Forex CFDs

The Forex CFD offering

CFD Fx is a service that allows you to trade CFDs with underlying currencies traded on the Forex Exchange (Forex) market, where two parties exchange two currencies at an agreed exchange rate. Forex is an OTC (over the counter) market: exchanges therefore do not take place in a regulated market and are freely subscribed by the two contracting parties in accordance with the predefined terms of a contract.

The liquidity, accuracy and security of the transactions are guaranteed by the individual parties participating in exchanges, including all the major international Banking Groups. There are no official market prices, but the exchanges are communicated to the international telematic circuits by all the main operators (Reuters, Bloomberg) that publish them in real-time globally. FinecoBank provides you with the quotes of more than 50 CFDs in real-time and in push mode from both the PowerDesk2 platform and directly from its website and through the mobile app.

The CFD Fx service allows you to undertake margin trading: each trade requires an amount equal to a reduced percentage of the value of the transaction. You can customise the requested margin from a specific list with a minimum value of 1% per intraday position and of 2% per overnight position.

With CFD Fx you can take a Long (bullish) or Short (bearish) position compared to a given exchange rate.

- In the case of a Long position you will make a profit when the first currency appreciates compared to the second (as a result, the underlying exchange rate will increase). Conversely, you will suffer a loss. For example, if you purchase a CFD Fx on EURUSD at a price of 1.2800 (long position on the EURUSD exchange rate), you will make a profit if the price of the CFD subsequently exceeds 1.2800, or a loss if it falls below 1.2800.

- In the case of a short position, you will make a profit if the first currency depreciates on the second (accordingly, the underlying exchange rate value will decrease). Conversely, you will suffer a loss. For example, if you sell a CFD Fx on EURUSD at an exchange rate of 1.2800 (short position on the EURUSD exchange rate), you will make a profit if the exchange rate subsequently falls below 1.2800, or a loss if it exceeds 1.2800.

Important:

The CFD Fx service differs from the traditional Multicurrency service that allows you to carry out the GBP/foreign currency (dollar/Euro/CHF)) exchange directly online with immediate availability of the currency for any amount and without the leverage effect that characterises the spot exchange rate trading of the Forex market.

CFD Fx trading is offered to customers through various channels: the Bank’s website, the PowerDesk2 platform in push, iPhone, iPad, Android, WP8 apps. For closing of positions only, you can also operate through the FinecoBank call centre orders service.

MAIN FEATURES

The main features of the CFD FX service are:

- Duration

The duration of your currency positions may be:

> Intraday - The position is closed on the same day it was set up. At the end of day (21:50 hours), if the position is still open for any reason, Fineco will close it automatically.

> Overnight - The position will remain open for a maximum of 12 months, unless closed earlier by the customer manually or automatically following the activation of the automatic stop loss.

The gain/loss will be credited/debited only upon closing the position, even only partially. - Average book value

The average book value is the weighted average of the prices of the transactions performed. - Automatic stop loss

With the opening of a position and the selection of the margin, an automatic Stop loss is automatically created on the position.

The price used as reference for calculating the automatic Stop Loss will be the average book value. The automatic Stop Loss cannot be removed manually. - Stop loss, Take profit and Trailing stop

Only on intraday positions can you enter the same SL, Tp and Trailing stop on the order and on the position. SL, TP and Trailing have a daily duration. - Profit&Loss

The P&L will be credited/debited on the Available Trading Balance only upon closing the position, even only partially.

As for other changes, the P&L will always be in euro. The logics underlying the calculation of the P&L do not change: this will be calculated in a quote currency (e.g., for USDJPY CFD Forex, in Yen) and credited/debited in GBP at the exchange rate of the settlement procedure. From the time the P&L is realised/incurred, until debiting/crediting to the c/a, the Available Trading Balance will be updated based on the exchange rate recorded upon closing of the position, using the same mechanism applied to the Classic CFD Indices available in production.

Example: If I open a Long position of 10000 CFDs on GDPUSD when the quote is 1.24839 - 1.25 the opening price of the position is 1.25.

I close the position when the CFD is quoted at 1.26 - 1.26892, selling the 10000 CFDs at 1.13.

The P&L in quote currency (USD) is equal to 10000* (1.26- 1.25) = + USD 100

The Available Trading Balance is increased by [(Quote Profit) / (Current GBPUSD exchange rate)], i.e.:+100/1.24879 = + GBP 80.08

At the end of the evening, the settlement will record a new exchange rate (average between Bid and Offer of the GBPUSD currency pair at 22:00 hours) which will be used to convert the profit in quote currency (+ USD 100) into GBP. - Interest

Example:

If on Day t I open a long position on CFD GBPUSD for 10,000 lots with a 2% margin (and 1% Stop loss), the amount of the margin will equal GBP 200 (10,000 *2%).

Given the Bid/Offer prices of the CFD, equal to 1.3044-1.3047, the Average Book Value will be the offer price of 1.3047 and the Stop loss will be 1.2916.

If the End-of-day Bid-Offer prices equal 1.3010-1.3013, the arithmetic average of the price of the CFD will be (1.3010 + 1.3013)/2 = 1.30115.

Fixed Borrowing Interest calculation:

2.95%*10,000/360*1 = Euro 0.82

Floating Interest calculation:

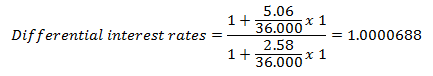

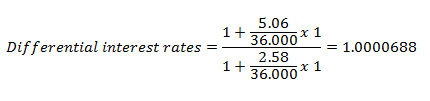

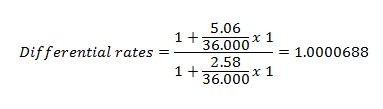

Bid Price–Offer Price certain currency’s rate of interest: 2.58-2.60

Bid Price–Offer Price quote currency’s rate of interest: 5.04-5.06

Differential interest rate: 1.0000688

Arithmetical average of the CFD price multiplied by the above rate differential (1.30115*1.0000688)= 1.301238

As the position is Long, the difference is calculated between:

- The arithmetical average of the CFD price

- The arithmetical average of the CFD price multiplied by the rate differential: (1.30115 - 1.301238) = - 0.000088

This difference is then multiplied by the position quantity (10,000 units): 10,000*( - 0.000088) = - 0.88

This amount is translated into GBP at the ruling GBP/USD rate (say, 1.3018), so that (- 0.88/1.3018) = GBP - 0.68 Consequently, the total interest charged will be (0.82 + 0.68) = GBP 1.5

Interest will be calculated daily, but debited on the current account only when the position is partially or entirely closed.

Note: every 90 days, on the positions which are still open, interest will be allocated on the available trading balance and recorded among the reserved items.

Modify Margin of the position

Similarly to Classic CFDs, the CFD Fx service envisages a Modify Margin which will only be available for positions already Overnight.

Modifying the margin will mean:

- adjusting the Available Trading Balance

- adjusting the position's margin

- adjusting the automatic Stop Loss, based on the new selected margin.

The margin cannot be modified if this would trigger the activation of the automatic Stop Loss.

Modify Margin is not permitted:

- when, in the case of increasing the margin, the Available Balance is not large enough;

- when the position includes orders in the placed status. - Trading times

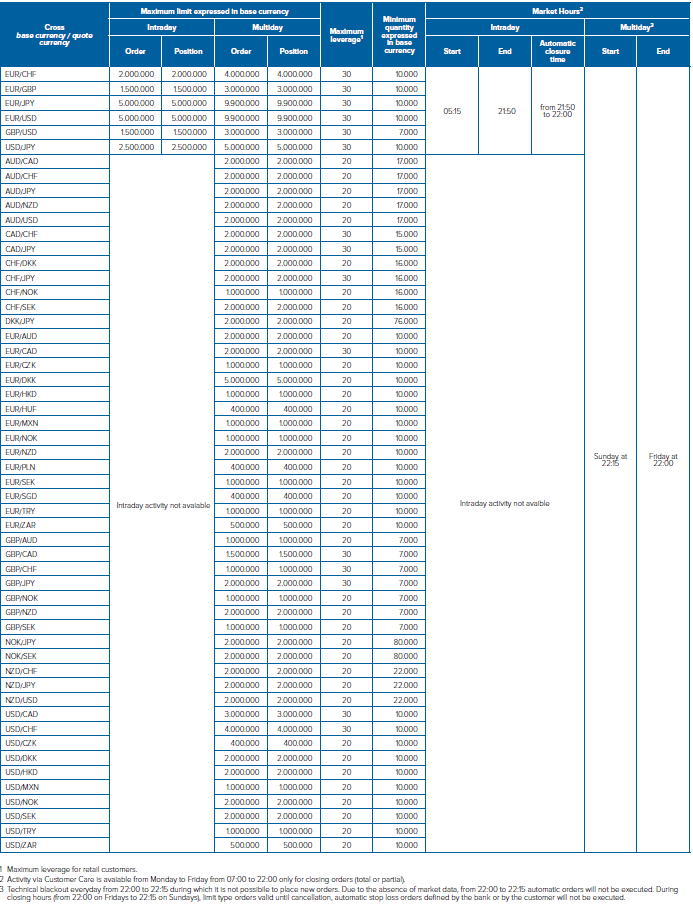

For Intraday trading, the service is active from Monday to Friday, from 05:15:00 to 21:50:00 hours;

For Overnight trading, the service is active from Monday to Thursday from 05:15:00 to 03:00:00 hours, on Friday from 05:15:00 to 22:00:00 hours. - Ceilings

In relation to trading on the currency market, FinecoBank applies two types of limits:

1. per order

2. per CFD position

The limits "per order" and "per position" differ for each CFD. For each CFD there is a limit "per order" with a value equal to the limit "per position".

