Platforms and services

In this section you will find all the information about Fineco's platforms, which provide all the necessary instruments to manage your trading in the best possible way:

- FinecoX: FinecoX is the trading platform developed by Fineco that stands out for its customisation, advanced functionality, rapidity of information and operational completeness.

The data are strictly real-time push (if push is enabled for the market in question). Trading is available on all equities, ETFs, Certificates, Options, CFDs and Forex, Futures, Bonds and Covered Warrants. The structure of FinecoX is designed to allow you to visualise much more data at a glance. It is fully customisable and you can simultaneously view watchlists, charts, news, your portfolio and order monitor and always have your profits and losses under control, even on a daily basis. - PowerDesk Fineco’s proprietary platform for professional trading: simple, quick and user-friendly. A single, easy-to-use and customisable screen that allows you to trade on more than 20 markets in push mode, perform intraday and multiday trading, place automatic orders, use the vertical book, chart trading, basket orders and much more besides.

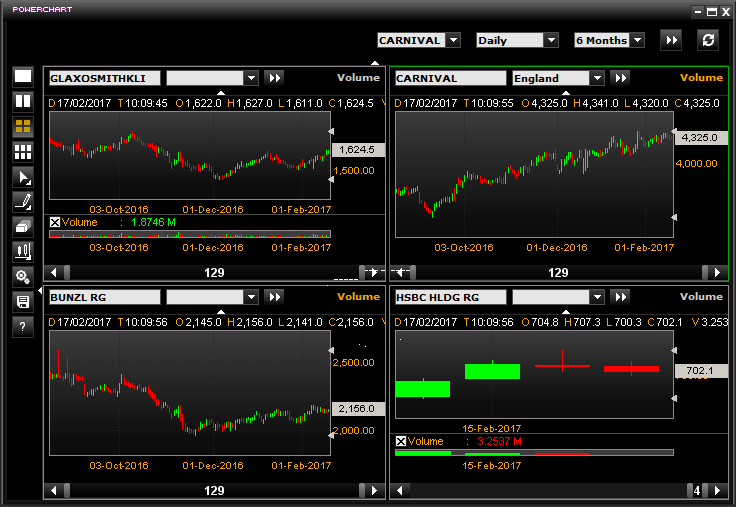

- PowerChart: This is one of the most advanced systems for studying markets and financial instruments using integrated technical analysis indicators, and for the usability of all the tools at its disposal.

- PowerCell, the DDE platform that allows you to use automatic update formulas and download data in real time, available from PowerDesk.

FinecoX

FinecoX is the platform that revolutionizes the way of trading: advanced, customizable and innovative.

FAQ

Are there any activation fees/costs?

The platform is free for all Fineco customers.

How to install FinecoX?

FinecoX is a web platform developed in Html5. It is accessed via a browser and does not require any download or installation. You can access directly from the private area of the Fineco website or from the dedicated FinecoX page by entering the access codes to the Fineco account.

Can I also use it from a tablet?

Of course, the platform is accessible from both PCs and tablets, it is important that the device meets the minimum requirements.

In fact, the platform can be used through the main operating systems.

Do I need to sign up for a new account or service?

No: the platform is available free of charge to all customers. It is also integrated into the account, which means that all orders placed on the FinecoX platform will then be visible in the portfolio section also on the Website and FinecoAPP.

Do I have to transfer liquidity in order to trade?

No, the platform is integrated into the account and you can use the liquidity available in the Fineco account.

Which products and markets can I invest in?

You can invest in all the financial markets and securities available with a Fineco account. Funds are excluded.

Can I use the platform with my ISA account?

No: FinecoX is available only with your standard account.

Technical requirements

Below are the suggested IT requirements for using the FinecoX platform to its full potential:

Chrome: 85.0

Opera: 70.0

Edge: 85.0

Firefox: 80.0

Safari: 14.0.2

At least 8 GB of RAM is recommended.

At least an Intel i5 / AMD Ryzen 5 processor (equivalent or higher) is recommended.

Stable, high-performance internet connection.

Minimum resolution FHD.

User manual

You can find out in detail all the features of the platform by accessing the manual available by clicking here

PowerDesk

Introduction

General presentation

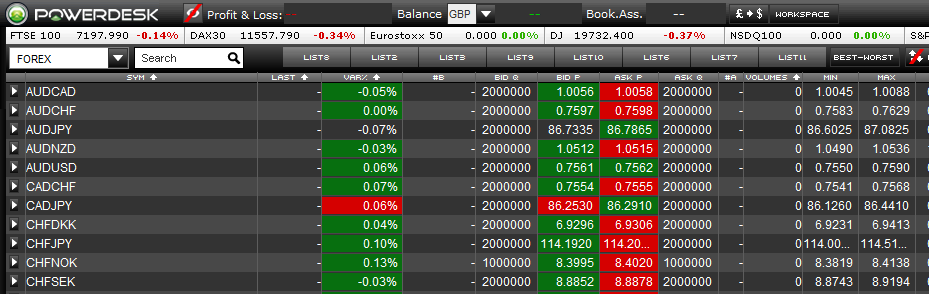

PowerDesk is the multi-market platform, using all push notifications, entirely developed by Fineco. It is characterised by advanced functionality, timely information and a full range of trading options.

Trading is available on equity securities, ETFs, Covered Warrants, Certificates, Currencies, Options, Futures, Bonds, CFDs on shares, indices, CFDs Logos Time and Forex.

With PowerDesk you can access the following stock exchanges: MTA, SeDeX, Nasdaq, Amex, Nyse, Euronext (France, The Netherlands, Portugal) Xetra, Ibex, LSE (Sets), Virt-x, Hex25, Idem, Eurex, CME, Forex, TLX, EuroTLX, Mot and EuroMot.

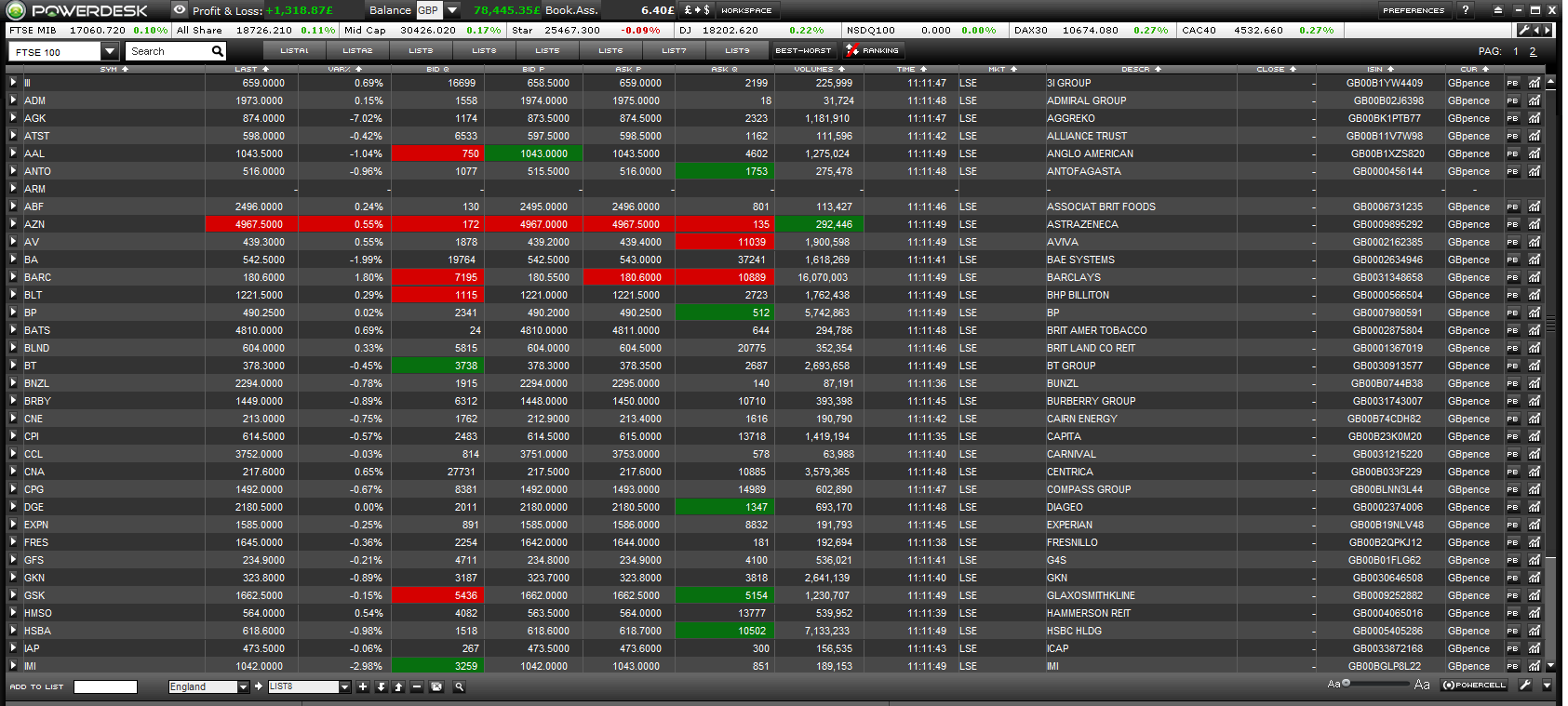

Main features

The horizontal format of PowerDesk has been designed as you can view all the data at the same time without having to carry out any configuration. Pre-set watchlists with the baskets of UK, European and American share indices and the lists of Futures traded on Idem, Eurex and CME, MOT and ETLX bonds, Forex, Options and CFDs; 8 fully customisable lists; news, order and portfolio screens are always in the foreground.

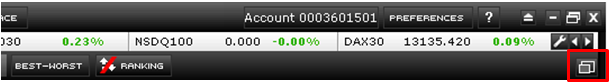

The top section of the platform includes:

- The Profit & Loss account, which shows the trading portfolio performance in real time.

- The dashboard with the reserved funds and the balance in a currency which can be selected from the drop-down menu.

- The button for currency exchange (€, $, £ and CHF).

- The button to activate Workspace (a customisable workspace)

- Platform management buttons: Preferences and Help.

- Buttons to set the PowerDesk dimensions.

- Market Bar, the fully customisable ticker, updated in real time.

![]()

The central section of the platform contains the lists of securities:

- At the end of each row, you can set up to two functions choosing from: an advanced technical analysis chart, the list of Covered Warrants with the pertinent underlying instrument, the Vertical Book and the PowerBoard.

