still not yet filled – margin change is not allowed. You could vary the margin after having deleted these orders.

- Margin change implies the settlement of fees applied to Multi-day positions. These fees will be recorded (debited) in your current account every time you vary the margin of the position.

- During the day the position expires, margin change is not allowed. In order to increase the margin you must have enough available balance. in cases of extreme markets volatility, Fineco makes use of the option of changing margin of all or some type of instrument.

Positions already opened when editing will maintain the preselected margin and their stop loss threshold; new positions could be opened by choosing only one of the new margins. If you decide to vary the margin of your position after Fineco has changed the allowed margin percentages, only new margins can be chosen and so the automated stop loss price of your position will be recalculated basing on new margin chosen.

CFD trading hours

Trading hours of CFDs on indexes

> Intraday trading

| Underlying index | Reference country | Intraday service hours | ||

| Start | End | Closing | ||

| FtseMIB | Italy | 07:00:00 | 20:50:00 | From 20:50:01 to 20:54:59 |

| Dax | Germany | 07:00:00 | 20:50:00 | From 20:50:01 to 20:54:59 |

| TecDax | Germany | 08:00:00 | 16:25:00 | From 16:25:01 to 16.29:59 |

| Ibex35 | Spain | 07:00:00 | 18:50:00 | From 18:50:01 to 18:54:59 |

| Cac40 | France | 07:00:01 | 20:50:00 | From 20:50:01 to 20:54:59 |

| Ftse100 | UK | 08:00:01 | 20:50:00 | From 21:50:01 to 21:54:59 |

| EU Stoxx Volatility | Europe | 07:00:00 | 20:50:00 | From 20:50:01 to 20:54:59 |

| Eurostoxx50 | Europe | 07:00:00 | 20:50:00 | From 20:50:01 to 20:54:59 |

| IcI20 | Belgium | 08:00:00 | 16:25:00 | From 16:25:01 to 16:29:59 |

| Omx C30 | Sweden | 08:00:00 | 16:20:00 | From 16:20:01 to 16:24:59 |

| Omx H25 | Finland | 07:00:00 | 20:50:00 | From 20:50:01 to 20:54:59 |

| Aex | The Netherlands | 07:00:00 | 20:50:00 | From 20:50:01 to 20:54:59 |

| Psi 20 | Portugal | 08:00:00 | 16:30:00 | From 16:30:01 to 16:34:59 |

| Smi | Switzerland | 07:00:00 | 20:50:00 | From 20:50:01 to 20:54:59 |

| Obx | Norway | 08:00:00 | 15:15:00 | From 15:15:01 to 15:19:59 |

| DJ30 | USA | 07:00:00 | 21:05:00 | From 21:05:01 to 21:09:59 |

| Nasdaq100 | ||||

| SP500 | ||||

| Russell2000 | ||||

| Ipc | Mexico | 14:30:00 | 20:50:00 | From 20:50:01 to 20:54:59 |

| Jse 40 | South Africa | 07:30:00 | 15:25:00 | From 15:25:01 to 15:29:59 |

| Bovespa* | Brazil | 14:15:00 | 20:40:00 | From 20:40:01 to 20:44:59 |

> Multiday trading

20:55:00

| Underlying index | Reference country | Multiday service hours | |

| Start | End | ||

| FtseMIB | Italy | 07:00:00 | 20:55:00 |

| Dax | Germany | 07:00:00 | 20:55:00 |

| TecDax | Germany | 08:00:00 | 16:30:00 |

| Ibex35 | Spain | 07:00:00 | 18:55:00 |

| Cac40 | France | 07:00:01 | 20:55:00 |

| Ftse100 | UK | 08:00:01 |

20:55:00 |

| EU Stoxx Volatility | Europe | 07:00:00 | |

| Eurostxx50 | Europe | 07:00:00 | 20:55:00 |

| Icl 20 | Belgium | 08:00:00 | 16:30:00 |

| Omx S30 | Sweden | 08:00:00 | 16:25:00 |

| Omx H25 | Finland | 07:00:00 | 20:55:00 |

| Aex | The Netherlands | 07:00:00 | 20:55:00 |

| Psi 20 | Portugal | 08:00:00 | 16:35:00 |

| Smi | Switzerland | 07:00:00 | 20:55:00 |

| Obx | Norway | 08:00:00 | 15:20:00 |

| DJ30 | USA | 07:00:00 | 21:10:00 |

| Nasdaq100 | |||

| SP500 | |||

| Russell 2000 | |||

| Ipc | Mexico | 14:30:00 | 20:55:00 |

| Jse | South Africa | 07:30:00 | 15:30:00 |

| Bovespa* | Brazil | 13:20:00 | 19:45:00 |

*Brasil uses winter time in different dates compared to the UK. For further details read the message concerning the summer/winter time change in the markets area