For CFDs on which intraday trading is possible, the different ceilings are indicated.

Notes:

- Any orders for a higher amount will be denied.

- FinecoBank reserves the right to change these limits due to changing market conditions.

For more exhaustive information please go to the list in the Trading limits on the CFD Fx market section.

For additional information, reference should be made to the Product Sheet and the CFD Fx trading regulations, included in the Derivatives trading service contract, available on the website, in: ACCOUNT MANAGEMENT > Managing services > Trading and investments.

All the advantages of Forex CFDs

Trading on CFD Fx enables investors to invest directly online on 54 currency pairs, using the 100% leverage, to exploit price fluctuations and abundant market liquidity, to define currency risk hedging strategies, especially for positions open on markets outside the Euro-zone. This has also many advantages, including:

- The Profit&Loss of overnight positions is debited/credited solely when the position is closed (partially or entirely).

- Overnight positions maintain the same opening price over their duration.

- The invested margin can be increased or decreased at any point during the day.

The Forex market on which CFD Fx are traded has the following distinctive features:

- High level of liquidity. Over the last ten years, the Forex market has seen a substantial increase in the volume of trading and, today, it is considered the largest and most liquid market in the world.

- Transparency. The abundant liquidity of the market means that no operator is able to move the market in a given direction, nor can they use exclusive and confidential information sources. Information regarding individual countries and international macro-economic data are made public at the same time for all operators.

- Open 24 hours a day. Forex is an unregulated OTC market, open 24 hours a day, every day of the week (except Sundays, 1 January and 25 December). With Fineco your conditional orders are managed 24 hours a day. Online or voice orders facilities are available at different times depending on the trading mode:

- in overnight mode from Monday to Thursday:

> from 05:15 to 22:00 hours (from 07:00 existing open orders can be cancelled by reaching out to the client service)

> from 22:31 to 03:00 hours (only online order facilities)

On Friday, you can place orders from 05:15 to 02:00hours and from 22:31 to 23:00 hours (voice orders facilities are available only between 08:00 and 21:00 hours);

- in intraday mode from Monday to Friday from 05:30 to 21:50 hours (voice orders facilities are available only from 08:00 hours).

> No commission fees. Unlike regulated markets, you do not have to pay a trading fee for each open or closed position. With FinecoBank you only have minimum bid/offer spreads (difference between the bid and the offer price) in respect of the prices recorded at that time by the main market makers. For example, for EUR/USD, the spread is only 3 pips (i.e., 3 ten-thousandths = 0.0003).

> Margin trading. FinecoBank’s CFD Fx is a margin trading service. In order to open a position, you need only invest a variable percentage of the value, rather than the total amount, of each transaction.

The minimum margin for intraday transactions is 1%, which is equivalent to a leverage effect of 10,000%. For overnight transactions, it is 2%, with a leverage effect of 5,000%: with GBP 1,000, you can open a GBP 100,000 intraday position or a GBP 50,000 overnight position.

> Real-time updates. With FinecoBank you have the quotes and charts of more than 50 exchange rates in real time and with no extra cost to view the quotes.

Quotes, spreads, tradable currencies

Rather than physically trading or exchanging the financial instrument, CFDs are a transaction where two parties agree to exchange cash based on the change in value of the underlying asset between the point when the transaction is opened and the time when it is closed. Consequently, the value of the CFD Fx is directly linked to the exchange rate between two currencies (crosses or pairs) and follows their trend.

Exchange rates

An exchange rate is the ratio of exchange for two currencies where, traditionally, one currency is the numerator and the other is the denominator. On the Forex market, currencies are usually quoted using four significant numbers, where the last decimal is called point or pip (being the minimum price variation of a pair).

For example:

USD/JPY exchange rate: the dollar (USD) is the numerator, while the Yen (JPY) is the denominator. The exchange rate shows how many Yens are necessary to buy a dollar.

Based on this example, for the EUR/USD exchange rate, the euro is the numerator and the dollar is the denominator. The exchange rate shows how many dollars are necessary to buy a euro.

Traditionally, on the Forex market, the numerator currency is called “certain or base currency”, while the denominator currency is called “quote” or “reference” currency.

Traditionally, each exchange rate is also called “cross” or “cross-rate”.

For example, for the GBP/USD exchange rate, the GBP will be the certain currency and the dollar the quote or reference currency.

For each cross, two prices are quoted: bid (on the left) and offer (on the right). The difference between the two prices is called “spread” and is usually measured in pips.

Quotes: bid and offer

According to Fineco's Pricing Policy, the bid-offer prices quoted by the Bank to open or close a CFD Fx contract replicate the trend of the Bid-Offer Prices of the Underlying asset and, under ordinary market conditions, hence for most of the trading day, their spread is in line with that of each Cross on the Fineco website.

Closing Price:

When the position is closed by the customer, it is the Price of the CFD quoted at that moment by Fineco: Bid or Offer in case of long or short position, respectively. In the case of automatic closing at the end of the trading day, it is the price (Bid or Offer in case of long or short position, respectively) recorded in a random instant of the Closing phase.

At the end of the trading day, if the CFD Fx quotes are not available due to the lack of the relevant data to determine the value of the Underlying asset, the last Bid-Offer prices of the CFD FX quoted by Fineco during the day are used.

Tradable currencies

FinecoBank offers you real-time push quotes for over 54 crosses. They cover the main currencies (GBP, Euro, Dollar, Yen and CHF), secondary currencies (Australian, New Zealand and Canadian dollar, Swedish krona) and the related crosses.

Each quote includes FinecoBank's Bid-Offer spread for each trade which may be considered as the transaction cost which never exceeds 3 pips on the main exchange rates (e.g., GBP/USD).

The spread is independent of the transaction amount. FinecoBank's spreads may be extended only when the market is particularly volatile or suffers from lack of liquidity.

The crosses which can be traded with FinecoBank are listed below with the related spreads:

|

Cross |

spread |

|

AUDCAD |

10 |

|

AUDCHF |

10 |

|

AUDJPY |

6 |

|

AUDNZD |

13 |

|

AUDUSD |

3 |

|

CADCHF |

8 |

|

CADJPY |

6 |

|

CHFDKK |

17 |

|

CHFJPY |

4 |

|

CHFNOK |

35 |

|

CHFSEK |

35 |

|

DKKJPY |

10 |

|

EURAUD |

10 |

|

EURCAD |

12 |

|

EURCHF |

3 |

|

EURCZK |

30 |

|

EURDKK |

5 |

|

EURGBP |

5 |

|

EURHKD |

30 |

|

EURHUF |

45 |

|

EURJPY |

4 |

|

EURMXN |

100 |

|

EURNOK |

35 |

|

EURNZD |

12 |

|

EURPLN |

45 |

|

EURSEK |

40 |

|

EURSGD |

15 |

|

EURTRY |

19 |

|

EURUSD |

0.8 |

|

EURZAR |

100 |

|

GBPAUD |

10 |

|

GBPCAD |

10 |

|

GBPCHF |

7 |

|

GBPJPY |

7 |

|

GBPNOK |

75 |

|

GBPNZD |

35 |

|

GBPSEK |

65 |

|

GBPUSD |

1 |

|

NOKJPY |

10 |

|

NOKSEK |

8 |

|

NZDCHF |

10 |

|

NZDJPY |

7 |

|

NZDUSD |

5 |

|

USDCAD |

5 |

|

USDCHF |

4 |

|

USDCZK |

50 |

|

USDDKK |

25 |

|

USDHKD |

8 |

|

USDJPY |

3 |

|

USDMXN |

70 |

|

USDNOK |

40 |

|

USDSEK |

40 |

|

USDTRY |

14 |

|

USDZAR |

175 |

Trading

The underlying of the CFD Fx is the exchange rate between two currencies (cross) and it follows their trend.

The notional amount, or the amount of CFD Fx contract to be purchased/sold, is the quantity of the underlying of the CFD Fx related to the base currency. You can decide the amount of the base currency to purchase/sell from a list predefined by FinecoBank.