- Symbol search.

- Buttons to manage the tools included in each Watchlist.

- Font size management tool.

- PowerCell, the command to copy the data in the Watchlist and export it to Excel spreadsheets, for example to use the DDE engine.

- Predefined lists from FTSE MIB, Mid Cap, Star, Dow Jones 30, Nasdaq 100, Germany, France, United Kingdom, Spain, Switzerland, The Netherlands, Portugal, Finland, TLX, Mot, Idem, Eurex, CME, CFDs on Indices, Forex and Options.

- Customisable lists.

- Best-Worst

- Ranking

The bottom section of the platform is divided into three areas and the height can be varied to give more space to the element you require.

By default, the panels include:

- News, Indices and Spread.

- Order Screen, Alerts and conditions, P&L and Baskets.

- Portfolio.

The size of each panel (portfolio, order screen, news) can be fully customised simply by selecting and dragging the side edge.

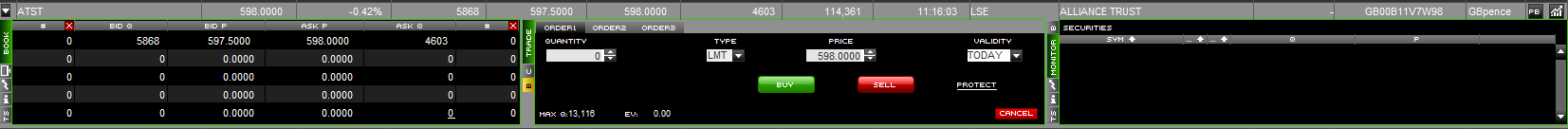

Security detail: each row of the Watchlist can be expanded to display the specific information about a financial product. Each expansion is divided into three areas where various information and tools can be found:

- On the left and right you can click and choose whether to see the five-level Book, the order screen for the single product, the tick by tick mini-chart, the news concerning the security and Time & Sales.

- The central part is used for trading and has two different screens for entering orders: Trade view and the window for conditional orders.

Activation and deactivation

To use PowerDesk, the service must be activated by clicking on "Subscribe/Unsubscribe" in the website area reserved for activations (Home Customer - Request new services). Activation is immediate: once you have completed the procedure, just log in again in order to use PowerDesk. Deactivation takes effect from the first day of the following month.

Technical data sheet

PowerDesk does not require software to be installed on your computer: however you do need Sun Java Virtual Machine. This means PowerDesk can be used anywhere and is not restricted to any specific PC: simply go to the Fineco website and click on the Powerdesk link or on Start to launch the platform.

You can also use the stand-alone platform by pressing the "download" button in the platforms and services section.

In both cases, a jnlp file will be downloaded which can be run manually if it does not open automatically.

Windows

To use PowerDesk, the minimum configuration required is: a Pentium IV processor, 1024 MB RAM, ADSL connection (minimum), 1280x1024 Monitor resolution, Windows 7, Internet Explorer 9 and Sun Java Virtual Machine version 8+.

Apple

PowerDesk is compatible with Macintosh, with an OS-X 10.7 or higher (Lion) operating system, recommended browser Safari, and Java Virtual Machine version 6+.

Installing Oracle Java Virtual Machine

To install the correct version of Virtual Machine on your computer, simply click on: http://www.java.com/en/download/download_the_latest.jsp

Technical notes

- Java components can be downloaded and installed by the system administrator for company networks.

- The RAM indicated is not the actual amount of memory used by the application, but is an indicative value to guarantee normal computer use. The value indicated is therefore the sum of the memory allocated by the operating system and the amount needed to use the trading platform and other programmes such as MS Excel or TradeStation.

- To be able to use PowerDesk with antivirus/firewall acting on the connection, you need to check the correct configuration of the finecobank.com domain with the antivirus manufacturer and enter it as trusted. In particular, PowerDesk connects to the powerdesk.finecobank.com machines through ports 80 and 443.

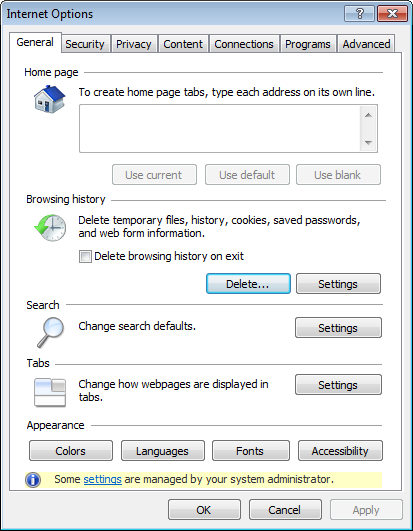

PowerDesk maintenance

For optimum use of PowerDesk, we recommend that you regularly (at least once a week) clean out the Temporary Internet and Cookie Files which may be found among the Internet options of your browser. For example, for Internet Explorer, just click on Internet Options in the Browser Tools menu.

Functionality

Management controls

The platform’s management controls are located in the top right corner.

- the help button

is connected to the Help Station: the User Manual may be viewed there

is connected to the Help Station: the User Manual may be viewed there - The PowerDesk Preferences button

- This function

transforms the PowerDesk platform into an independent ticker which contains the following information:

transforms the PowerDesk platform into an independent ticker which contains the following information:

- Profit & Loss.

- Dashboard showing reserved funds and the balance in the selected currency.

- Market Bar. - Windows Controls

to minimise PowerDesk, to resize it and to close it.

to minimise PowerDesk, to resize it and to close it.

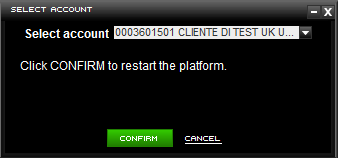

Account switch

If you have more than one current account, you could select the account on which to trade directly from Powerdesk by clicking on the “account” button in the top section of the platform.

By clicking on it, a pop up will be displayed as follow:

By clicking on CONFIRM the account data will recharge and the personal WL, the Portfolio, the order monitor and the P & L., too.

Note: Joint accounts are divided into several sub-portfolios: an individual portfolio for each account holder and a joint portfolio held in common. In order to load the right sub-portfolio it is necessary to previously set it as default in the Client Area, at the website section: Home / Account Management / Managing Services / Banking and Cards / Sub - Portfolios and click on Edit.

Preferences

The  link opens the personal settings window and these settings are also stored for subsequent accesses.

link opens the personal settings window and these settings are also stored for subsequent accesses.

The window has several sections:

- General settings

- Market Bar

- Order

- Watchlist

- Screen

- PowerBoard

Settings and any changes are managed by using these three buttons:

> Restore Setting > allows you to cancel all changes made and to restore the initial settings.

> Confirm > allows you to save the changes made.

> Cancel > is used in order not to implement any changes.

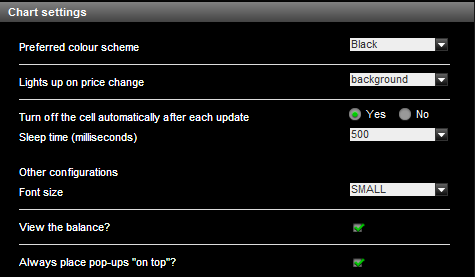

> General

The PowerDesk graphic settings can be selected in this section

- the colour scheme: black, ice, sky blue, light blue, dark blue and grey;

- the method of displaying every upward or downward price change by highlighting: the cell border, the background or only the text;

- the "shutdown" speed of the cells after each update. This function allows you to change the speed, measured in milliseconds, at which cells are shut down. The value can be selected from the drop-down menu: the lower the value selected, the faster the cell illumination is "shut down".

Other configurations

It is possible to select:

- the size of the font, choosing among small, medium or large;

- the balance display;

- the pop-ups display (graphics, portfolio, screens, etc.) always in the foreground.

You can also define the configuration of the bottom panels, choosing the best combination between: Indices, News, Spread and Portfolio.

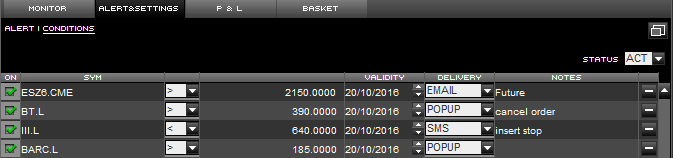

Alerts

Settings and defaults: when an alert is triggered on a security, you can choose whether to be notified by pop-up, email or text message. Note: Before you can use email or text alerts, it is important to ensure these contacts have been certified by Fineco.

Closing options: you can set a request for confirmation when the platform closes in this section.

> Market Bar

This section allows you to choose which contents should be included in the horizontal ticker located below the PowerDesk logo.

You can choose any financial instrument: shares, indices, futures or currencies. Powerchart, the technical analysis chart, opens by clicking on the symbol.

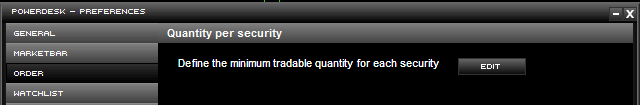

> Order

With PowerDesk you can decide the default quantity for the 25 securities you trade most frequently.

By clicking on the button, the relevant pop-up opens:

Enter the instrument symbol in the first box; otherwise, if the symbol is not recognised, you can use the Symbol Search by clicking on the magnifying glass icon. The button with the double arrow confirms the data, displaying the description of the instrument in the central part of the pop-up.

You can then enter the quantity that you require to appear by default in the order entry window, the intraday or overnight margin on derivatives that you wish to use and finally the minimum quantity of shares with which you wish to vary the initial order in the quantity column of the description cell. The <X> key deletes the values entered in the corresponding row.

You can also set the general minimum quantity valid for all securities and derivatives excluding the 10 securities you have already set:

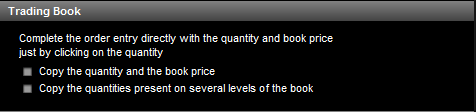

Book Trading is an option that allows you to speed up filling in the Order Entry window. You can copy the quantity plus the price for a specific book level by simply clicking on the quantity, or you can copy the quantities present on several levels of the book.

This is in addition to the normal integration between Book and Order Entry, where the price is automatically copied into the Order Entry window with a single click on the Book price.

Vertical Book

By activating the anchor to the last price, the "last" price will always remain in the middle of the window in the vertical book.

Trading

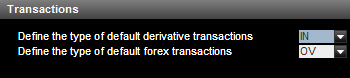

This option allows you to set pre-defined trading on derivatives.