Trading hours of CFDs on bond futures

> Intraday trading

| Underlying future | Reference market | Intraday service hours | |||

| Start | End | Closing | |||

| BTP | Eurex | 07:00:00 |

17:50:00 | From 17:50:01 to 17:54:59 |

|

| Super BTP | |||||

| Short Term BTP | |||||

| OATS | |||||

| Bund | 07:00:00 |

20:50:00 |

From 20:50:01 to 2:54:59 |

||

| Super Bund | |||||

| Bobl | |||||

| Schatz | |||||

| Buxl | |||||

| Super Buxl | |||||

> Multiday trading

| Underlying future | Reference market | Multiday service hours | ||

| Start | End | |||

| BTP | Eurex | 07:00:00 | 17:55:00 | |

| Super BTP | ||||

| Short Term BTP | ||||

| OATS | ||||

| Bund | 07:00:00 | 20:55:00 | ||

| Super Bund | ||||

| Bobl | ||||

| Schatz | ||||

| Buxl | ||||

| Super BUXL | ||||

Trading hours of CFDs on USA and UK shares

> Intraday trading

| Underlying share | Reference market | Intraday service hours | ||

| Start | End | Closing | ||

UK shares |

Lse | 08:00:00 | 16:25:00 | From 16:26:00 to 16:27:00 |

| USA shares | Nyse e Nasdaq | 14:30:00 | 20:50:00 | From 20:56:00 to 21:00:00 |

| Europe shares | Borsa Italiana, Equiduct, Euronext | 08:00:00 | 16:25:00 | From 16:25:15 to 16:30:00 |

> Multiday trading

| Underlying share | Reference market | Multiday service hours | |

| Start | End | ||

| UK shares | Lse | 08:00:00 | 16:27:00 |

| USA shares | Nyse e Nasdaq | 14:30:00 | 20:57:00 |

| Europe Shares | Borsa Italiana, Equiduct, Euronext | 08:00:00 | 16:27:00 |

Trading hours of CFDs on Commodities

| Underlying Commodity Futures | Reference Market | Intraday Trading Hours | Intraday Trading Hours | |||

| Start | End | Automatic closing phase | Start | End | ||

| Silver | CME | 07:00:00 |

21:05:00 | From 21:05:01 to 21:10:00 |

07:00:00 |

21:10:00 |

| Super Silver | ||||||

| Copper | ||||||

| Super Copper | ||||||

| Oil | ||||||

| Super Oil | ||||||

| Natural gas | ||||||

| Super Natural Gas | ||||||

| Gold | ||||||

| Super Gold | ||||||

| Platinum | ||||||

| Super Platinum | ||||||

| Palladium | ||||||

| Super Palladium | ||||||

Taxation considerations

Currency date

The settlement of CFD transactions depends on the underlying asset. The settlement of CFDs on indices takes place on the business day following the trade date (T+1). The settlement of CFDs on shares takes place two business days following the trade date (T+2).

Cost for multiday positions

For open CFD positions lasting more than one day a Multi-day Position Fee, net of the margin shall be payable by you, on the following terms:

| Instruments |

| Long CFD positions with underlying bonds, indices and commodities: Euribor 1m 360 (**) (***) + 2.50% |

| Short CFD positions with underlying bonds, indices and commodities: Euribor1m360 (**) (***) – 2.50% |

|

Long CFD positions with underlying shares: Euribor 1m360 (**)(***) + 2.50% |

|

Short CFD positions with underlying shares: 2.50% |

** Euribor (European Interbank offered rate) is an interbank rate, the interest rate by which banks lend money to other banks in the interbank market and it is published daily.

*** CFDs in a non-euro currency, in the formula for calculating the Multi-day Position Fee to apply to Multi-day positions, in place of Euribor, the average between Bid/Ask values of the Rates of trading currency

shall be used and published daily in the Client Area of our website.

Dividends

Upon specific corporate events (such as dividend payments) the price of the underlying shares will change, and consequently have an impact on indices and derivatives.

In order to keep the price of a CFD – as well as the value of the related Position – in line with the price of the respective underlying shares or index, adjustments will be also made to each existing Position, or otherwise Positions will be automatically closed at the end of the last available trading day before the ex-date trading day.

In particular, should dividends or other profits be declared for distribution to shareholders by the issuing company, we will credit, or in the case of a short position, debit your current account:

- For CFDs with shares as the Underlying Asset, of the same gross value as the dividend or profit;

- For CFDs with an index as the Underlying Asset, of the corresponding amount of index points

multiplied per Lot number of the existing Position.

At the same time, the Stop Loss Price of each Position will be adjusted accordingly.

In case of divided booking amendments and/or cancellations, there will not be an extra corresponding adjustment of the Stop Loss Price.