For each base currency Fineco sets the minimum trading amount for an individual Contract and minimum multiples, as listed below:

|

Base currency |

Minimum multiple |

|

AUD (Australian dollar) |

17.000 |

|

CAD (Canadian dollar) |

15.000 |

|

CHF (Swiss franc) |

16.000 |

|

DKK (Danish krone) |

76.000 |

|

EUR (euro) |

10.000 |

|

GBP (Sterling) |

7.000 |

|

NOK (Norwegian dollar) |

80.000 |

|

NZD (New Zeland dollar) |

22.000 |

|

USD (US dollar) |

10.000 |

Profit and loss calculation

The profits and losses of each transaction are always calculated in the currency indicating the denominator and are credited/debited and recognised in your current account when the position is partially or entirely closed.

They are converted into euros using the average between the Bid-Offer price recorded by Fineco at around 22:00 hours.

Important: You can open an intraday position and an overnight position at the same time on the same CFD Fx.

The average book value and the profit/loss generated by the individual positions will always be different.

Market, Limit and Stop Orders

With CFD Fx trading there are three types of orders: LIMIT and STOP orders, with which you can send to FinecoBank an order to purchase or sell a currency amount when the market reaches a certain level and MARKET orders, which can be used to apply the quote available at the current exchange rate.

- MARKET ORDER

You can use it to purchase or sell at current market prices and it enables you to trade immediately by purchasing on bid and selling on offer.

You are, therefore, accepting the price quoted by the market at the time it receives your order. This means that the executed price may be different from the quote displayed when you placed your order: this is the case especially when there is a high level of trading, liquidity or volatility.

Examples: The XXX/YYY cross is quoted at 1.2883 (bid) – 1.2886 (offer).

If you send a MARKET purchase order, this means that you are willing to apply the offer price (1.2886). However, this order may be executed at a price that is higher by a few pips than the price displayed (for example 1.2887/1.2888).

If you place a MARKET selling order, this means that you wish to apply the bid price (1.2883). Also in this case, owing to increased volatility, the order may be executed at a slightly lower price. - LIMIT ORDER

You can use it to

- purchase below or at market price

- sell above or at market price.

Normally, it is used to make a profit on an already open position and, in this case, it can also be defined as a "Take Profit" order. Alternatively it can be used to open a new position.

You can place LIMIT orders to purchase at a price below market prices and to sell at a price above the current price. However, these orders will be executed:

- If purchasing, when the offer price of the market reaches the level specified

- If selling, when the bid price reaches the level specified.

In these cases, they will be executed only at the price indicated, neither worse nor better.

Examples

The XXX/YYY cross is quoted at 1.2883 (bid) – 1.2886 (offer).

- You can place a purchase order below 1.2886 (offer price), e.g. 1.2885, however this order will be executed only when the offer price reaches the level specified (1.2885)

- You can place a selling order above 1.2883 (bid price), e.g. 1.2884, however this order will be executed only when the bid price reaches the level specified (1.2884). - STOP ORDER

A Stop order is entered in order to:

- purchase above the market current price

- sell below the market current price.

Normally a Stop order is placed in order to limit a potential loss in relation to an open position and, in this case, it can also be referred to as a Stop Loss order. For this reason, when the price condition you have indicated is met, the STOP order is entered as a MARKET order to guarantee its execution, even though the executed price may be slightly different to the one indicated. A STOP order can also be used to open new positions on reaching a certain technical level that is deemed significant. In this case, it is defined as a Stop Entry order.

Please remember that:

- A purchase STOP order can be executed only when the offer price reaches the level indicated. The order may be executed at a price that is a few pips higher due to exceptional market conditions

- A selling STOP order may be executed only when the BID reaches the level indicated. The order may be executed at a price that is slightly lower by a few pips.

The STOP order templates on Fineco’s website and on PowerDesk2 are set up to be as intuitive as possible: if you select "PURCHASE", the "OFFER" field is set by default, instead, if you select "SELL", the "BID" field will be set by default.

Examples

- In your portfolio, you have a long position of 50,000 XXX/YYY with a book value of 1.2850. You may decide to place a Stop Loss order at the price of 1.2830 in order to limit your losses at a price close to the set threshold. In this case, for the order to be executed you have to submit a sell order specifying the activation threshold: you must therefore select "SELL" as the transaction type and "BID" as the price, and then enter the defined threshold (which in this case is 1.2830).

- In your portfolio, you have a short position of 50,000 QQQ/ZZZ with a book value of 1.2850. You may decide to place a Stop Loss at the price of 1.2880 in order to limit your losses at a price close to the set threshold. In this case, for the order to be executed you have to submit a purchase order specifying the activation threshold: you must, therefore, select "PURCHASE" as the transaction type and "OFFER" as the price, and then enter the defined threshold (which in this case is 1.2880).

- There are no positions in your portfolio. The XXX/WWW cross is quoted at 1.2877 - 1.2880. According to your analyses, the exchange rate will rise and exceed 1.29. In this case, you can place a STOP order, entering a purchase order (set at the OFFER price) at a threshold level equal to 1.29. The order will be activated when the offer price reaches the level set by you (1.29) and will be executed at a price equal to or slightly higher than 1.29.

Important: the prices shown in the charts on Fineco’s various trading platforms may not include any pips added by FinecoBank. Therefore, they do not represent the official price quoted by the market in a given period of time. The charts are created using FinecoBank data, which provide the bid prices for the part of the chart that is displayed on opening it, while the preceding part of the chart is based on the bid price distributed by the provider of historical data.

Intraday positions

For specific CFD Fx products, Fineco also enables you to trade intraday positions with reduced margins, using the 100% leverage:

- GBPUSD

- EURCHF

- EURGBP

- EURJPY

- EURUSD

- USDJPY

Intraday trading implies that the position lasts only one day: i.e. the position must be closed on the very day of opening.

If some intraday positions are still open at the close of the trading session (21:50 hours), Fineco automatically closes all these positions by 22:00 hours without charging penalties.

Important: You cannot place several orders with different margin levels on the same cross.

If, for example, there is an open position on the XXX/YYY cross with a 1% margin, you will not be able to place orders with a different margin (1.5%) on the same cross until the initial position on the selected cross is closed.

As a result, each close-out transaction on a cross must be performed with the same margin selected to open the position.

You can open an intraday position and an overnight position at the same time on the same cross.

- Order placement and execution time:

from Monday to Friday from 05:15 to 21:50 hours (orders placed via the client service can be sent from 07:00 hours).

Important: from Monday to Friday, intraday trading closes at 21:50 hours.

If, for any reason, intraday positions are still open after 21:50 hours, Fineco will automatically close them by 22:00 hours. Furthermore, all orders still placed on Intraday positions at 21:50 hours, will be removed.

- Margin trading and Stop Loss:

The margin for Intraday transactions varies from 1% to 1.5%; the automatic Stop Loss value is equal to half a percentage point less than the margin level, i.e.: 0.5% or 1% respectively.

|

Margin |

FinecoBank Stop loss |

|

1% |

0,5% |

|

1,5% |

1% |

Note: Only for CFDs, the EURCHF margin for intraday trading can be equal to 8% or 9%, with stop loss of 4% or 5%, respectively.

Important: The Automatic Stop loss order is always placed on the system when the indicated price is reached. However, sometimes, due to events dependent on the market (for example, excessive or limited volatility), the execution price may be slightly different to the one set.

The stop loss order is in fact an automatic market order intended to execute the order regardless of market conditions.

Example of intraday trading:

A long position is opened with a 1% margin of GBP/USD 100,000 at a price of 1.0789.

This means that you have purchased GBP (GBP +100,000) and sold US dollars (USD -107,890). Your margin is GBP 1,000 (1% of the value in the base currency).

The automatic Stop will be triggered when the exchange rate drops by 0.5% (1.07350 bid price).

When the price condition indicated by the automatic Stop is met, in order to close the GBP/USD 100,000, the system will send a selling order to the market (assuming that the order is executed at the price of 1.07350).

The outcome of the transaction will be a sale of GBP 100,000 (GBP -100,000) and a purchase of USD 107,350 (USD +107,350) with a result = GBP 0 (closed position of the base currency) and USD -540 (USD -107,890 + USD 107,350 = USD -540).

These USD 540 will be recorded as losses from your transaction, exactly 0.5% of the position when initially opened.

The loss will then be converted into GBP at the exchange rate ruling at 22:00 hours and then recorded in your current account.

Should the quote fail to reach the price level indicated by the automatic Stop loss, the position would remain open until 21:50 hours of the same opening day.

Throughout the day, you can increase the value of your intraday position, reverse the sign in the opposite direction, or close it by 21:50 hours by placing an order for an amount equal to the open position but with an opposite sign (choosing the same margin selected for the opening position).

At the end of day (21:50 hours), if, for any reason, the position is still open, Fineco will close it automatically by 22:00 hours.

If orders are still open on the intraday position at 21:50 hours, they will be automatically removed by Fineco.