You can choose between intraday and overnight margin trading.

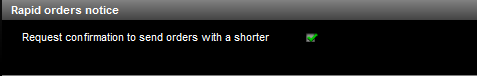

Close Orders Notice

This option allows you to be notified when several orders are entered on the same instrument within a short space of time.

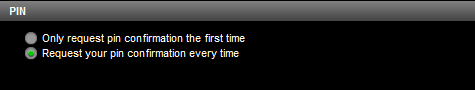

You can define the PIN confirmation frequency in the same section: the PIN can be requested for each transaction or only the first time. If you choose the second option, it will be valid until PowerDesk is open: closing PowerDesk means that the PIN will need to be re-entered for the next new order:

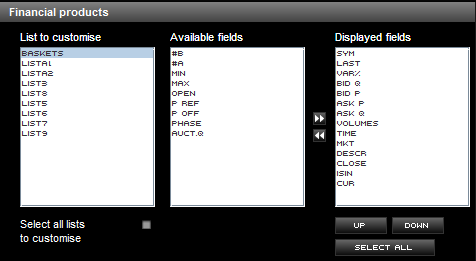

> Watchlist

By opening PowerDesk, you will notice that the platform is already pre-set with some lists of securities (share baskets, Italian and foreign futures, bond baskets, Forex, Options and CFDs on Indices) which show specific contents. To change the order or the contents of the securities lists, you can use the window in this section of the Preferences:

By clicking on the contents of the three boxes to highlight them, you can organise the contents of the individual lists:

To reorganise the columns in your Watchlist without changing their contents, you can use Drag and Drop directly on the platform. In order to use Drag & Drop, simply select the label of the column you wish to move and drag it with the mouse to the desired position.

Selecting the Phase field allows you to view the parameters of the various market phases provided by the Borsa Italiana (LSE Group) market trading service:

| Parameter | Description |

| ACO | Opening auction |

| ACC | Closing auction |

| CNT | Continuous trading |

| PXO | Volatility auction due to lack of validation of the theoretical auction price |

| PXIN | Pre-volatility auction during continuous trading |

| PXI | Volatility auction |

| INI | Service opening or pre-trading |

| FRC | Period of inactivity during the closing auction |

| CLS | Market closure |

| ADM | Service administration phase |

| VWP | Last 10 minutes of the continuous trading phase |

| EOD | Service closure |

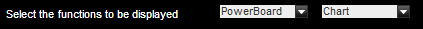

In addition, you can select the function to be displayed at the end of each security string, choosing from: Chart, Covered warrant, Vertical Book or PowerBoard.

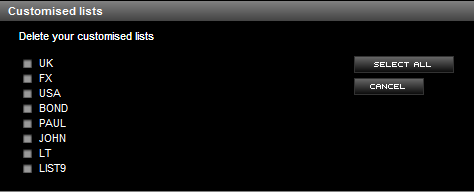

To delete the securities included in a customised list, simply select the name on the list and click on the button:

<Delete> button:

To delete all the contents of all the securities lists, first click on the <Select all> button and then on <Delete>.

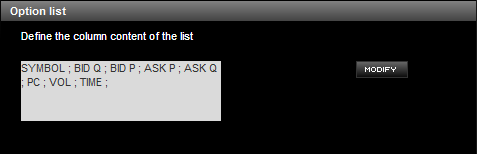

Finally, you can define the content of the options list columns:

> Screen

In PowerDesk you can download screen and portfolio data as an Excel file or in a csv format, setting the directory for saving the data.

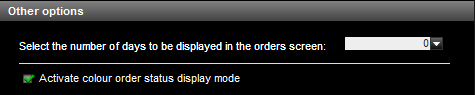

You can also define the number of days to be displayed in the order screen.

The orders status can also be customised in the order screen, whose visibility can be increased by colouring the background.

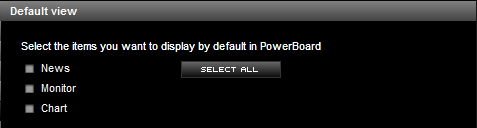

> PowerBoard

PowerBoard consists of 4 sections: Book, News, Screen and Chart. You can choose which sections to activate from this preferences area. Note: PowerBoard is programmed to be a modular mini-platform, therefore, when it is opened from PD2, its sections can be activated or deactivated independently from the settings given in the Preferences.

You can also choose the pre-defined size to open PowerBoard.

Market Bar

Market Bar is the fully customisable ticker with push notifications. It can contain financial products chosen among Shares, Futures, Indices and Currencies.

The security performance information displays the last price and the percentage change in relation to the previous day’s closing. Click on the security symbol to open PowerChart.

Watchlist

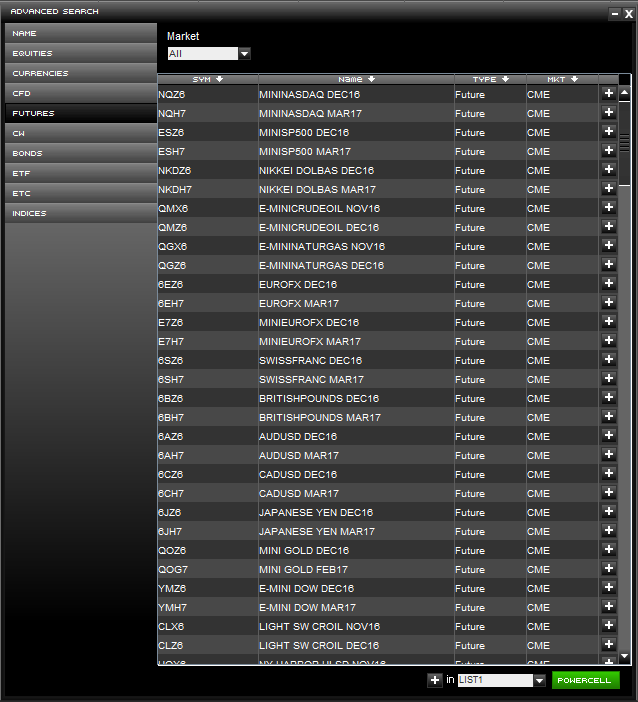

The PowerDesk watchlist consists of pre-defined baskets, eight customisable lists and the Best & Worst function. The market baskets are divided into:

- UK shares (Ftse100, Ftse 250)

- US shares (Dow Jones 30 and Nasdaq100)

- European shares (France, Germany, UK, Spain, Switzerland, Portugal, The Netherlands and Finland)

- CFDs on Indices

- Futures (Idem, Eurex and CME)

- Bonds (MOT and TLX)

- Forex

- Options.

Each customisable list can contain up to a maximum of 50 products including Shares, Bonds, Futures, ETFs, Options, CWs, Currencies and CFDs, without any restriction.

The Best-Worst function is located next to the last customisable list.

This function allows you to create lists of securities ordered according to:

- the best or worst percentage variation;

- the higher or lower equivalent values;

- the higher or lower volumes.

You can choose to compare all the securities on the markets available on PowerDesk or you can use the Country, Market or Type filters for more specific searches.

By clicking on the relevant arrow in each row  , the security details will be displayed, whose description can be found in the dedicated section.

, the security details will be displayed, whose description can be found in the dedicated section.

Each security row displays a button (customisable from the preferences panel) which opens:

- PowerChart, the technical analysis chart relating to the security

- CW, the list of Covered Warrants of the security (this is only present if the security is the underlying of a CW)

- PowerBoard, the modular platform of the specific security

- Vertical Book

These functions can be activated by right-clicking the mouse:

To add an instrument to the customised list, you can use the keypad located at the bottom left of the platform:

By entering the symbol or the name in the security field and you can enter the desired instrument in the customised list immediately, selecting it from the specific drop-down menu.

If you do not know the symbol/name, simply click on the button marked by a magnifying glass  which opens the full search pop-up (working details of the search function are given in the paragraph). When you have found the symbol, simply click on the button in order to add the corresponding instrument to the list

which opens the full search pop-up (working details of the search function are given in the paragraph). When you have found the symbol, simply click on the button in order to add the corresponding instrument to the list  .

.

The new instrument will be entered at the bottom of the selected customised list.

Moreover, to copy several instruments in one of the pre-defined lists, just open the pre-defined list, keep the CTRL key on the keyboard pressed and use the mouse to select the rows (i.e. the instruments) that you wish to copy. Or press the Shift key and drag the mouse to select up to 15 consecutive rows. The symbols appear inside the cells at the bottom of the Watchlist.

Then select the list on which you wish to copy the symbols and click on the <Add> key  .

.

- To remove a security from the customised list, simply select the securities you wish to remove, press the CTRL key and drag the mouse and then click on the <Delete symbols> button

. The button can be found either at the top right of the platform or at the bottom of each customised list. In the same way used for adding symbols, you can use the CTRL and SHIFT keys to make multiple selections.

. The button can be found either at the top right of the platform or at the bottom of each customised list. In the same way used for adding symbols, you can use the CTRL and SHIFT keys to make multiple selections.

You can also cancel the contents of several Watchlists at the same time with just a few clicks in the Preferences window, in the dedicated Watchlist section. - To move securities press the CTRL key and select the securities, then use the <Move symbols> buttons

. By clicking on the arrows, the securities will be moved up or down.

. By clicking on the arrows, the securities will be moved up or down. - To reset each selection, use the <Reset>

button, which deletes the selected securities displayed at the bottom of the Watchlist.

button, which deletes the selected securities displayed at the bottom of the Watchlist. - To assign a name to each customised list simply right-click the mouse on the header (e.g. List 10) and enter the name.

- To change the order of the columns in the Watchlist, use Drag and Drop or open preferences in the Watchlist section.

- To sort the rows according to the most appropriate criteria, click on the column header with the arrow. The columns which can sort new rows are: market, symbol, percentage change, volumes and time.

NOTE: All the changes made to the Watchlist will be saved automatically.

Watchlist Duplication

This function allows you to duplicate the Watchlist panel in order to view more than one list at the same time.

You could double the Watchlist just once from the main one.

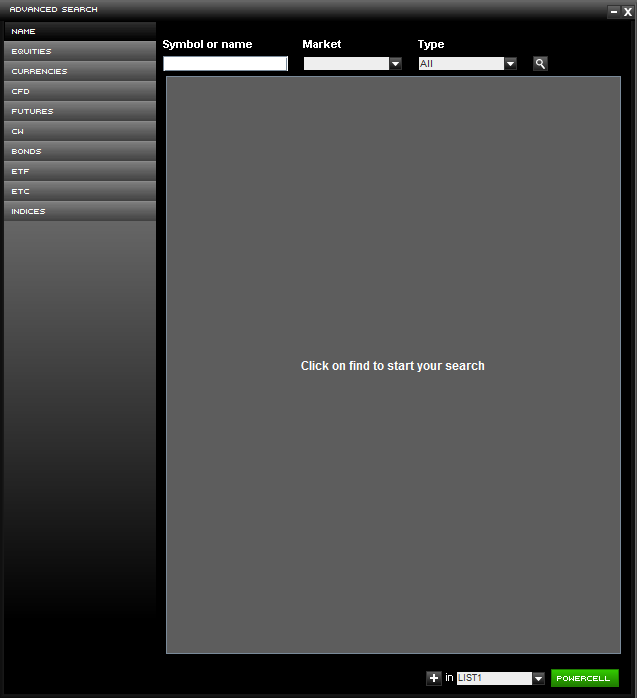

Symbol search

You can access the securities search in PowerDesk by using the button  .

.

The top row of the window displays commands which allow improved filtering of the search. To find a symbol you should:

- Indicate the type of instrument that you are searching for: Shares, Indices, Derivatives and Currencies

- Enter the name or symbol through which you want to search in the first field

- Select the symbol or name filter

- Trading market: MTA, Milan MCW, NYSE, Nasdaq, Amex, France, Germany, The Netherlands, Portugal, Spain, Switzerland and United Kingdom

and then click on the <Search> button  .

.

If the symbol is not unique, the search provides a list of instruments. However, if the symbol is unique, you need to select the instrument in the list and click on the <Add> button  in order to add the instrument to the customised Watchlist or on <PowerCell> in order to copy the master record of the instrument into Excel and use it for dynamic updates through DDE.

in order to add the instrument to the customised Watchlist or on <PowerCell> in order to copy the master record of the instrument into Excel and use it for dynamic updates through DDE.

You can search by product (shares, currencies, CFDs, futures, CWs, bonds, ETFs, etc. and indices).

If you are searching for derivatives and currencies, the search is easier: for example, by selecting "Derivatives" the search immediately returns all the futures, present at that time.

Security details

To view the details of a security, simply click on the button with the arrow at the start of each row in the securities lists.

The central part of the expanded row contains the order entry screens, concerning which there is a specific paragraph (Trade View and Conditional Orders).

The two equal-sized side-by-side and modular sections can contain Book, Tick by Tick or Spread Bid & Ask Charts, Screens, News and Time & Sales. Every detail can be customised by clicking on the vertical label at the left of each section:

- The Book displays in real time the five best bid and ask price proposals on the market. The Book is always connected with the order entry window. To activate the Trading Book and increase the level of integration between the Book and the order entry screen, simply open "Preferences" and set its details.

- The Screen records all orders on the security entered during the day. It is divided into tabs according to the trading permitted on the instrument: securities if the details are for a share, Derivatives trading for Futures.

- The tick-by-tick chart is built on the Last price or on the updated bid/ask Spread, with push notifications when the Book is updated.

- News is filtered for the specific security. To read the full text of the news item, just click on the title and open the pop-up.

- Time & Sales is the table that allows you to see all the contracts exchanged on a security.

To go back to the compact mode of the details row, simply click on the button again.

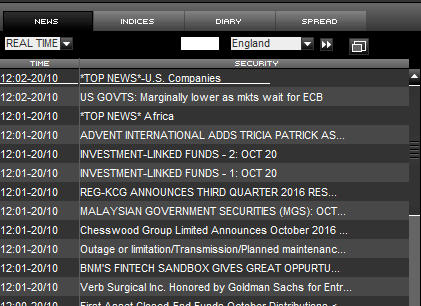

Indices

Indices The most important national and international indices are updated in real time: symbol, last price, percentage change in respect of the previous day’s closing, day maximum and minimum and minute of the last update.

There is also a thermometer which tracks index performance: the distance of the last quote from the maximum is given in red, in green from the minimum, and the triangle indicates the day’s opening. Click on the symbol to open the technical analysis chart.

When PowerDesk opens, this information block is in the bottom left panel: to move it, you need to open the preferences window in the general section.

News

News is provided by Reuters, MF Dow Jones News in real time. Click on a news headline to open a window with the full text.

To filter news, enter the symbol in the specific "SYM" box and click on the button. In the security details and in PowerBoard the filter on the financial instrument has already been applied.

When PowerDesk opens, the general news is in the bottom left panel: to modify it, open the preferences window in the general section.

Spread

The Spread view shows the 10-year yields of the main global government bonds.

The spread value represents the difference in index points between the two bonds.

The %var indicates the increase or decrease of the spread since the previous day (close).

Minimum, maximum and open refer to the current day.

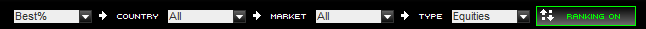

Best&Worst/Ranking

You could access the Best & Worst list  by clicking on the corresponding button to the right side of the custom lists.

by clicking on the corresponding button to the right side of the custom lists.

This function allows you to update financial instruments ranking, based on the following criteria:

- Daily percentage change - Best / Worst

- Daily values - Greatest / Lowest

- Daily volumes - Greatest / Lowest

For each list, the first 100 results are shown.

The list is updated dynamically and it automatically orders financial instruments according to the selected criteria, as well as by the country, the market and the type of instrument.

The dynamic ordering allows adding in the ranking also instruments which are not part of the initial 100.

If you expand a row concerning a single instrument (so-called Expanded row) the Ranking will be deactivated.

Click on the "Ranking on" button to reactivate it.

A column shows green / red triangles indicating the shift of the instrument: if the security shifts up in the ranking list, a green triangle appears and a red triangle will be shown for instruments that have come down accordingly.

For the proper functioning of the Best&Worst list you need to be subscribed to the push information on all markets.

For financial instruments listed on markets for which you have subscribed for pull or delay information, the list is updated dynamically however quotes and changes are not updated real-time.

Best&Worst is available only during trading hours. If you select a closed market, an error message showing “No security found” will be displayed.

Heikin Ashi

Heikin-Ashi is a type of trading chart that originated in Japan.

Normal candlestick charts are composed of a series of open-high-low-close (OHLC) bars set apart by a time series. Heikin Ashi charts calculate their own open (HAO), high (HAH), low (HAL) and close (HAC) using the actual open (O), high (H), low (L) and close (C) of the time frame as follow:

1. The HA close price is a sort of average of the open, high, low and close for the current period

HA-Close = (Open + High + Low + Close) / 4.

2. The HA Open is the average of the prior Heikin- Ashi candlestick open plus the close of the prior Heikin-Ashi candlestick.

HA-Open = (HA-Open [-1] + HA-Close [-1]) / 2.

3. The Heikin-Ashi is the maximum of three data points: the current period’s high, the current Heikin-ashi candlestick open or the current Heikin-Ashi candlestick close.

HA-High = Maximum of the High, HA-Open or HA-Close

4. The Heikin-Ashi low is the minimum of three data points: the current period’s low, the current Heikin-Ashi candlestick open or the current Heikin-Ashi candlestick close.

HA-Low = Minimum of the Low, HA-Open or HA-Close

Heikin Ashi Charts are also color coded, like candlesticks, so as long as the price is rising (based on the calculations) then the bars will show up as green. As long as the price is falling (based on the calculation) then the bars will show up as red.

Heikin Ashi chart is available by clicking on the icon  between chart icons with the following label: “Heiken Ashi (F8)”

between chart icons with the following label: “Heiken Ashi (F8)”

“Ichimoku” Indicator

Ichimoku is a moving average-based trend identification system and because it contains more data points than standard candlestick charts, it provides a clearer picture of potential price action. Ichimoku translates to one glance the chart and it defines support and resistance, identifies trend direction, gauges momentum and provides trading signals.

The key elements of Ichimoku’s Graphic Envirorment:

Tenkan-sen – Turning Line: is derived by averaging the highest high and the lowest low for the past nine periods.

Tenkan-sen = (highest high + lowest low)/2 for the last 9 periods

Kijun-sen – Base line:

Kijun-sen = (highest high + lowest low)/2 for the last 26 periods

Chinkou span – Lagging line:

Chikou span = today's closing price projected back 26 days on the chart.

Senkou span A – First leading line

Senkou Span A = (Tenkan-sen + kijun-sen)/2 plotted 26 periods ahead.

Senkou span B - Second leading line

Senkou span B = (highest high + lowest low)/2 calculated over the past 52 time periods and plotted 26 periods ahead.

Senkou span A and Senkou span B form the edge of the kumo (cloud). The cloud edges identify current and potential future support and resistance points.

If the price is above the cloud, the top line serves as the first support level while the bottom line serves as the second support level.

If the price is below the cloud, the bottom line forms the first resistance level while the top line is the second resistance level.

Generally, markets are bullish when Senkou Span A is above Senkou Span B and vice versa when markets are bearish.

The Tenkan Sen is an indicator of the market trend. If the Tenkan-sen line is moving up or down, it indicates that the market is trending. If it moves horizontally, it signals that the market is ranging.

The Kijun Sen is a support/resistance line, and can be used as a trailing stop line. The Kijun Sen acts as an indicator of future price movement. If the price is higher than Kijun-sen line, it could continue to climb higher. If the price is below the Kijun-sen line, it could keep dropping.

Periods 9, 26 and 52 are set as default, but you can change them by clicking on the indicator name in the chart window.