Overnight positions

The interest to be applied to each FX CFD position open for more than a Working Day (Multiday), to be composed of a fixed and a floating part described as follows:

> Fixed interest: charge of 2.95% of the position value in Euro, using the CFD Fixed Currency as reference

> Floating Interest: calculated by applying the Interest Rate spread on each working day, as detected between 22:00:00 and 22:30:00 hours, as the average between Bid and Offer prices of the CFD

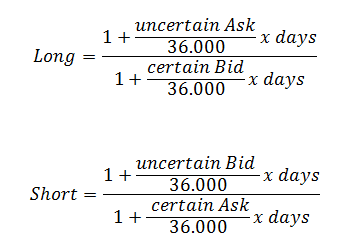

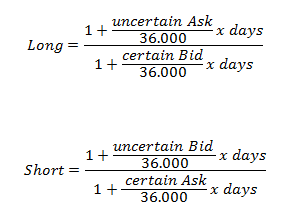

Long positions are calculated as the difference between:

- Mathematical average of CFD price

- Mathematical average of CFD price multiplied by the above factor.

Multiplied by the quantitative factor of the position and translated into Euro, employing the current Euro/Quote currency exchange rate. The resulting amount, if negative, will be billed to the customer. If positive, it will be credited to the customer’s account.

Short positions are calculated as the difference between:

- Mathematical average of CFD price multiplied by the above-mentioned factor

- Mathematical average of CFD price

Multiplied by the quantitative factor of the position and translated into Euro, employing the current Euro/Quote currency exchange rate. The resulting amount, if negative, will be billed to the customer. If positive, it will be credited to the customer’s account.

Daily, should the position result, at the end of the day, reduced or zeroed if compared to the initial one, interest is calculated and recorded.

Multi-day positions that stay unchanged for at least 90 days have interest calculated according to the available balance. Said interest, with the corresponding charging of the current account, will be recognised when the position is closed, including partially.

Example:

If on Day t I open a long position on CFD GBPUSD for 10,000 lots with a 2% margin (and 1% Stop loss), the amount of the margin will equal GBP 200 (10,000 *2%).

Given the Bid/Offer prices of the CFD, equal to 1.3044-1.3047, the Average Book Value will be the offer price of 1.3047 and the Stop loss will be 1.2916.

If the End-of-day Bid-Offer prices equal 1.3010-1.3013, the arithmetic average of the price of the CFD will be (1.3010 + 1.3013)/2 = 1.30115.

Fixed Borrowing Interest calculation:

2.95%*10,000/360*1 = Euro 0.82

Floating Interest calculation:

Bid Price–Offer Price certain currency’s rate of interest: 2.58-2.60

Bid Price–Offer Price quote currency’s rate of interest: 5.04-5.06

Differential interest rate: 1.0000688

Arithmetical average of the CFD price multiplied by the above-given rate differential (1.30115*1.0000688)= 1.301238

As the position is Long, the difference is calculated between:

- The arithmetical average of the CFD price

- The arithmetical average of the CFD price multiplied by the rate differential: (1.30115 - 1.301238) = - 0.000088

This difference is then multiplied by the position quantity (10,000 units): 10,000*( - 0.000088) = - 0.88

This amount is translated into GBP at the ruling GBP/USD rate (say, 1.3018), so that (- 0.88/1.3018) = GBP - 0.68 Consequently, the total interest charged will be (0.82 + 0.68) = GBP 1.5

Interest will be calculated daily, but debited on the current account only when the position is partially or entirely closed.

Note: every 90 days, on the positions which are still open, interest will be allocated on the available trading balance and recorded among the reserved items.

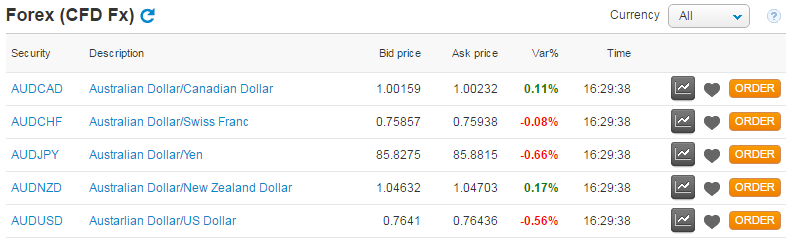

Trading on the Fineco website

You can trade on CFD Fx directly from the Fineco website. To access the list of tradable currency crosses on the Fineco website, just click on the "Forex (CFD Fx)" link on the sidebar of the page "Trading" - “Forex and CFD FX”.

For each CFD Fx you will see: Security (symbol), description, bid price, offer price, Var%, time of last variation.

From the row of each cross, you can open the chart  , the specific Powerbook

, the specific Powerbook  or include a CFD Fx to your personal list

or include a CFD Fx to your personal list  .

.

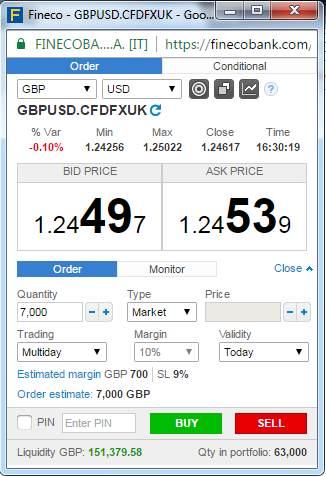

Buying or selling

Powerbook is a specific tool for trading currencies. You can edit the cross on which you are trading at any time from the two drop down menus.

By clicking on the "push" button  prices will be displayed in real time.

prices will be displayed in real time.

Important: in order to purchase, you must apply the offer price, to sell you must apply the bid price.

For each order you must indicate:

- Quantity: the list of predefined amounts relating to the base currency.

- Type: the type of order placed. This can be a "limit", "market" or "stop" order.

- Price: for "market" orders, the offer price (if purchasing), or the bid price (if selling) is automatically applied. For "limit" orders, you can fill in the price field by directly clicking on the offer and bid values.

- Trading: you can choose between intraday and overnight.

- Margin: when you choose intraday trading, the available margin levels are: 1% and 1.5%. If you choose to trade overnight, the margin can be selected from a default list of between 2% and 30%.

- Validity: today, your order is valid until 22:00 hours for overnight transactions (until 21:50 hours for intraday transactions); Good till cancelled, the order is valid until cancelled.

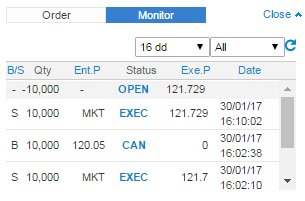

Orders Monitor

You can view a summary of the status of the orders placed on a cross directly from the Powerbook monitor.

The first row indicates the overall balance on the cross:

- QTY: the total value of the position

- STATUS: the status of the position; OPEN (open position); CLOSED (closed position)

- AVG P.: the average book value of the position

The following values are displayed for each row:

- B/S: the sign of the order. Buy (B); Sell (S)

- QTY: the amount of the single order

- ENTERED PRICE: the price at which the order is sent to the market

- STATUS: EN (placed); CAN (cancelled); EXEC (executed)

- EXE P.: the order execution price

- DATE: the time of execution of the order

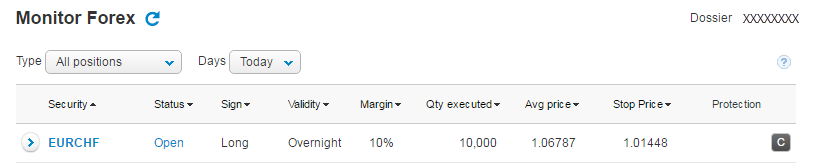

All your positions and orders will be displayed in the Orders Monitor on the Portfolio page by clicking on the "Forex" link.

On the single cross, the first row indicates the overall balance:

- STATUS: the status of the position; OPEN (open position); CLOSED (closed position)

- TITLE: the cross of the position

- VALIDITY: the validity of the position (overnight/intraday)

- Qty executed: the total value of the position

- Avg Price: the average book value of the position

- Stop Price: the automatic stop loss threshold of the overall position

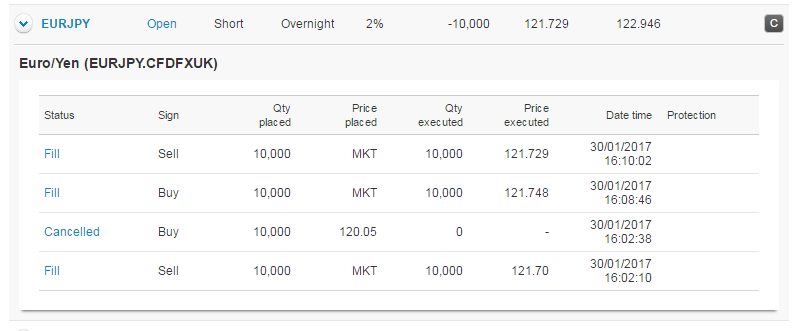

The following values are displayed for each order:

- STATUS: order status; Order entered; Order cancelled; Order processed

- SIGN: Order sign; Buy (buy order on the cross); Sell (sell order on the cross)

- QTY PLACED: the amount of the order (in absolute value) referred to the base currency

- PRICE PLACED: the price entered on the market

- QTY EXECUTED: the executed amount

- PRICE EXECUTED: the price at which the individual order was executed

- DATE AND TIME: the date and time of the order’s execution.