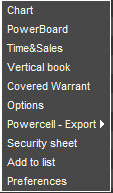

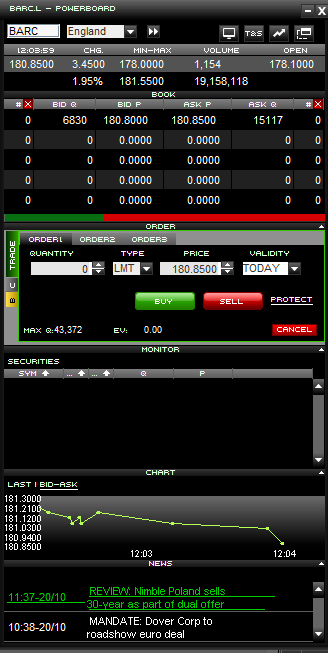

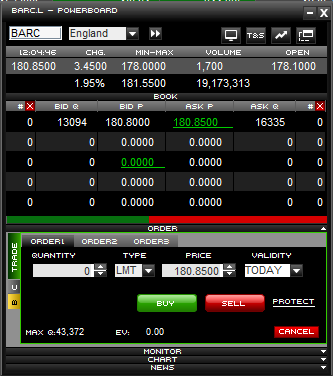

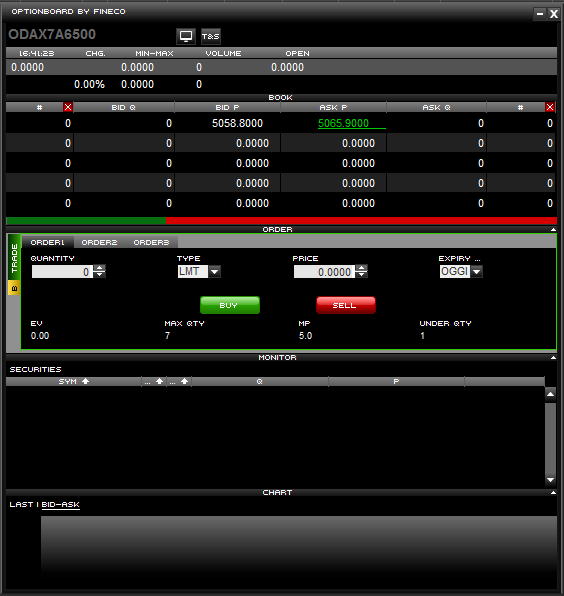

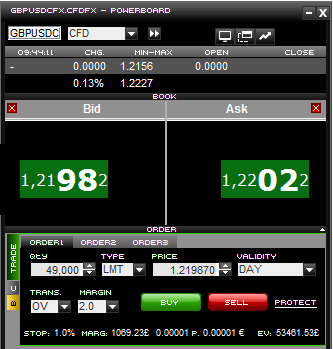

PowerBoard

PowerBoard is an independent platform where you can also change the symbol directly. PowerBoard is integrated with the platform and the Preferences you have set. To open PowerBoard, click on the  button in the security row in the Watchlist (if set as a function to be displayed in the security row) or right-click the mouse and choose PowerBoard from the drop-down menu.

button in the security row in the Watchlist (if set as a function to be displayed in the security row) or right-click the mouse and choose PowerBoard from the drop-down menu.

PowerBoard is modular and consists of 4 parts:

- The Book is always connected to the order entry window. To activate the Trading Book and increase the level of integration between the Book and the order entry screen, simply open "Preferences" and set its details.

- The Screen records all orders on the security entered during the day. It is divided into tabs related to the trading allowed on the security.

- The chart is tick-by-tick or bid/ask spread, updated with push notifications, when the Book is updated.

- News is filtered for the security. To read the full text of the news, just click on the news headline.

Each section described above can be deactivated by the arrow, located at the top right of each section, until you reach the security and order entry windows.

With PowerBoard all trading is in any case ensured even in the most basic section: ordinary, margin trading and on Derivatives, either through the displayed real-time information or through the two Order Entry screens: Trade View and window for conditional orders.

There are two methods to change the financial instrument:

- type in the symbol of the new instrument in the symbol entry area.

- drag the symbol from the Watchlist, screen or PD2 portfolio using Drag & Drop inside the PowerBoard window.

NOTE: you can open up to 50 PowerBoards at the same time if the computer meets the necessary requirements.

You can expand or shrink each PowerBoard simply by selecting the bottom right corner.

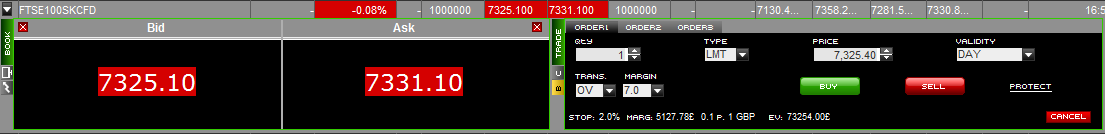

Vertical Book

The Vertical Book is activated by clicking on the ![]() button in the security row, or from the drop-down menu opened by right-clicking the mouse. 10 price levels are displayed when the Book is opened: 5 levels below and 5 above the last price. The quantity and number of proposals are indicated for the first 5 levels above and below the last price.

button in the security row, or from the drop-down menu opened by right-clicking the mouse. 10 price levels are displayed when the Book is opened: 5 levels below and 5 above the last price. The quantity and number of proposals are indicated for the first 5 levels above and below the last price.

The quantity and number of proposals for each level are displayed to the right and left of the central column. The first five bid and ask levels scroll up or down following the security’s performance. To enlarge or shrink the window, just select the bottom right corner and choose the preferred size.

In Preferences, you can select to anchor the last price in the centre of the window or to keep the price bar fixed, regardless of the security transactions.

Trading:

- Set the quantity traded and the trading type (standard, Intraday margin trading - Overnight margin trading).

- To buy, just click the mouse on a specific level in the Bid quantity column; to sell, just click on the fields of the Ask quantity column corresponding to specific price levels.

- By clicking on a price level above the last (in the Bid quantity column), a buy order is sent to market at the selected price; however, by clicking on a price level below the last in the Ask quantity column, a sell order is sent to market with the selected price.

- The first column on the left (ORDERS) is a useful screen that displays the quantities of the orders entered on the market.

- Just click on the quantities entered in the "ORD" column to cancel all orders entered in the market quickly.

- Under the book there is a screen in which you can follow the details of each order and cancel these if necessary.

The Vertical Book is an independent mini-platform on which you can view every security by dragging the symbol with Drag & Drop.

Important! By clicking on the quantities column, the order is entered immediately on the market, without a confirmation window.

Time and Sales

Time & Sales is the table that allows you to see all the contracts made on a security.

Time & Sales can be activated by clicking on the  button, therefore from the Vertical Book, PowerBoard and Order Entry in the expanded row of each security (by clicking on the button from the two side windows).

button, therefore from the Vertical Book, PowerBoard and Order Entry in the expanded row of each security (by clicking on the button from the two side windows).

After activation, the individual trades are gradually displayed showing the time, price, quantity and change from the previous contract.

To avoid excessive consumption of the PC’s memory, by default the table shows up to the last 10 trades made. Using the specific drop-down menu at the bottom, you can choose to display up to the last 1000 contracts.

Time & Sales is developed in a pop-up which can be expanded as desired from the bottom edge. The instrument is totally independent from the security from which it was activated and is automatically updated even when working on other instruments or markets.

Price alerts

The Alert service advises you when a security in the Portfolio or one that you are monitoring reaches a certain price level. You can therefore monitor securities even when you are not in front of your computer. You need to configure a condition (e.g. "If the price of the ABC security drops below 3.2 Euros"), enter the date by when the event has to happen and indicate how you want to be alerted: By pop-up, email or Texts. Moreover PowerDesk allows you to write a short message which will be sent to you with the alert.

There are 30 price alerts available in PowerDesk. Setting an alert directly from the dedicated "Alert" screen is very easy:

- Type in the symbol in the cell

- Set the event: i.e. the price must be higher than, higher than/equal to, less than or less than/equal to a specific reference price

- Define the validity of the alert

- Select the way you want to be alerted of the event’s occurrence

- Define a message (maximum 50 characters) that you want to receive at the same time as the alert message

- Activate the row in the ON column.

You can set an alert for a price being reached on any UK or international security.

NOTE: thanks to the (ON/OFF) option on the platform, you can pre-configure alerts and activate them only at the appropriate time. You can link the alert to automatically enter an order, by setting a conditional order (see the relevant paragraphs for the details).

Acoustic alert and pop-ups

You can select the two functions from the securities screen header by using the two dedicated buttons  . If the two icons are crossed out, the functions are not active

. If the two icons are crossed out, the functions are not active  .

.

By clicking on the bell button you can receive an acoustic alert for every executed order.

Whereas, by clicking on the left-hand button, each time an order is executed, a pop-up opens reporting all the details of the executed order.

When both functions are activated, the acoustic alert sounds at the same time as the summary pop-up appears.

Chart customisation

You can personalise some of the platform’s graphic elements from the PowerDesk Preferences panel:

- the character size choosing from three different pre-defined sizes: large, medium and small

- the background colour and each price update highlight

- "always on-top": by flagging the function, each pop-up that opens will always appear on top

Expandable monitor and portfolio

The order monitor and portfolio can be expanded by selecting and dragging the edge of each panel sideways.

Ranking

By clicking on the  button, you can dynamically sort (with push notifications, at each price change) the securities in each list. For example, you can sort the securities by percentage change or by the time of the last price (in this case you can decide to show the security that was last traded on the top row of the list).

button, you can dynamically sort (with push notifications, at each price change) the securities in each list. For example, you can sort the securities by percentage change or by the time of the last price (in this case you can decide to show the security that was last traded on the top row of the list).

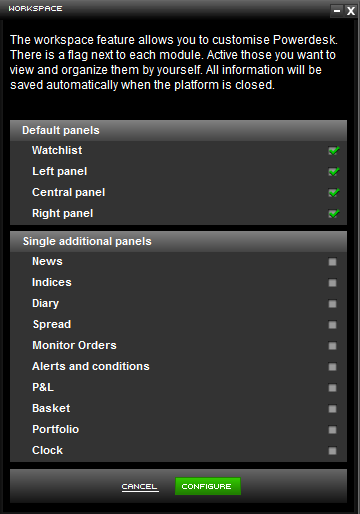

WORKSPACE

Using the  function you can create a completely customised workspace. By activating the workspace the main components are broken down into single panels, whose shape and size can be managed according to your needs.

function you can create a completely customised workspace. By activating the workspace the main components are broken down into single panels, whose shape and size can be managed according to your needs.

By clicking on the  button a pop-up opens with the choice of the modules you wish to view:

button a pop-up opens with the choice of the modules you wish to view:

DEFAULT PANELS:

- Watchlist: contains the 8 customised lists, pre-defined baskets and management bar

- LH multifunction panel: the content of this panel can be customised from preferences.

By default it contains the News, Indices and the Spread view. - Central multifunction panel: it consists of the screen, the "alerts and conditional orders" section, the P&L and the BASKET.

- RH multifunction panel: the content of this panel can be customised from preferences.

By default it contains the Portfolio

SINGLE ADDITIONAL PANELS:

- by selecting one or more single panels, you can duplicate the functions inside the "default panel" macro groups.

Inside each panel there is a "duplicate" button which allows you to add an additional panel of the single section  ; in this way for example you can create more than one portfolio or several order screens.

; in this way for example you can create more than one portfolio or several order screens.

- When clicking on this button

the platform is broken up, and additional panels are created in the centre.

the platform is broken up, and additional panels are created in the centre.

The single panels can be reduced to icons by using the  button. All the components can also be minimised using the same button

button. All the components can also be minimised using the same button  on the control bar at the top of the platform:

on the control bar at the top of the platform:

The workspace also allows you to use several screens, managing all the panels as individual platform structures.

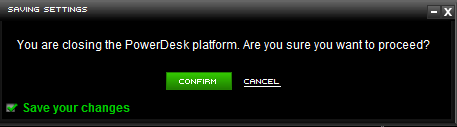

Note: When you close the platform, you will be asked whether you want to save the changes made.

The changes are saved on the Fineco server so you will be able to access the customised PowerDesk regardless of the PC you are using.

In any case, you can restore the default version at any time from the Preferences panel.

To return to the "Fixed" or standard structure, just click on the  button and confirm by pressing.

button and confirm by pressing.

If you want to recreate the standard structure, without losing what has been saved in the Workspace, you need to uncheck automatic save in the platform closure pop-up. Otherwise, the changes will be overwritten saving the fixed structure.

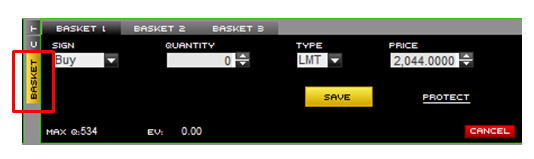

Basket Order

Basket order is the Powerdesk tool that allows you to preset one or more orders and save them within one or more lists, reserving the right to transmit them, all or in part, to Fineco at a later time.

How does it work

- Order entering and saving

In the central monitor, in the expanded row of each title, there is a BASKET tab that allows you to create and save an order, without submitting it to the market.

Orders saved in the Basket are considered transmitted to Fineco for their execution only when, after being flagged, you click on the "SEND ORDERS" button and enter the PIN. Those orders will then be submitted to the market by Fineco.

Saved orders are displayed in the List as already flagged and at any time you can:

- transmit them to Fineco by clicking the "SEND ORDERS" button

- delete them by clicking the "CANCEL ORDER" button

Furthermore, by clicking on the row of each saved order, you can change it at any time:

- the sign: buy or sell

- the quantity

- the order type: at a limit price or at a market price

When a market order is saved (type=MKT) it is not possible to change it into a limit order (type=LMT); You will need to create and save a new order at a limit price.

By clicking on the "CANCEL ORDERS" button, all the selected orders will be deleted from the list. You could also cancel a saved order via the  button displayed next to each order.

button displayed next to each order.

- Protect  : this link allows you to enter / edit a Stop Loss, a Take Profit and a Trailing Stop on the order.

: this link allows you to enter / edit a Stop Loss, a Take Profit and a Trailing Stop on the order.

If you set a Stop Loss or a Take Profit, the button is reduced in size, showing the pre-determined price for the corresponding Stop and Take

Example of an order with no protection :

Example of an order with a Stop Loss:  (the Stop is always shown on the left)

(the Stop is always shown on the left)

Example of an order with Take Profit:  (Take Profit is always shown on the right)

(Take Profit is always shown on the right)

Example of an order with Trailing Stop:  (the protect button on the left appears lighter)

(the protect button on the left appears lighter)

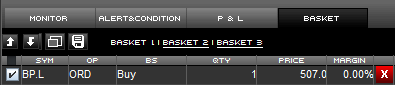

Saved orders can be viewed in a List in the BASKET Monitor and remain permanently stored.

In the list, the following information are available:

- SYM: Security symbol

- OP: operating settings (ORD: ordinary, In: intraday, Ov: overnight)

- BS: the sign of the operation (buy / sell)

- Q.TY: quantity

- PRICE: Market or Limit

- MARGIN: Selected Margin for orders on derivative instruments

Send an order

The last saved order is the first one that appears at the top of the BASKET List.

All saved orders are displayed in the List as flagged, ready to be transmitted to Fineco.

It is necessary to unflag the orders that you DO NOT want to submit to the market, afterwards you have to click on the “SEND ORDERS” button to transmit the selected orders.

If several orders are sent, the first to be transmitted to Fineco is the first at the top of the List, then the second and so on. However, you can change the order via the arrows  , moving the orders up or down the list; thus submitting to the market.

, moving the orders up or down the list; thus submitting to the market.

After clicking the "SEND ORDERS" button, a summary popup will be displayed for checking the order status.

In the "Orders Monitor" section, you can check the execution of orders and the relative execution price.

Basket order allows keeping track of the orders previously saved in the List and subsequently transmitted to Fineco. These orders will remain in the List indeed:

- if in the “basket order status” panel are figuring as “send”, they will be displayed as unflagged;

- if in the “basket order status” panel are figuring as “error”, they will remain flagged so that you could transmit them again to Fineco later.

Note: before sending orders to the market, we suggest you to check the correctness of all parameters and the sending sequence that you want to keep.

All orders are independent from each other. In case of multiple submissions, the refusal of one of them does not prejudice the transmission of the other orders requested to be sent.

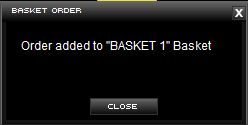

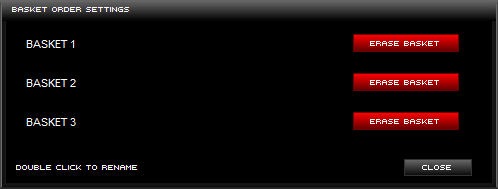

Multi Basket

Due to BASKET1, BASKET2, BASKET3 you could manage your orders in 3 different panels.

Clicking on SAVE, a confirmation of the order transmission is given via a pop-up:

By adding an order from the “Basket 2” tab, for example, the order will be displayed in the central Basket 2 panel, as shown below:

Up to 3 different Baskets can be saved. You can delete all orders added to one basket just in one click or you can rename a Basket by using the  icon:

icon:

If you want to rename a basket, simply click twice on the word “Basket”

Note: The "ERASE BASKET" button deletes all orders saved in that basket, as well as the customized name.

Futures trading

> What is a Future?

The derivatives consist of a standardised forward contract, for the purchase/sale of a commodity or financial asset (underlying) at a future date, at a price fixed at the time the contract is agreed.

The parties signing a Futures contract undertake to trade, on a pre-established date and at a price (Futures Price) defined by the contract, the amount of financial instruments or of a specific asset underlying the contract, whose price is formed on the related market. Investors purchasing a Futures contract have a long position; they must buy the asset underlying the contract on expiry, or they can close their position by selling a Future which is equivalent to the purchased one before expiry. Likewise, investors selling a Futures contract have a short position and undertake to deliver the underlying asset on expiry, or they close their position before expiry, by purchasing a contract which is equivalent to the one sold. An increase in the price of the Future generates profit for investors that have a long position, and losses for investors that have a short position.

> Clearing margin

Futures trading is characterised by the so-called margins system, according to which investors entering into a Futures contract must deposit, through an intermediary called the Clearing Member, a sum of money (initial or clearing margin), in order to guarantee performance on expiry. The margin is a limited percentage (which varies from 2% to 30%) of the traded amount.

Fineco allows you to customise both the level of the clearing margins held and the positioning of the related Stop Loss order (always 5% lower than the clearing margin). If the clearing margin is set at 20%, with the Stop Loss order at 15%, this level can be changed directly on PowerDesk, using the drop-down Margin Trading menu in the order entry screen, increasing the margin level up to 30% with a stop at 25% or reducing it to 2% with a stop at 0.5%, for "tighter" trading.

Margins can therefore be changed, provided your derivatives portfolio does not already have open positions on that specific Future.

> Fineco’s Automatic Stop Loss

This is an automatic order that closes your position if the price undergoes excessive variations. The Stop Order varies according to the traded instrument, the type of trading and the selected margin.

The Automatic Stop Order is triggered when the underlying instrument (and not the margin) varies by a percentage equal to: Margin% - 5%. For example, with a Margin fixed at 20%, the Automatic Stop Order will be triggered if the underlying index (e.g. FTSE MIB) varies by 15% (= 20%-5%). For the purpose of this calculation, the reference value used is the average price of the executed orders. At the end of the day, if there are open positions, the Stop Order value will be reintroduced the following day, still calculated on the average of executed orders, whereas the closing value at the end of the day will be used for margin adjustment transactions and for subsequently calculating profits/losses at the closure of the contract. This Stop Loss cannot be changed by the customer.

It is possible to enter a Stop Loss with a "tighter" price level and a Take Profit on the position, but not a Trailing Stop.

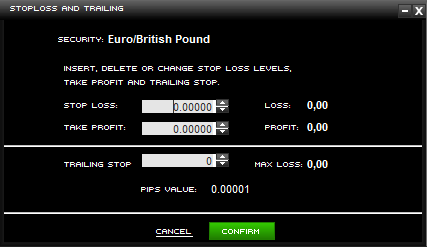

> Stop Loss, Take Profit and Trailing Stop

Automatic orders (Stop Losses, Take Profits and Trailing Stops) can be entered on the single orders making up the position.

> Settlement

The settlement or official closing price is calculated daily for each Futures contract and is displayed in a specific "Settlement of Futures" table in the Portfolio page of the website.

After closing of the Idem, Eurex and CME markets, all settlement prices that are used to calculate the margin and accounting positions are updated.

Note: each stock exchange can establish different procedures for calculating the official closing price.

> Multiplier/Minimum lot

For index products, the multiplier is the value in Euros of each index point. For futures, the minimum lot refers to the number of futures contracts covered by the order.

> Accounting and administrative note

Trading on derivatives is recognised at T+1, while the Euro/Dollar exchange rate has a value date of T+3.

Therefore, a currency request to trade US futures guarantees available funds for trading. Whereas, for open Overnight positions, the account could become overdrawn because of the different recording of exchange and derivatives transactions.

Entering an order

You must enter the following in the order screen:

> Quantity: the number of lots you wish to buy/sell.

> Type: indicates the type of order:

- "MKT" market.

- "STF" at best or sweep to fill.