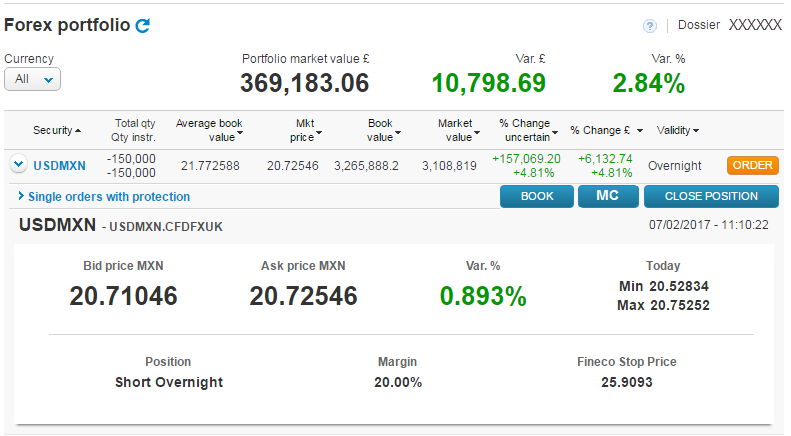

Forex portfolio

You can monitor all CFD Fx positions still open from the Fineco website: Portfolio section - My investments - Forex.

To close the individual positions from the Fineco website, just place an order for the same amount and with the same margin, but with an opposite sign, by clicking on

For example: in order to close a long position of GBP/USD 10,000 you must place a sell order of GBP/USD 10,000.

Moreover, in the Forex - Portfolio you can close the position by clicking the  button located below the summary of the open position.

button located below the summary of the open position.

Trade & Reverse: similarly, you can decide to reverse the sign of your position with a new order with a value greater than the position in place.

To operate in an open position, click on  to open the Powerbook related to the individual cross.

to open the Powerbook related to the individual cross.

The single columns in the Forex Portfolio show:

- Security: the cross on which there is an open position

- Total qty Qty ins: the total amount of the position (base currency). If the quantity is positive this indicates a Long position, if negative, a Short position.

- Average book value: the average book value of the position

- Mkt price: Bid/Offer price - (selling/purchasing)

- Book value: the value of the position in quote currency, calculated based on the average book value

- Market value: the position’s value in quote currency, calculated according to the market price

- % Change uncertain: the theoretical profit and loss on the basis of the current market price. It therefore shows the Profit & Loss in quote currency and as a percentage deviation from the opening position.

- % Change £: the theoretical profit and loss of the current day only

- Validity: intraday or overnight trading.

- Click on  to open the PowerBook and place other orders on the same cross;

to open the PowerBook and place other orders on the same cross;

- Click on  to place a closing position order;

to place a closing position order;

- You can use the  button on each overnight position to increase/decrease the provisional margin, including on days following the opening of the position.

button on each overnight position to increase/decrease the provisional margin, including on days following the opening of the position.

Trading on PowerDesk

CFD Fx List

Enter the static list of the 54 most liquid crosses from the "Forex" item in the drop-down menu at the top left.

The following data are displayed for each cross:

- SYM: the symbol which identifies each exchange rate

- DESCR: the extended description of each exchange rate (for example euro/dollar)

- BID P.: the bid price. By applying this price you sell the cross (you are selling the base currency and purchasing the quote currency).

- ASK P.: the offer price. By applying this price you purchase the cross (you are purchasing the base currency and selling the quote currency).

- MIN: the lowest bid price quoted by the Bank from 23:00 hours on the previous day

- MAX: the highest offer price quoted by the Bank from 23.00 hours on the previous day

- VAR %: the percentage change in the current bid price over the closing price of the previous day

- TIME: the time of the last change.

You can delete the non-valued columns directly from the preferences panel of the platform. You can also change their layout by selecting the heading and dragging it with the mouse.

In addition to the currency crosses found in the static list, you can trade on all other available crosses by selecting the base currency from the drop down menu located at the top centre of the heading.

You can trade directly from the "Forex basket" or by entering the crosses into one of your customised Watchlists; in this case, you must indicate the symbol of the cross in the "SYM" box and add it to the list. You can also search for the currency you are interested in and negotiate it directly from the platform’s general search.

Buying or selling

Three ways are available for CFD Fx: expanded row, Powerboard and the new MultiBook

- Expanded row

By expanding the row of a single cross both the bid and offer prices are displayed: the two most significant decimals (also called pips) are highlighted with a larger font.

The book can be displayed on the right or left of the order entry, as can the orders monitor and the Last and Bid/Offer chart.

- Powerboard

The structure of Powerboard has been redesigned to specifically trade on the Forex market. At the top you can see the bid and offer prices, under the order entry form.

You can change crosses directly from the two drop-down menus at the top or simply with the drag & drop option. To trade, just select a price and send the order to the Bank.

- PowerDesk: New MultiBook

MultiBook is the interface for Trading Spot FX transactions: you can view the quotes of all crosses on the Forex Watchlist.

To open the pop-up window, just click on the "MultiBook" button of the Forex Watchlist. You can customise the "MultiBook" by deleting all crosses with the "delete all" button and adding others from the drop down menu. The layout of the individual crosses can be modified and re-aligned.

To place an order click twice on the price and the order entry screen will open; with one click you can place your orders.

- Order entry

The same order entry screen is present in the expanded row, Powerboard and Multibook.

For each order, you must indicate:

- AMOUNT: the list of predefined amounts relating to the base currency.

- TYPE: the type of order placed. It can be "LIMIT" or "MARKET".

- PRICE: to purchase you must apply the offer price; to sell you must apply the bid price.

- VALIDITY: Day, your order is valid until 22:50 hours; GTC, "good till cancelled". For Intraday positions you can only enter orders with Day validity.

- TRANS: IN to open an intraday position, OV for an overnight position.

- MARGIN: when you choose an intraday position, the margin levels range between 1% and 1.5%.

Should you choose to trade overnight the margin can be selected from a predefined list of between 2% and 30%.

Orders monitor

Click on the "FOREX" link on the PowerDesk2 monitor to display all the orders that have been placed in the various currencies.

Summary row - all orders related to a cross are grouped into a single position. The first row summaries the overall balance of the position and indicates:

- SYM: the exchange rate symbol of the position.

- ST: status of the position; OPEN (open position); CLOSED (closed position).

- L/S: position sign; Ov (Overnight cross position); In (Intraday cross position); “-“ (closed position).

- EXE.Q: the total quantity of the position.

- EXE.P: the average book value of the position.

- STOP: the automatic stop loss set on the position.

- DATE: the date of first opening of the position.

The columns relating to individual orders indicate:

- SYM: the time the order is executed.

- ST: order status; EN (entered); CA (cancelled); EX (executed);

- L/S: sign of the order; L (LONG purchase order); S (SHORT purchase order).

- ENT.Q: the amount of the order (in absolute value) referred to the base currency.

- ENT.P: the price entered on the market - EXE.Q: the executed amount

- EXE.P: the price at which the individual order was executed

- STOP: the price of any stop order set by the customer

- DATE: the order execution date

- Section including the buttons to cancel/repeat orders and those indicating any Stop loss/Take profit or Trailing stop set by on the order

Orders portfolio

The portfolio area related to Forex shows all open positions on the currency market. The individual columns indicate:

- SYM: the cross symbol related to the open position.

- EXP: In (Intraday position) Mo (Overnight position).

- SIGN: Long indicates a bullish position on the cross, Short indicates a bearish position.

- AMOUNT: total amount of the position

- P&L: the theoretical profit or loss arising from your transactions. It is always expressed in quote currency (the denominator).

- P&L GBP: the real-time conversion of the provisional P&L (cross quote currency) in GBP. The definitive P&L in GBP will be determined based on the closing rate.