- "LIM" limit.

> Price: the buy/sell price of a contract.

> Margin: the clearing margin.

> Validity: you can choose from three different methods to enter the order:

- GTC: Good Till Cancelled. It allows you to enter an order that is valid until the end of the trading day. This parameter is pre-set in the order window.

Note: Stop Loss orders cannot be entered without a price limit. - IOC: is the abbreviation for "Immediate or Cancel". It allows you to enter an order, at a specified price, that will be executed (possibly partially) at the time that it is entered. Any quantity not met at the set price will automatically be cancelled.

Note: Stop Loss orders cannot be entered without a price limit. - FOK: fill or kill. The order must be executed in full or it is automatically cancelled.

It allows you to enter an order with a price indication, which will be executed only if the book contains enough to cover the quantity in full; otherwise the entire order is automatically cancelled. This type of order is not accepted by Eurex.

Note: Stop Loss orders cannot be entered without a price limit.

IOC and FOK orders are never entered in the book (despite generating a PDN).

Validity of market orders

For derivatives traded on IDEM, a market order can be associated with an IOC or FOK validity.

For derivatives traded on Eurex, this type of order is restricted to a GTC validity.

Market orders on Futures traded on the CME can be GTC or IOC.

> SL – TP: automatic orders (Stop Losses, Take Profits and Trailing Stops) can be entered both on orders and on positions.

Operating notes:

- Every order on derivatives must be executed on the same market day. Otherwise it will be cancelled.

- The rollover (lengthening the position beyond expiry) must be performed manually by closing out the contract prior to the upcoming expiry date and then setting up the same position rolled over to the next expiry date. All the positions still open on the expiry date will automatically be closed.

- You can enter orders at a price close to the automatic Stop Loss, but there could be sudden market movements, and the possibility that both the order entered and the Stop Loss are executed, producing the effect of opening a new position with opposite sign.

- The default quantity for orders on Futures can be pre-set in the PD2 Preferences. This allows filling in the Order Entry screen more quickly.

Cancelling an order

To cancel an order, the order status must be, “in the queue, to be queued or partially executed”. It is cancelled by clicking on the specific button  in the Derivatives Order Screen.

in the Derivatives Order Screen.

If the order is entered, in the queue or to be queued, by clicking on the cancel button, the command has effect on the entire equivalent value of the order.

If the order has been partially executed, clicking on the  button only cancels the non-executed part of the order.

button only cancels the non-executed part of the order.

When an order is cancelled, the funds reserved for the transaction are immediately credited back to the available balance.

As occurs with the other instruments that can be traded on PowerDesk, both individual orders and all orders entered on a future can be cancelled from the book through the cancel functions.

Repeating an order

An order can be repeated at any time provided the order to be repeated has been executed. Repeat an order by clicking on the specific button  in the Order Screen.

in the Order Screen.

NOTE: as the linked conditional order is an active order, clicking on the <Repeat> button also repeats the order.

Closing a position

Derivatives trading allows you to close a position by entering a sell order for the same security. The sell order can be filled in either in the order entry screen in the security details, or in PowerBoard and the derivatives Portfolio. Moreover, still from the Portfolio, you can enter a market order by clicking on the "C" button in the Close column.

Closure can be partial or total according to the quantity of securities you wish to sell.

Derivatives trading not only allows you to close the position but, at the same time, to reverse the position by entering a larger quantity in the order.

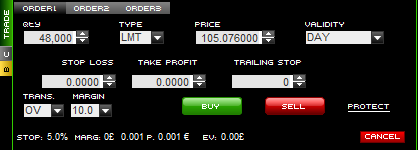

Entering Stop Loss, Take Profit and Trailing Stop conditions

> Automatic Stop Losses

Fineco automatically associates a Stop Loss to each open position. This Stop Loss varies according to the traded instrument, the type of trading and the margin selected. The Stop Loss is a "market" order, which automatically closes your position if the price undergoes excessive variations.

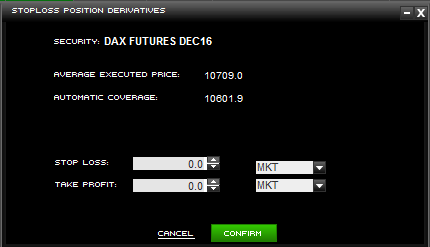

To display the automatic cover price, click on the  button by the position string in the futures screen. Clicking opens a box which shows the automatic cover value in detail.

button by the position string in the futures screen. Clicking opens a box which shows the automatic cover value in detail.

> Customised Stop Losses and Take Profits on the position

You can enter a Stop Loss with a "tighter" price level than the automatic Stop Loss and a Take Profit in the same box which shows the Fineco Stop Loss. It is not possible to enter any Trailing Stops on the position.

These automatic orders can be sent either with a "market" or with a "limit" price.

> Customised Stop Losses and Take Profits on the order

Customisable automatic orders such as Stop Losses, Take Profits and Trailing Stops can be entered in addition to the automatic cover price. They can be entered:

- during the order entry phase by clicking on the specific link (in this case the order entry screen expands offering the option of entering an SL, TP or Trailing Stop)

- or they can be entered after entering the order by clicking the

button by the order string in the futures screen.

button by the order string in the futures screen.

You need to enter the two values on which you want to place the Stop Loss and Take Profit and the number of ticks for the Trailing Stop.

The potential Profit or Loss calculator is located next to each value entered.

The personalised Stop Loss cannot be less than the Fineco automatic cover price for long positions and cannot be higher in the case of short positions. The system allows you to enter Stop Loss higher than the average carrying value and lower than the market price of the position. This enables you to protect any gains, updating the Stop Loss value to the market value taken by the position.

After entering one of the values, the specific button lights up (bright blue) indicating the presence of at least one of the automatic orders. To edit the values entered, simply click on the arrows of the related box and click on confirm; to cancel the values entered just click on the "x" button.

Revocation

Fineco will consider the SL and TP and TS values lapsed if:

- one of the three conditions occurs and the order is therefore sent to market

- should the position be reversed, the values entered on the individual orders remain valid; however, any SLs and TPs entered on the position lapse. The stops must be entered again in order to protect the position.

Remember that Trailing Stops are valid for one day; any active Trailing Stops will be cancelled at the end of the continuous trading phase.

> Protect  : this link allows you to enter/edit Stop Loss, Take Profits and Trailing Stops on the order.

: this link allows you to enter/edit Stop Loss, Take Profits and Trailing Stops on the order.

If a Stop Loss or Take Profit is entered, the size of the button is reduced, showing the predetermined price for the corresponding Stop Loss or Take Profit

Example of an unprotected order:

Example of an order with a Stop Loss:  (the Stop Loss is always shown on the left)

(the Stop Loss is always shown on the left)

Example of an order with a Take Profit:  (the Take Profit is always shown on the right)

(the Take Profit is always shown on the right)

Example of an order with a Trailing Stop:  (the protect button on the left is a lighter colour)

(the protect button on the left is a lighter colour)

Trade and Reverse

This function allows traders to reverse their position on the market with a single click, as it enables completely closing the long or short position on Futures and opening a position with the opposite sign with a single order.

Trade & Reverse cancels any Stop Loss and Take Profit entered on the position, but it does not modify the conditions placed on the single orders which remain active.

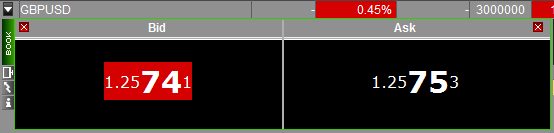

Bid and Ask Orders

It is possible to be present in the Book at the same time with several buy and sell orders on the same future. Bid & Ask Orders are active on CME, Eurex and IDEM Futures.

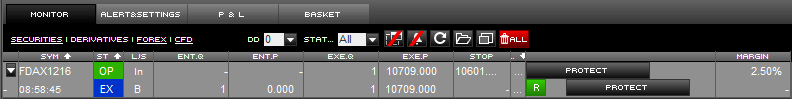

Derivatives Order Screen

Derivatives transactions are characterized by setting up a position containing all orders on the same instrument regardless of the opening date of the position.

In the Derivatives screen, the top row refers to the position on the instrument, whereas the expanded top row shows the details of all the orders which constitute it.

1. The following are displayed in the header:

> In the top drop-down menu, the number of trading days ("dd") for which you wish to view the orders entered (please note that 0 days corresponds to the last 24 hours of trading).

> The "Status" drop-down menu allows you to filter the orders in the screen according to their status.

2. The Screen columns contain:

- "SYM": Symbol of the Future.

- "ST": Order status: the information provided by the market concerning the execution status of the order at that point in time. This status can be:

- Executed

- Partially Executed

- Entered

- Cancelled

- Refused: the order was refused by the system or by the Market. There could be various causes, including: a lack of liquidity (in the case of a buy order) or of securities (in the case of a sell order); any other reason why the order cannot be executed.

- In the queue

- To be queued. The order has been taken up. It will be placed on the market as soon as the market starts accepting new orders (this usually happens when the market is still closed).

- "B/S": indicates whether the order is Buy or Sell.

- "ENT.Q": Quantity entered in the order.

- "ENT.P": Price entered in the order.

- "EXE.Q": Executed quantity of the order.

- "EXE.P": Executed price of the order.

- "COND": if there is a conditional order.

- “DATE”: The Date and Time the order is placed and any quantity executed, even partially.

> Order management column:

- Cancel Order: there is a button next to each non-executed or partially executed order; simply click on the button to send a command to withdraw the order.

- Repeat Order: to re-enter an order, just click on the button and the order will be sent to market with the same characteristics as the original order.

- SL – TP: to set a Stop Loss, Take Profit and Trailing Stop on each individual order or, when by the position line, to allow you to set a Stop Loss and Take Profit on the position.

NOTE: the Order Code indicates the unique number assigned to each order: by clicking on the order status, you can see the order certificate, which can be printed for your own records.

3. You can set a further filter on the orders shown by entering the security Symbol and clicking on Filter at the bottom of the Screen.

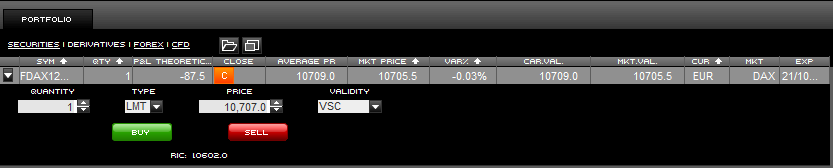

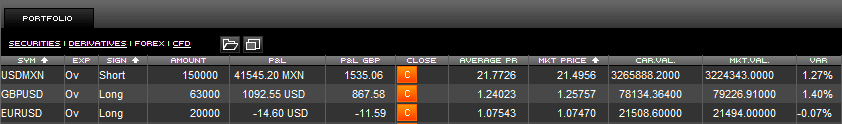

Derivatives Portfolio

The portfolio allows you to view your Futures position in real time, at any moment.

Some information is shown for each security:

- "SYM": the symbol of the contract on which a position is open.

- "QTY": Quantity of the position, i.e. the number of lots and the position sign ("-" indicates a short position).

- "Theoretical P&L": updated profits or losses on the open position; the value indicates how much the customer would gain or lose if he closed the "market" position at that point in time

- "CLOSE" instruction column

- "AVERAGE.P": the average carrying value indicates the price at which the securities were bought. From the day following the purchase, the price also includes paid fees.

- "MKT.P": indicates the market price updated in real time.

- "% Var": expresses the difference between the average carrying value and the market price.

- "Car Val": indicates the total value of the derivative at the time of purchase

- "Mkt Val": indicates the value of the derivative in real time

- "Cur": the currency in which the financial instrument is traded

- "Mkt": indicates the traded product (fut = futures)

Operating Note: the Profit & Loss value, which follows a cover, is calculated in relation to the average price (the lots are covered taking into consideration their average price). The average carrying value of the lots changes from day to day in relation to the compensation with the clearing house.

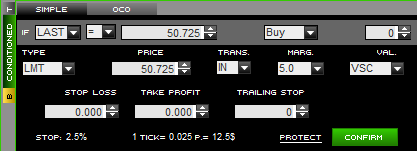

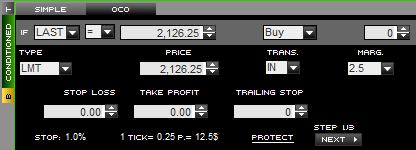

Conditional orders

The customer can enter up to 30 conditional orders (Stop Losses or Take Profits) on PowerDesk. In this case also, the Customer’s order is not shown in the book until the Condition Price is reached.

As conditional orders on derivatives are sent and handled by the reference markets, each market has different operating rules for accepting conditional offers.

For the same reason, once this type of order has been entered, it does not appear in the special Conditional Order Screen, but it is included in the Derivatives Order Screen.

Each market has different rules for accepting conditional orders:

> EUREX: this market has very restrictive rules for accepting conditional orders.

- Condition: the last price is the same as the reference price.

- Order: the order price is the same as the condition price (the price field is not active): the conditional order is triggered when the market reaches a key price and sends an order to market at that price.

Moreover, a conditional buy order is accepted if the reference price is higher than the Last price, whereas a conditional sell order is accepted if the reference price is less than the Last price.

> CME: this market has some rules for accepting conditional orders.

- Condition: the Last price is the same as the reference price.

- Order: there is no inextricable link between the trigger price (the condition price) and the price that is then sent to market, therefore they may be different. The order type can be either "limit" or "market".

Operating note: Conditional orders have a one-day validity and, if not executed, the conditions associated with them (Stop Loss, Take Profit or Trailing Stop) will be cancelled on expiry of the order.

> IDEM: this market offers great flexibility for setting conditional orders.

- Condition: the last price can be more than/equal to or less than/equal to the reference price.

- Order: there is no inextricable link between the trigger price (the condition price) and the price that is then sent to market, therefore they may be different. A price limit must be entered.

> OCO orders can be entered on the IDEM, Eurex and CME markets.

Trading on Options

> What is an option?

Options are derivatives financial contracts that give the holder the right, but not the obligation, to buy (in which case the option is known as a CALL) or to sell (in which case the option is known as a PUT) a specific underlying instrument (which can be a share, an index, a currency, etc.) at a set price (known as the STRIKE PRICE) in return for the payment of a premium.

The Option is defined a EUROPEAN TYPE if the right can only be exercised on the expiry date; if on the other hand it can be exercised at any time up to the expiry date, the Option is defined an AMERICAN TYPE.CALL and PUT Options can be bought or sold, thereby obtaining very different return profiles.

> Some definitions

Underlying: The underlying financial instrument can be a share, an index, a currency, a government bond, a future contract or any other transferable security (e.g. Fiat, FTSE MIB, Dollar/Euro) for which it is possible to identify official prices.

Contract multiplier: If the underlying instrument consists of an index, a monetary value is attributed to each of its units. In the case of Options on the FTSE MIB, each point has a value of 2.5 Euros, on the DAX index each point has a value of 5 Euros and on the EUROSTOXX50 the value of each point is 10 Euros.

Contract size: The contract size is given by the product of the value of the strike price (in index points) and the value of the contract multiplier.

Premium: This is the price paid by the investor on acquiring the Option and represents the maximum loss that he/she can incur. The equivalent value invested is equal to the option’s premium (expressed in index points) multiplied by the contract multiplier (2.5 Euros in the case of options on the FTSE MIB index).

Strike price: The price of the underlying instrument at which the investor can exercise the option. Movements in the underlying instrument can modify the value of an Option and, according to its position in respect of the strike price, call options can be defined as:

- in the money: when the value of the underlying instrument is greater than the strike price;

- out of the money: when the value of the underlying instrument is lower than the strike price;

- at the money: when the value of the underlying instrument is the same as the strike price.

Conversely, put Options can be defined as:

- in the money: when the value of the underlying instrument is lower than the strike price;

- out of the money: when the value of the underlying instrument is greater than the strike price;

- at the money: when the value of the underlying is the same as the strike price

> Trading

With PowerDesk you can buy all the expiring Option contracts on the FTSE MIB Index traded on the IDEM market and all the expiring option contracts on the DAX and EUROSTOXX50 indices.

However, no short sale is available. In order to open a long position you must pay a premium, which is the maximum potential loss that the investor could suffer. If the position is closed before the expiry of the contract, the Option is traded on the market and the profit or loss on the position is calculated as the difference between the sell price and the carrying value.

For each maturity of options on shares and on the FTSE MIB index, trading is possible until the market closure (17:40) on the day prior to the end of each contract (usually on Friday mornings).

Each contract is displayed in the securities portfolio until the evening before the last trading day.

For options on the Eurex market, trading on each expiring contract ends at its maturity (usually the third Friday of the month).

Specifically, at 12:00 on the expiry date, for options on the EUROSTOXX50 index and at 13:00, also on the expiry date, for options on the DAX index.

Trading on the platform

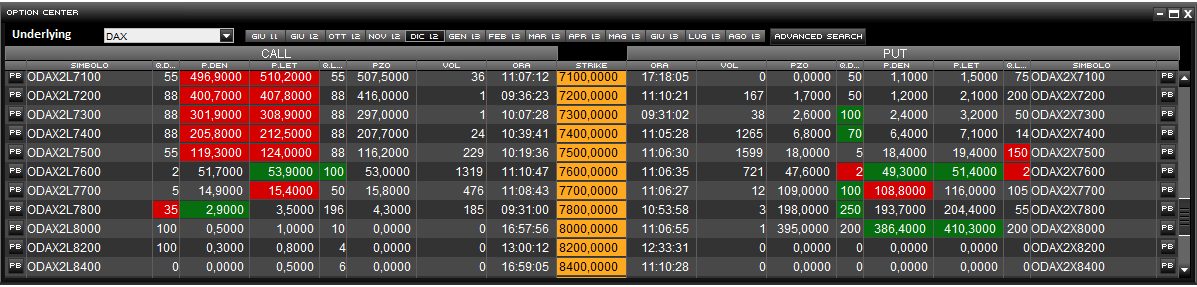

In order to trade simply select the "Options" list from the list of available baskets in PowerDesk. When launched, you will see the Options center displayed - the popup completely dedicated to Options transactions. The window can be enlarged to full screen or shrunk, by selecting the icons in the top right of the screen.

All the current available expiry dates which are traded on the IDEM market are displayed in the pop-up heading by default.

The drop-down menu is selected by default for the FTSE MIB index options; by scrolling through the menu you can select the options on various IDEM shares and the options on the DAX and EUROSTOXX50 indices.

Options centre

By clicking on "Advanced Search", you can carry out a more precise request by simultaneously cross-referencing several variables. The Strike price of each contract is positioned at the center of each row against a yellow background. For each level, you will see all the Put contracts to the right of the strike price and all the Call contracts to the left of the strike price.

For improved trading, by clicking on the "CALL" ("PUT") button, the call (put) panel options only expands to full screen; by clicking the button again, it returns by default to the initial view.

Trading: you will see the PowerBoard with the book, order screen, tick-by-tick chart, order entry and time and sales displayed by double-clicking on each contract row (to the right for puts, or to the left for calls).

> Order screen. Each transaction is displayed in the order monitor, in the general "securities" section. The fields displayed are:

- "SYM": Option symbol.

- "ST": Order status. The information provided by the market concerning the execution status of the order at that point in time. This status can be:

- Executed

- Partially Executed

- Entered

- Cancelled

- Refused

- In the queue

- To be queued - "ENT.Q": Quantity entered in the order.

- "ENT.P": Price entered in the order.

- "EXE.Q": Executed quantity of the order.

- "EXE.P": Executed price of the order.

- "DATE"

Once purchased, each contract is displayed in the general securities portfolio. The equivalent carrying and market value takes into account the contract purchase price x the number of contracts x the multiplier (2.5). For each contract in the portfolio, the same columns already indicated for standard trading on equity securities are evidenced

> P&L panel

The profit and/or loss for each closed position is indicated in the "P&L" panel.

As occurs for any PowerDesk list, you can also customise the Options centre (from the preferences panel) with the skin colour, the font size and the highlighted columns

Trading on Bonds

With PowerDesk you can trade all TLX, EuroTLX, MOT and EuroMOT market bonds with prices updated with push notifications, a 5-level book, PowerBoard and Time & Sales. By selecting "MOT" from the drop-down menu of the baskets available on PowerDesk you access the list of bonds most traded by FinecoBank customers. By selecting "TLX” you access the list of the 50 most traded bonds on the market.

From the platform search function, you can search for any other bond traded on MOT and TLX and enter it in customised watchlists.

All the instruments and operating functions for equity securities can also be used for bonds: 5-level book, push notifications, PowerBook, charts, Time & Sales.