- CLOSE: this button automatically closes your position by sending an order to the market

- AVERAGE PR: the average book value of the position

- MKT PRICE: the price of the cross updated in real time (bid price quote for long positions and offer price quote for short positions)

- BOOK VAL.: the book value in quote currency

- MKT. VAL.: the market value in quote currency at market price

- VAR: P&L as a percentage, calculated as the difference between the market value and the book value

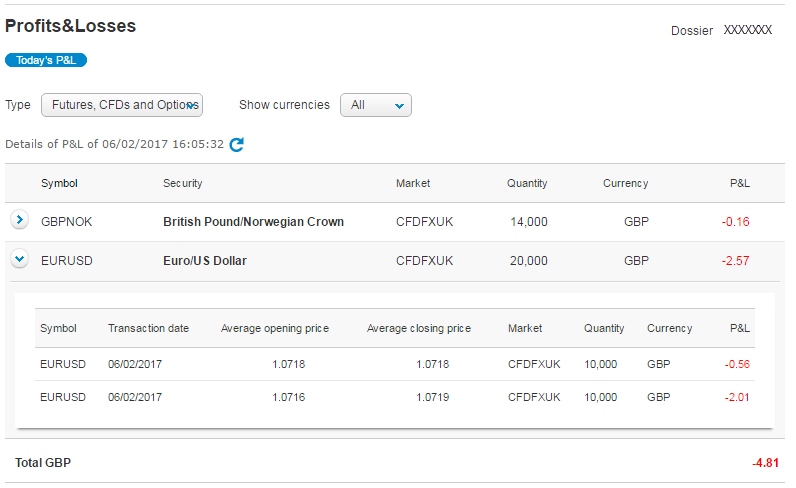

Profit & Loss realised/incurred

With PowerDesk2, you can view all the profits and losses realised/incurred with CFD Fx transactions.

By clicking on the "FOREX" link in the specific panel you can access only the transactions made with the CFD FX service.

The first row sums up the gains and losses concerning all the positions closed during the day on a single cross. By expanding the row, you can see the individual closed positions and the related P&L.

For each position closed the following is displayed:

- SECURITY: the cross on which the position was closed

- POSITION: the sign of the position (Long/Short)

- TIME: the closing time of the position

- P&L TOT: the profit and loss for each position (updated in Euro)

- P&L PERC: the profit and loss as a percentage

- QTY: the total value of the position

- PM LOAD: the book value of the position (opening value)

- PM CLOSE: the closing price of the position' (closing value)

- BOOK VAL.: the position’s opening value

- CL.VAL.: the position’s closing value

- CURRENCY: the closing currency

Forex CFD trading regulations

You can display the trading regulations from the customer homepage, by clicking on Account management > Service Management > Trading & Investments > Derivative trading: Futures, Options, CFDs (Classic, Logos, Logos Time, FX).

Hours and conditions

Hours

Forex is an international OTC market open 24 hours a day, six days a week. Therefore, with the exception of Saturdays and Sundays (until 22:15), trading on CFD Fx transactions never stops. There are a few other days when trading is interrupted such as, for example, New Year's Day or Christmas Day. These days will be communicated in advance on the website.

FinecoBank allows you to place multidays orders online from 22:15 on Sundays to 22:00 on Fridays (with the exception of the interval from 22:00 to 22:15).

Intraday orders can be placed every working day from 5:15 to 21:50.

Closing orders (partial or total) can be placed also via Customer Care from Mondays to Fridays from 07:00 to 22:00.

Your conditional orders, FinecoBank automatic stop loss orders and possible valid until cancellation orders will remain active 24 hours (with the exception of the interval from 22:00 to 20:15).

Important: intraday activity, from Monday to Friday, will terminate at 21:50. If after 21:50 there will still be any opened intraday position or any non-executed orders, Fineco will automatically close the

The CFD Fx service does not charge any trading fee for each individual transaction.

FinecoBank applies minimum spreads (the term "spread" refers to the difference between the bid price and the offer price) of each individual currency cross.

Spreads are values that vary in relation to each reference exchange rate and can change only in exceptional market conditions.

Margins and automatic Stop Loss

The CFD Fx service allows margin trading, committing an amount equal to a certain percentage of the value of the currency covered by the transaction. Margin trading is available for both intraday and overnight positions: indeed, the term of the transaction can be limited to one trading day or can cover several days. This enables you to choose the margin from a default list set by FinecoBank regardless of the total amount and the cross on which you are trading.

The margin for intraday transactions may be: 1% or 1.5% (for CHF crosses, the intraday margin can be 8% or 9%); The margin for overnight transactions ranges between 2% and 100%.

Upon sending the order, the system values in GBP the margin required for each transaction and checks that this amount is less than or equal to the balance available for trading. If this amount is greater than the balance available then the order is not submitted.

Otherwise, the system sends the order and debits the margin to your current account.

The margin is valued in GBP based on the exchange rate at the time between the GBP and the base currency on which a position is to be taken.

For example, if you have placed a purchase order on a EUR/CHF cross at a price of 2.2732 (bid) - 2.2739 (offer) for Euro 30,000, with a 2% margin, the margin withheld will be equal to 2% of the amount in the base currency (in this case 2% of Euro 30,000 = Euro 600).

The margin is therefore converted into GBP at the EUR/GBP offer price at the time (Euros are sold to buy GBP, for which it is necessary to apply the offer price). If the price of the cross is 0.6822 (bid) - 0.6825 (offer), the Euro 600 of your margin will be equal to GBP 879 (Euro 600 / 0.6825). In order to complete the order, GBP 879 will be debited to your current account.

The margin is returned only once the position is closed by crediting the initial balance to your account.

Position closing

In order to close your positions, you just need to place an order for an amount equal to that of the open position but with an opposite sign (in order to close the position, you must choose the same margin as that selected for the open position). If, for example, you have a long position of EUR/USD 50,000 with a 2% margin, in order to close it, you must place a sell order for EUR/USD 50,000 with a 2% margin.

Similarly, you can increase the value of your position on a cross or reverse the position.

For example, if you have a position of EUR/USD 50,000, you can:

- Increase the value of the long position: if you place another purchase order for EUR/USD 50,000, your total position will be EUR/USD 100,000

- Reverse your position: if you place a selling order for EUR/USD 100,000, your total position will become a short position of EUR/USD 50,000.

Intraday positions must be closed by 21:50 hours. If the position is still open at the end of the day for any reason, Fineco will automatically close it by 22:00 hours.

Important:

- You cannot place several orders with different margin levels on the same cross.

If, for example, there is an open position on the EUR/USD cross with a 30% margin, you will not be able to place orders with a different margin on the same cross until the initial position on the selected cross is closed.

As a result, each close-out transaction on a cross must be performed with the same margin selected to open the position. - Moreover, you can open an intraday and an overnight position at the same time on the same cross.

Leverage effect

Margin trading enables you to take advantage of the so-called "leverage effect", multiplying the returns (positive and negative) of each purchase/sale currency transaction. This is the ratio between the result obtained (the difference between the opening and closing values of the position) and the margin.

For example, if the result of a transaction is a gain of GBP 5,000 (the difference between the bid value of GBP 50,000 and an offer value of GBP 55,000) and the initial margin is 2% (GBP 1,000), the positive return obtained from the transaction is equal to 500%. Likewise, if the result of a transaction is a loss of GBP 5,000 (the difference between the bid value of GBP 50,000 and an offer value of GBP 45,000) and the initial margin is 2% (GBP 1,000), the negative return obtained from the transaction is equal to 500%.

The result obtained (positive or negative in the two cases) by committing the entire value of the transaction would have been 10%. With a margin of 2%, the return on the margin-traded transaction is 50 times greater than that achieved by investing the entire capital: the leverage effect, therefore, amounts to 5.000%.

Automatic stop losses

For each open position, FinecoBank sets an automatic closing value at which the transaction is closed should the market trend go against the position adopted.

For overnight positions, the automatic Stop Loss is always positioned at one percentage point below the margin level. The automatic stop loss is calculated with reference to the position opening price (without taking into account the automatic reopening process of the overnight transactions). The automatic Stop Loss value for intraday positions is half a percentage point less than the margin level.

When there are several transactions open on the same cross (same margin level), the stop price is determined in respect of the average book value of the positions opened by the customer (also in this case, without taking into account the automatic reopening process of the overnight transactions). Due to sudden market changes, any order placed close to the automatic stop loss may not lead to an immediate recalculation of the new stop level.

For example, if you choose an intraday margin of 1% and you have a long position, the automatic stop loss will be triggered when the exchange rate value drops by 0.5% Conversely, if you choose a margin of 30%, the automatic stop loss is set at 29%.

The table below shows the margin levels available and their stop loss value.

|

Margin |

FinecoBank Stop loss |

|

1% |

0,5% |

|

1,5% |

1% |

|

2% |

1% |

|

5% |

4% |

|

10% |

9% |

|

20% |

19% |

|

30% |

29% |

Note: if Fineco’s automatic stop loss is triggered, the system does not perform any check on the available balance. If Fineco’s automatic stop loss produces the reopening of a new position, this could lead to the current account being overdrawn.

FinecoBank enables you to customise the margin level withheld and, consequently, the value of the automatic stop loss.

However, the automatic stop losses are not the only way to keep your positions and any possible losses under control: FinecoBank enables you to enter stop orders to close the positions at the value that you deem most appropriate depending on your trading strategy.

Example:

Fineco’s automatic stop loss is set on opening your position at a value defined based on the margin level selected. For example: a long position is opened with a 2% margin of EUR/USD 100,000 at a price of 1,2800. This means that you have purchased Euros (GBP +100,000) and sold Dollars (USD -128,000). Your margin is Euro 2,000 (2% of the value in the base currency).

The stop will be triggered when the exchange rate value drops by 1% (1.2672 bid price).

In order to close the position of EUR/USD 100,000, the system will sell at the bid price (1.2672).

The outcome of the transaction will be a sale of Euro 100,000 (Euro -100,000) and a purchase of USD 126,720 (USD +126,720) with a result = Euro 0 (position closed of the base currency) and USD -1,280 (USD -128,000 + USD 126,720 = USD -1,280 dollars). These USD 1,280 will be recorded as losses from your transaction, exactly 1% of the position when initially opened.

The loss will then be converted into GBP only at the exchange rate ruling at 22:00 hours and then recorded in your current account.

Important: the stop loss order is always placed on the system when the condition is met (stop level), but, sometimes, due to events dependent on the market (for example, excessive or limited volatility), the execution price may be lower. The stop loss order is in fact an automatic order intended to execute the order regardless of market conditions. Any orders in overnight trading mode that are executed:

- from 22:15 to 22:30 hours and from 03:00 to 05:15 hours from Monday to Thursday

- from 22:00 hours on Sunday to 05:15 hours on the following Monday

will be protected by Fineco’s automatic stop loss only as of the end of the time intervals indicated.

Trading note: if the position held on the cross comprises various intraday orders, any partial covering on the same day can modify the book value and, consequently, Fineco’s automatic stop loss

Modify margin:

The margin accrued on each overnight position may be increased or decreased on the same day the position was opened and in the next few days following the opening of the position.

The margin can be changed using the  button on the website’s Portfolio page, in the expanded row of the individual security and on Powerdesk, in the orders monitor next to the position string.

button on the website’s Portfolio page, in the expanded row of the individual security and on Powerdesk, in the orders monitor next to the position string.

Notes:

> If the position includes orders still “placed” (which have not been executed and/or cancelled), changing the margin is not permitted. It will be necessary to remove them to then be able to perform the change.

> On the final expiry day of the overnight positions, changing the margin is not permitted.

> For the margin of the position to be changed by adding liquidity (thus departing from Fineco’s automatic Stop loss), the liquidity needed for the new margin must be available.

Stop Loss and Take Profit

Automatic orders are available, with no extra cost, also for CFD Fx transactions and enable you to protect your positions also when you are not at the PC, or cannot connect to the website or the PowerDesk platform.

Indeed, a Fineco automatic stop loss is set on the position which closes the entire position when a certain price is reached. This Stop Loss cannot be changed by the customer but a Stop Loss with a "tighter" price level and a Take Profit may be entered. Automatic orders on the individual orders of the position may also be entered (stop loss, take profit, trailing stop).

As no last is available on the foreign exchange market, but always a bid/offer quote, it should be considered that any stop loss, trailing stop and take profit set, which resides on Fineco's servers, will be triggered and sent to the market when the bid/offer condition occurs, depending on whether the position is short or long.

Specifically, any stop loss, take profit and trailing stop on long positions will be checked against the currency’s bid quote. Conversely, any stop loss, take profit and trailing stop on short positions will be verified against the currency’s offer quote.

For example, I hold a long position in my portfolio on which I have set a stop loss. The latter will be sent to the market by Fineco when the set value is quoted on the basis of the currency’s bid value. While on a short order on which I have set a trailing stop, this will be sent to the market when its value is quoted on the basis of its offer value.

Important: trailing stops cannot be entered on the position.

Order entry hours

- Intraday trading: It is possible to place, change and cancel automatic orders (stop loss, take profit and trailing stop) from 05:15 AM until 9:50 PM. If for any reason, after 9:50 PM there are intraday positions still open, Fineco will automatically close them by 10:00 PM. Furthermore, at 9:50 PM all orders still placed on intraday positions will be cancelled.

- Overnight trading: It is possible to place, change and cancel automatic orders (stop loss, take profit and trailing stop) 24/24 - 7/7 with the exception of the interval that goes from 3:00 AM to 5:15 AM on Saturday and Sunday.

Stop Loss and Take Profit on single orders

I place an order to purchase GBP/USD 10,000 (intraday operation) at the price of 1.27955, I then enter a stop loss at the price of 1.27885 and take profit at 1.28555.

The order is executed, and my position consists of an order for GBP/USD 10,000. During the morning, I purchase GBP/USD 10,000 at the price of 1.28155 and I enter a trailing stop equal to 500 ticks (10 ticks = 1 pip) and purchase a further GBP/USD 20,000 at the price of 1.28055 and I place a stop loss equal to 1.27450 and take profit equal to 1.28975 on this order. The order is executed and my long position (consisting of three orders) is now GBP/USD 40,000. Each order has conditions that reside on Fineco’s servers. Once each condition occurs, a "market" order will be sent. If the GBP/USD instrument reaches the quote of 1.28555/1.28585 (take profit of the first order), Fineco will send a market order for GBP/USD 10,000, which is the amount of the first order. The overall position will, therefore, decrease to GBP/USD 30,000

At this point, the instrument abruptly reverses its trend, rising to 1.28055/1.28085. This quote triggers the trailing stop placed on the second order, calculated as the highest level reached by the bid value - 500 ticks (50 pips) 1.28555 - 50 pips = 1.28055: Fineco will send a market order for GBP/USD 10,000. The position will be reduced to GBP/USD 20,000. The instrument continues its decrease to the 1.27450/1.27480 quote (stop loss of the third order) and Fineco will send an order to the market for GBP/USD 20,000, closing the position.

Stop loss and Take Profit on the position

Note: no trailing stop can be entered on the position.

Using the example above, let’s assume you have a position consisting of three orders on the GBP/USD instrument as previously described. The overall position is 40,000 and the instrument is quoted at 1.28225/1.28255.

I decide to place a stop loss and a take profit on the position equal to 1.28055 and 1.28455, respectively. As soon as the instrument’s bid value reaches 1.28455, a market order of 40,000 is sent which closes the entire position and cancels all the settings previously placed on individual orders.

Important notes:

- The combined use of Stop Loss and / or Take profit on the order and the position may not result in the immediate closing of the position, thereby causing a rollover.

- Closing the Forex position results in the cancellation of any stop loss, take profit and trailing stop placed on the single orders and/or position.

- The orders placed (including conditional orders) not yet executed always keep the position open.

Let’s assume a GBP/USD 20,000 long position at a price of 1.27565, a Stop loss on the order at 1.27255 and a Take profit on the position at 1.28765. I decide to extend my position, entering a new purchase order for GBP/USD 10,000 with a limit price equal to 1.27870 and a trailing stop of 70 pips; the order is placed but not executed yet.

I place a selling order of GBP/USD 20,000 with a market price, the order is executed, but the position is still open due to the purchase order for GBP/USD 10,000 still placed but not executed.

As a consequence, the Take profit at 1.28765 set on the position will be cancelled but the Stop loss (1.27255) and Trailing stop (70 pips) orders set on the single orders will remain active.

To close the position I will have to cancel the order still in place. - Trade & Reverse cancels any Stop loss and Take profit placed on the position, but does not modify the settings placed on the single orders which remain active.

Trading limits

With respect to trading on CFD Fx positions, FinecoBank applies two types of limits:

- per order

- per position on individual cross

The limits "per order" and "per position on individual cross" change for each cross.

For each cross there is a limit "per order" with a value equal to the limit "per position".

For crosses on which intraday trading is possible, the different ceilings are stated.

For example, for the EURUSD CFD, the intraday ceiling is 5,000000, for overnight it is 10,000,000, while for the USDJPY CFD, the overnight ceiling is 5,000,000. This ceiling coincides with the ceiling per order and position.

Note: FinecoBank reserves the right to change these limits due to changing market conditions.

The following table shows the limits for all crosses available for overnight trading.

|

Cross |

Ceiling per individual overnight order |

Ceiling per overnight position on individual cross |

|

AUDCAD |

2.000.000 |

2.000.000 |

|

AUDCHF |

2.000.000 |

2.000.000 |

|

AUDJPY |

2.000.000 |

2.000.000 |

|

AUDNZD |

2.000.000 |

2.000.000 |

|

AUDUSD |

2.000.000 |

2.000.000 |

|

CADCHF |

2.000.000 |

2.000.000 |

|

CADJPY |

2.000.000 |

2.000.000 |

|

CHFDKK |

2.000.000 |

2.000.000 |

|

CHFJPY |

2.000.000 |

2.000.000 |

|

CHFNOK |

1.000.000 |

1.000.000 |

|

CHFSEK |

2.000.000 |

2.000.000 |

|

DKKJPY |

2.000.000 |

2.000.000 |

|

EURAUD |

2.000.000 |

2.000.000 |

|

EURCAD |

2.000.000 |

2.000.000 |

|

EURCHF |

4.000.000 |

4.000.000 |

|

EURCZK |

1.000.000 |

1.000.000 |

|

EURDKK |

5.000.000 |

5.000.000 |

|

EURGBP |

3.000.000 |

3.000.000 |

|

EURHKD |

1.000.000 |

1.000.000 |

|

EURHUF |

400.000 |

400.000 |

|

EURJPY |

9.900.000 |

9.900.000 |

|

EURMXN |

1.000.000 |

1.000.000 |

|

EURNOK |

1.000.000 |

1.000.000 |

|

EURNZD |

2.000.000 |

2.000.000 |

|

EURPLN |

400.000 |

400.000 |

|

EURSEK |

1.000.000 |

1.000.000 |

|

EURSGD |

400.000 |

400.000 |

|

EURUSD |

9.900.000 |

9.900.000 |

|

EURTRY |

1.000.000 |

1.000.000 |

|

EURZAR |

500.000 |

500.000 |

|

GBPAUD |

1.000.000 |

1.000.000 |

|

GBPCAD |

1.500.000 |

1.500.000 |

|

GBPCHF |

1.000.000 |

1.000.000 |

|

GBPJPY |

2.000.000 |

2.000.000 |

|

GBPNOK |

1.000.000 |

1.000.000 |

|

GBPNZD |

2.000.000 |

2.000.000 |

|

GBPSEK |

1.000.000 |

1.000.000 |

|

GBPUSD |

3.000.000 |

3.000.000 |

|

NOKJPY |

2.000.000 |

2.000.000 |

|

NOKSEK |

2.000.000 |

2.000.000 |

|

NZDCHF |

2.000.000 |

2.000.000 |

|

NZDJPY |

2.000.000 |

2.000.000 |

|

NZDUSD |

2.000.000 |

2.000.000 |

|

USDCAD |

3.000.000 |

3.000.000 |

|

USDCHF |

4.000.000 |

4.000.000 |

|

USDCZK |

400.000 |

400.000 |

|

USDDKK |

2.000.000 |

2.000.000 |

|

USDHKD |

2.000.000 |

2.000.000 |

|

USDJPY |

5.000.000 |

5.000.000 |

|

USDMXN |

1.000.000 |

1.000.000 |

|

USDNOK |

2.000.000 |

2.000.000 |

|

USDSEK |

2.000.000 |

2.000.000 |

|

USDTRY |

1.000.000 |

1.000.000 |

|

USDZAR |

500.000 |

500.000 |

Furthermore, for CFD Fx transactions on which intraday trading is possible, the ceilings per order and per position on individual cross, are as follows:

|

Cross |

Max per singolo ordine intraday |

Max per posizione intraday su singolo cross |

|

EURCHF |

2.000.000 |

2.000.000 |

|

EURGBP |

1.500.000 |

1.500.000 |

|

EURJPY |

5.000.000 |

5.000.000 |

|

EURUSD |

5.000.000 |

5.000.000 |

|

GBPUSD |

1.500.000 |

1.500.000 |

|

USDJPY |

2.500.000 |

2.500.000 |

Taxation considerations

The interest applied to each FX CFD position open for more than a Working Day (Multiday), is composed of a fixed and a floating part, as follows:

- Fixed interest: charge of 2.95% of the position value in Euro, using the CFD Fixed Currency as reference

- Floating Interest: calculated by applying the Interest Rate spread on each working day, as detected between 22:00:00 and 22:30:00 hours, as the average between Bid and Offer prices of the CFD.

Long positions are calculated as the difference between:

- Mathematical average of CFD price

- Mathematical average of CFD price multiplied by the above factor.

Multiplied by the quantitative factor of the position and translated into Euro, employing the current Euro/Quote currency exchange rate. The resulting amount, if negative, will be billed to the customer. If positive, it will be credited to the customer’s account.

Short positions are calculated as the difference between:

- Mathematical average of CFD price multiplied by the above mentioned factor

- Mathematical average of CFD price

Multiplied by the quantitative factor of the position and translated into Euro, employing the current Euro/Quote currency exchange rate. The resulting amount, if negative, will be billed to the customer. If positive, it will be credited to the customer’s account.

Every date, at the end of the day, should the position be decreased or zeroed compared to the initial one, interest is calculated and recorded.

Multi-day positions that stay unchanged for at least 90 days have interest calculated according to the available balance. Said interest, with the corresponding charging of the current account, will be recognised when the position is closed, including partially.

Example 1 (Intraday trading)

Selected margin: 1%

Stop Loss Threshold: 0.5%

Quantity: 10,000 units Margin Amount = 10,000 * 1% = GBP 100 (invested capital)

Position’s sign: Long (the Customer is a Buyer)

CFD: GBPUSD

Base currency: GBP

Quote currency: USD

Bid-offer price of the CFD: 1.25803-1.25833 (spread = 3 pips)

Average book value 1.25833. Book value in GBP: GBP 10,000

Stop Loss: 1.25204. If the Bid price reaches this threshold limit (calculated on the Average Book Value less 0.50%), an automatic order will be activated without a price limit for terminating the Contract.

Bid closing price: 1.253 (it could be the price quoted by the Bank at the instant the customer decides to terminate the contract or if the contract is still open at the end of the day, the one listed at closing time – a random instant between 21:50 and 22:00 hours)

Differential: (1.253 minus 1.25833)*10,000 = USD 53.3 (loss in USD)

USD/GBP exchange rate at closing time: 1,254

Loss value in GBP: -53.3/1.254=-42.50 in GBP

Given the unfavourable price trend equal to 0.42%, the loss is about 42% of the margin (invested capital). Leverage is therefore equal to about 100%.

Example 2 (long overnight trading)

Day t

Selected margin 2%

Stop Loss threshold: 1%

Quantity: 10,000

Margin = 10,000 *2% = GBP 200

Sign: Long (the Customer is a Buyer)

CFD: GBPUSD

certain currency: GBP

quote currency: USD

Bid Price- Offer Price of CFD: 1.3044-1.3047

Average book value: 1.3047

Average book value in GBP: GBP 10,000

Stop Loss: 1.2916 if the Bid price reaches this threshold limit (calculated on the Average Book value less 1.0%), an automatic order will be triggered without a price limit for terminating the Contract.

End-of-day Bid-Offer prices: 1.3010-1.3013 Arithmetical average of the CFD price:

(1.3010 + 1.3013)/2 = 1.30115

Fixed Interest calculation:

2.95%*10,000/360*1 = GBP 0.82

Floating Interest calculation:

Bid Price–Offer Price certain currency’s rate of interest: 2.58-2.60

Bid Price–Offer Price quote currency’s rate of interest: 5.04-5.06

Interest rate differential: 1.0000688

Arithmetical average of the CFD price multiplied by the above given rate differential1.30115*1.0000688= 1.301238

As the position is Long, the difference is calculated between:

- The arithmetical average of the CFD price

- The arithmetical average of the CFD price multiplied by the rate differential:

(1.30115 - 1.301238) = - 0.000088

This difference is then multiplied by the position quantity (10,000 units):

10,000*( - 0.000088) = - 0.88

The amount obtained is then converted into Euros at the EUR/USD current exchange rate (say, 1.3018) resulting in a total amount of GBP (-0.88/1.3018) = GBP 068. 0.82 + 0.68 = GBP 1.5

Example 3 (Overnight trading with extension and partial closing)

Date T: opening an overnight position with the following features:

Selected margin: 2%

Stop Loss Threshold: 1%

Quantity: 10,000 units

Margin Amount = 10,000*2% = GBP 200

Position’s sign: Long (the Customer is a Buyer)

CFD: GBPUSD

Base currency: GBP

Quote currency: USD

Bid-offer price of the CFD: 1.3044-1.3047

Average Book value: 1.3047

Book value in Euro: GBP 10,000

Expiry date of the Position: T+365

Stop Loss: 1.2916 if the Bid price reaches this threshold limit (calculated on the Average Book value minus 1.0%), an automatic order will be activated without a price limit for terminating the Contract.

Date T + 1: Position increase in the following order:

Selected margin: 2%

Stop Loss Threshold: 1%

Quantity: 20,000 units

Average Book value: 1.31

The position will be modified and will have the following features:

Quantity: 30,000 units

Average Book value: 1.3082

New Stop Loss: 1.2951

Position expiry date: it remains T+365

Date T + 2: partial closure of 20,000 units

Partial closing price: 1.32

P&L in quote currency: USD 236

P&L in base currency: GBP 178.78

The interest relating to the 2-day open position will be calculated and charged.

Stop Loss of the residual position: 1.2951 (unchanged)

Date T + 365: Expiry date of position

As 365 days have passed since the opening of the first contract, the Bank is committed to closing the position (long overnight 10,000) at the current market price at the scheduled time for the daily closing time of the service. Concurrently, the Bank will credit the Margin Call, debit/credit the variation margin and charge the accrued interest.